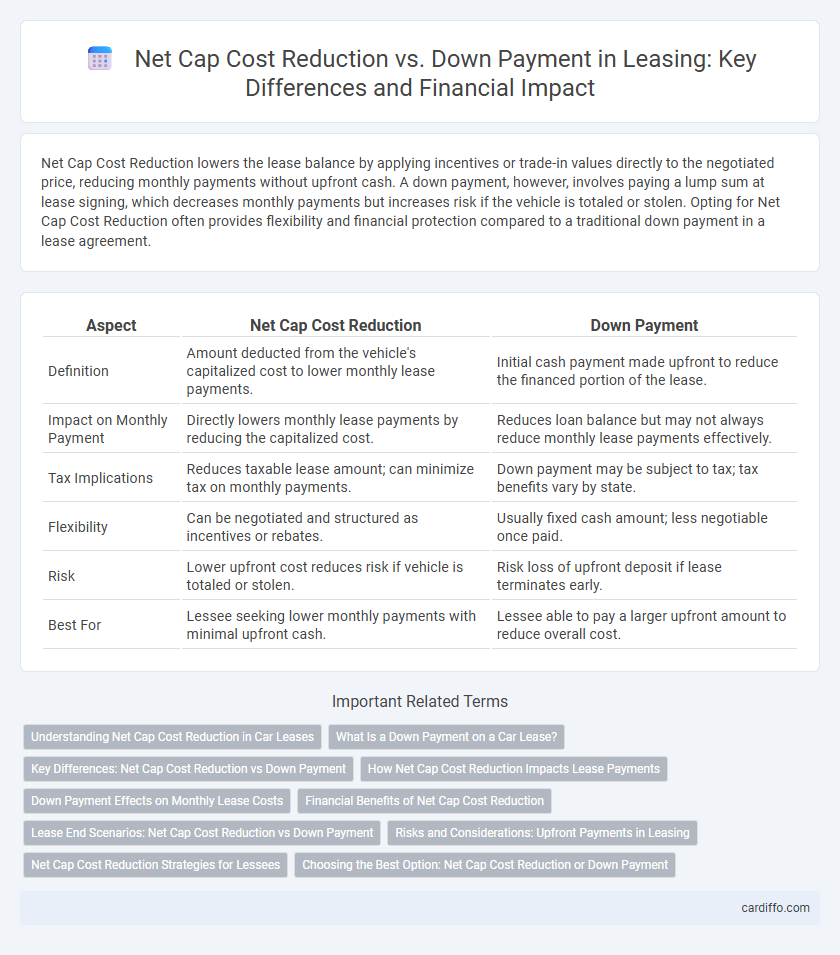

Net Cap Cost Reduction lowers the lease balance by applying incentives or trade-in values directly to the negotiated price, reducing monthly payments without upfront cash. A down payment, however, involves paying a lump sum at lease signing, which decreases monthly payments but increases risk if the vehicle is totaled or stolen. Opting for Net Cap Cost Reduction often provides flexibility and financial protection compared to a traditional down payment in a lease agreement.

Table of Comparison

| Aspect | Net Cap Cost Reduction | Down Payment |

|---|---|---|

| Definition | Amount deducted from the vehicle's capitalized cost to lower monthly lease payments. | Initial cash payment made upfront to reduce the financed portion of the lease. |

| Impact on Monthly Payment | Directly lowers monthly lease payments by reducing the capitalized cost. | Reduces loan balance but may not always reduce monthly lease payments effectively. |

| Tax Implications | Reduces taxable lease amount; can minimize tax on monthly payments. | Down payment may be subject to tax; tax benefits vary by state. |

| Flexibility | Can be negotiated and structured as incentives or rebates. | Usually fixed cash amount; less negotiable once paid. |

| Risk | Lower upfront cost reduces risk if vehicle is totaled or stolen. | Risk loss of upfront deposit if lease terminates early. |

| Best For | Lessee seeking lower monthly payments with minimal upfront cash. | Lessee able to pay a larger upfront amount to reduce overall cost. |

Understanding Net Cap Cost Reduction in Car Leases

Net Cap Cost Reduction in car leases directly lowers the capitalized cost, reducing monthly lease payments by decreasing the amount financed, unlike a simple down payment which may or may not affect the lease structure similarly. This reduction often includes rebates, trade-in values, and upfront payments applied toward the vehicle's negotiated price before interest and depreciation calculations. Understanding how Net Cap Cost Reduction influences the lease ensures more accurate budgeting and can lead to significant savings over the lease term.

What Is a Down Payment on a Car Lease?

A down payment on a car lease, also known as capitalized cost reduction, is an upfront cash payment that lowers the total amount financed through the lease. This payment reduces the vehicle's net cap cost, resulting in lower monthly lease payments and decreased interest charges over the lease term. Understanding the difference between net cap cost reduction and down payment is crucial for optimizing lease agreements and managing monthly expenses effectively.

Key Differences: Net Cap Cost Reduction vs Down Payment

Net Cap Cost Reduction directly lowers the negotiated capitalized cost in a lease agreement, effectively reducing the overall amount financed and monthly payments. A Down Payment is an upfront cash payment made at lease signing that may or may not affect the capitalized cost but decreases initial out-of-pocket expenses. Net Cap Cost Reduction influences lease calculations by reducing depreciation and finance charges, whereas a Down Payment primarily impacts the lessee's initial cash flow.

How Net Cap Cost Reduction Impacts Lease Payments

Net Cap Cost Reduction directly lowers the capitalized cost of the leased vehicle, reducing the lease payment amount by decreasing the principal balance on which interest is calculated. Unlike a simple down payment, it can also affect the residual value and money factor, leading to more favorable monthly payments. By strategically applying a Net Cap Cost Reduction, lessees can achieve lower monthly costs and reduce overall lease expenses.

Down Payment Effects on Monthly Lease Costs

Down payment directly reduces the net capitalized cost in a lease, lowering the amount financed and thus decreasing monthly lease payments. Higher down payments result in reduced interest charges over the lease term, improving overall cost efficiency. However, large down payments increase upfront cash outflow without significantly improving lease-end flexibility.

Financial Benefits of Net Cap Cost Reduction

Net Cap Cost Reduction directly lowers the capitalized cost in a lease agreement, resulting in reduced monthly lease payments compared to a traditional down payment. This reduction improves cash flow management by spreading financial benefits over the lease term rather than upfront. Leasing with Net Cap Cost Reduction enhances affordability while preserving working capital for other investments or expenses.

Lease End Scenarios: Net Cap Cost Reduction vs Down Payment

Net Cap Cost Reduction directly lowers the capitalized cost of the lease, resulting in reduced monthly payments and potentially a higher residual value at lease-end, impacting lease-end scenarios by minimizing the amount due or purchase price. A down payment reduces the upfront cash due but does not affect the lease amortization as significantly, often leading to higher monthly payments and less equity in the vehicle at lease termination. Evaluating lease-end outcomes reveals that net cap cost reduction optimizes total lease expenses and end-of-lease financial obligations more effectively than a simple down payment.

Risks and Considerations: Upfront Payments in Leasing

Net cap cost reduction lowers the lease's capitalized cost, reducing monthly payments and total interest but poses the risk of less flexibility if the vehicle is totaled or stolen since upfront payments are often non-refundable. A down payment, commonly mistaken for net cap cost reduction, also lowers monthly payments but increases financial exposure because the initial cash outlay is at risk without asset ownership. Lessees must carefully evaluate their liquidity needs and potential loss scenarios before making significant upfront payments in leasing agreements.

Net Cap Cost Reduction Strategies for Lessees

Net Cap Cost Reduction (NCCR) strategies empower lessees to lower the capitalized cost of a leased vehicle, reducing monthly payments and overall lease expenses. Effective NCCR methods include applying trade-in equity, manufacturer rebates, and negotiated discounts directly to the lease balance rather than as upfront down payments. These tactics optimize lease affordability while preserving lessee cash flow and minimizing front-end costs.

Choosing the Best Option: Net Cap Cost Reduction or Down Payment

When deciding between Net Cap Cost Reduction and Down Payment in a lease agreement, understanding their impact on monthly payments and overall lease cost is essential. Net Cap Cost Reduction lowers the capitalized cost, potentially reducing depreciation fees and monthly payments, while a down payment directly reduces the amount financed but may not affect fees in the same way. Evaluating lease terms, residual value, and total lease expense helps determine the most cost-effective choice tailored to individual financial goals.

Net Cap Cost Reduction vs Down Payment Infographic

cardiffo.com

cardiffo.com