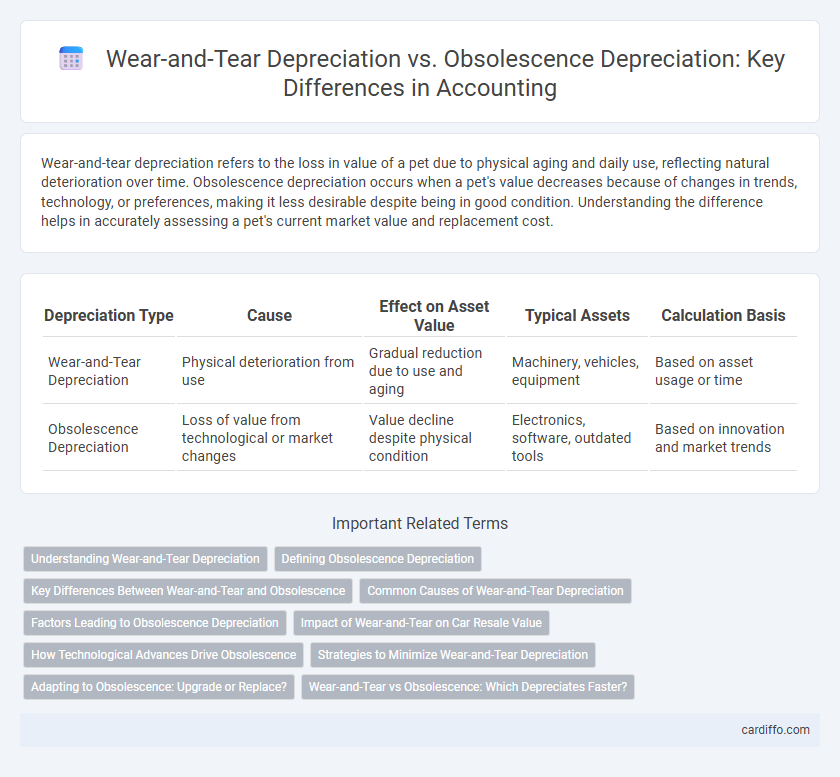

Wear-and-tear depreciation refers to the loss in value of a pet due to physical aging and daily use, reflecting natural deterioration over time. Obsolescence depreciation occurs when a pet's value decreases because of changes in trends, technology, or preferences, making it less desirable despite being in good condition. Understanding the difference helps in accurately assessing a pet's current market value and replacement cost.

Table of Comparison

| Depreciation Type | Cause | Effect on Asset Value | Typical Assets | Calculation Basis |

|---|---|---|---|---|

| Wear-and-Tear Depreciation | Physical deterioration from use | Gradual reduction due to use and aging | Machinery, vehicles, equipment | Based on asset usage or time |

| Obsolescence Depreciation | Loss of value from technological or market changes | Value decline despite physical condition | Electronics, software, outdated tools | Based on innovation and market trends |

Understanding Wear-and-Tear Depreciation

Wear-and-tear depreciation reflects the gradual decline in an asset's value due to physical usage and aging over time. This type of depreciation is calculated based on the asset's expected lifespan and intensity of use, impacting machinery, vehicles, and equipment directly through daily operations. Understanding wear-and-tear depreciation is crucial for accurate accounting, ensuring precise expense allocation and asset valuation on financial statements.

Defining Obsolescence Depreciation

Obsolescence depreciation refers to the loss in an asset's value due to factors that render it outdated or less useful despite it being in good physical condition. This type of depreciation occurs when technological advances, changes in market demand, or regulatory shifts reduce the asset's efficiency or relevance. Unlike wear-and-tear depreciation, which results from physical deterioration, obsolescence depreciation is driven by external influences that affect the asset's economic viability.

Key Differences Between Wear-and-Tear and Obsolescence

Wear-and-tear depreciation reflects the physical deterioration of an asset due to regular use over time, while obsolescence depreciation accounts for the loss of value from technological advancements or market changes that render an asset outdated. Wear-and-tear affects machinery, vehicles, and equipment primarily through usage and environmental factors, whereas obsolescence impacts assets in rapidly evolving industries like electronics and software. The key difference lies in wear-and-tear being measurable by physical condition, whereas obsolescence is influenced by external economic or technological developments.

Common Causes of Wear-and-Tear Depreciation

Common causes of wear-and-tear depreciation include physical damage, aging, and regular usage, which gradually reduce an asset's functional efficiency. Environmental factors such as exposure to moisture, dust, and temperature fluctuations also accelerate wear-and-tear on machinery and equipment. Routine operational stress and lack of maintenance contribute significantly to the deterioration affecting asset value.

Factors Leading to Obsolescence Depreciation

Obsolescence depreciation arises from factors such as technological advancements, changing consumer preferences, and regulatory changes that render assets less useful or outdated before their physical wear-and-tear is complete. Unlike wear-and-tear depreciation, which results from regular usage and aging, obsolescence depreciation reflects a decline in asset value due to external changes impacting its relevance or efficiency. Industries heavily influenced by rapid innovation, like electronics or automotive, frequently face high rates of obsolescence depreciation impacting asset management and financial reporting.

Impact of Wear-and-Tear on Car Resale Value

Wear-and-tear depreciation significantly reduces a car's resale value due to physical deterioration such as scratches, tire wear, and engine performance decline. Unlike obsolescence depreciation, which is influenced by technological advancements and changing consumer preferences, wear-and-tear depreciation directly affects the vehicle's mechanical condition and aesthetic appeal. Maintaining a car through regular servicing and repairs can slow wear-and-tear depreciation, preserving higher resale value.

How Technological Advances Drive Obsolescence

Wear-and-tear depreciation results from physical deterioration due to regular use over time, whereas obsolescence depreciation stems from reduced asset value because of newer technological innovations. Rapid technological advances in industries like consumer electronics and automotive accelerate obsolescence depreciation by rendering existing equipment outdated or incompatible with current standards. This diminished utility forces businesses to replace assets prematurely, impacting long-term financial planning and asset management strategies.

Strategies to Minimize Wear-and-Tear Depreciation

Regular maintenance and timely repairs significantly reduce wear-and-tear depreciation by preserving asset functionality and extending useful life. Employing high-quality materials and adhering to manufacturer guidelines prevent accelerated deterioration and maintain operational efficiency. Strategic usage patterns, such as avoiding overloading and minimizing unnecessary stress, also help in minimizing wear-related value loss.

Adapting to Obsolescence: Upgrade or Replace?

Wear-and-tear depreciation results from the physical deterioration of assets over time, while obsolescence depreciation is caused by technological advancements or market shifts rendering assets outdated. To adapt to obsolescence, businesses must evaluate whether upgrading existing assets or replacing them entirely offers better cost-efficiency and performance improvement. Strategic investment in modern equipment or software upgrades can extend asset life and maintain competitive advantage in rapidly evolving industries.

Wear-and-Tear vs Obsolescence: Which Depreciates Faster?

Wear-and-tear depreciation reflects the physical deterioration of an asset due to regular use, typically resulting in a consistent and predictable loss of value over time. Obsolescence depreciation occurs when an asset becomes outdated or less useful because of technological advances or market changes, often causing a more rapid decline in value. Generally, obsolescence depreciation depreciates assets faster than wear-and-tear due to the sudden loss in relevance or utility, especially in industries with rapid innovation.

Wear-and-Tear Depreciation vs Obsolescence Depreciation Infographic

cardiffo.com

cardiffo.com