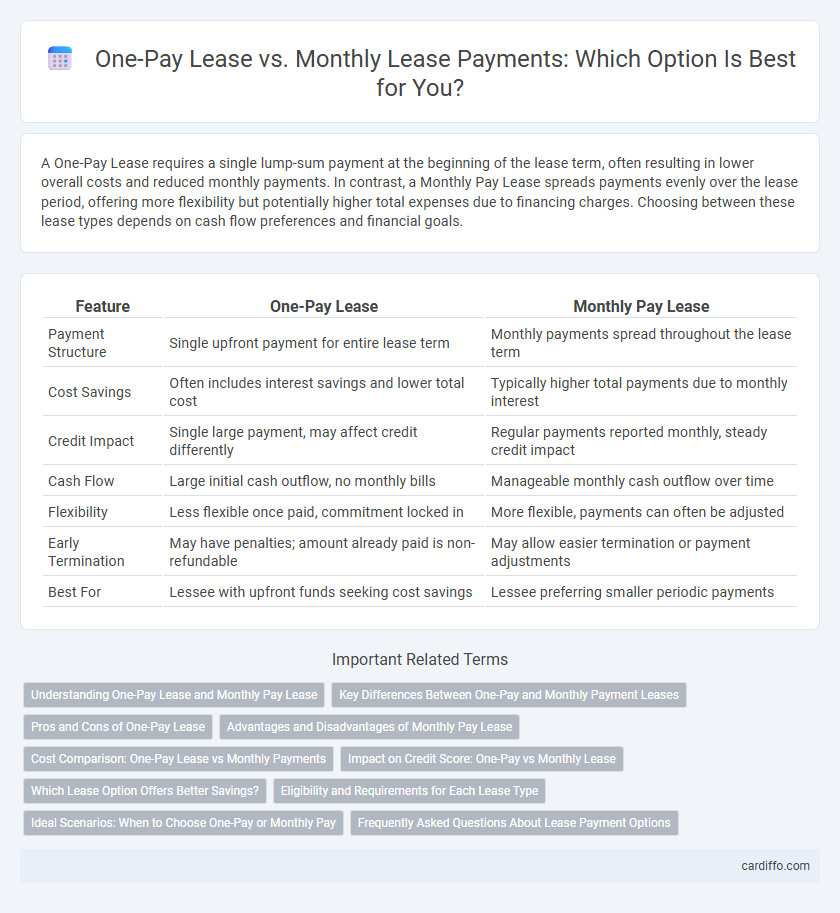

A One-Pay Lease requires a single lump-sum payment at the beginning of the lease term, often resulting in lower overall costs and reduced monthly payments. In contrast, a Monthly Pay Lease spreads payments evenly over the lease period, offering more flexibility but potentially higher total expenses due to financing charges. Choosing between these lease types depends on cash flow preferences and financial goals.

Table of Comparison

| Feature | One-Pay Lease | Monthly Pay Lease |

|---|---|---|

| Payment Structure | Single upfront payment for entire lease term | Monthly payments spread throughout the lease term |

| Cost Savings | Often includes interest savings and lower total cost | Typically higher total payments due to monthly interest |

| Credit Impact | Single large payment, may affect credit differently | Regular payments reported monthly, steady credit impact |

| Cash Flow | Large initial cash outflow, no monthly bills | Manageable monthly cash outflow over time |

| Flexibility | Less flexible once paid, commitment locked in | More flexible, payments can often be adjusted |

| Early Termination | May have penalties; amount already paid is non-refundable | May allow easier termination or payment adjustments |

| Best For | Lessee with upfront funds seeking cost savings | Lessee preferring smaller periodic payments |

Understanding One-Pay Lease and Monthly Pay Lease

A One-Pay Lease involves paying the entire lease amount upfront, often resulting in lower overall costs due to reduced money factor fees and fewer monthly financing charges. Monthly Pay Lease requires paying fixed monthly installments throughout the lease term, offering flexibility and manageable cash flow without a large initial payment. Understanding the cost differences and cash flow impacts helps lessees choose between immediate savings and ongoing affordability.

Key Differences Between One-Pay and Monthly Payment Leases

One-Pay Lease requires a single upfront payment covering the entire lease term, significantly reducing interest costs and simplifying monthly budgeting. Monthly Pay Lease involves spreading payments over the lease duration, offering flexibility but potentially higher total costs due to interest accumulation. Key differences include payment structure, total cost, and impact on credit scores, with one-pay leases often leading to lower overall expenses but higher initial financial commitment.

Pros and Cons of One-Pay Lease

One-pay lease requires a single upfront payment covering the entire lease term, reducing monthly installments and potentially lowering total interest costs. This option often results in higher initial cash outflow and limited flexibility for early lease termination or upgrades. One-pay leases may offer savings but demand significant liquidity, making them suitable primarily for lessees with stable finances.

Advantages and Disadvantages of Monthly Pay Lease

Monthly pay leases offer flexibility by allowing lower upfront costs and easier budgeting through manageable payments spread over the lease term. This payment structure may result in higher overall costs compared to one-pay leases due to interest and fees accumulating over time. However, monthly payments provide lessees with better cash flow management and the option to upgrade vehicles more frequently without large initial financial commitments.

Cost Comparison: One-Pay Lease vs Monthly Payments

One-Pay Lease typically involves a single upfront payment that covers the entire lease term, often resulting in lower overall costs due to reduced finance charges and administrative fees. Monthly Pay Lease requires continuous monthly payments, which may accrue higher interest over time and include additional processing fees, increasing the total cost. Analyzing the net present value of both options reveals that One-Pay Lease generally offers better financial efficiency and potential savings compared to spreading payments monthly.

Impact on Credit Score: One-Pay vs Monthly Lease

One-Pay Lease often results in a single, large payment reported to credit bureaus, potentially boosting credit scores by demonstrating on-time payment history in full, while reducing the risk of missed payments. Monthly Pay Lease spreads payments across the lease term, allowing consistent monthly credit activity but increasing the risk of negative impact from late or missed payments. Credit scoring models typically favor consistent, timely payments, making one-pay leases advantageous for borrowers with stable cash flow and strong credit profiles.

Which Lease Option Offers Better Savings?

One-Pay Lease often offers better savings by consolidating lease payments into a single upfront amount, reducing or eliminating finance charges compared to Monthly Pay Lease plans, which involve interest accrual on monthly installments. This lump-sum payment can also lead to lower total lease costs and fewer administrative fees. However, choosing the best lease option depends on individual cash flow and financial goals, with One-Pay Leases providing clear benefits for minimizing overall lease expenses.

Eligibility and Requirements for Each Lease Type

One-pay leases require upfront payment of the total lease amount, appealing to lessees with strong credit scores and sufficient funds, often excluding those with lower credit profiles. Monthly pay leases allow for smaller, periodic payments, making them accessible to a broader range of applicants, though they typically require consistent monthly income verification and satisfactory credit history. Both lease types mandate proof of insurance and a valid driver's license, but eligibility criteria for one-pay leases emphasize financial liquidity, while monthly leases focus more on steady income and creditworthiness.

Ideal Scenarios: When to Choose One-Pay or Monthly Pay

One-Pay Lease suits individuals with available liquid funds aiming to minimize overall lease costs and avoid monthly fees. Monthly Pay Lease benefits those seeking flexible cash flow management and predictable monthly expenses without large upfront payments. Opt for One-Pay Lease for lower total lease cost and less administrative hassle; choose Monthly Pay Lease for budget-friendly monthly budgeting and maintaining liquidity.

Frequently Asked Questions About Lease Payment Options

One-pay leases require a single upfront payment covering the entire lease term, often resulting in lower overall costs and reduced interest compared to monthly pay leases. Monthly pay leases involve fixed monthly payments, offering more manageable cash flow but potentially higher total expenses due to interest accumulation. Frequently asked questions about lease payment options include inquiries about total cost differences, impact on credit scores, and flexibility in early termination or mileage adjustments.

One-Pay Lease vs Monthly Pay Lease Infographic

cardiffo.com

cardiffo.com