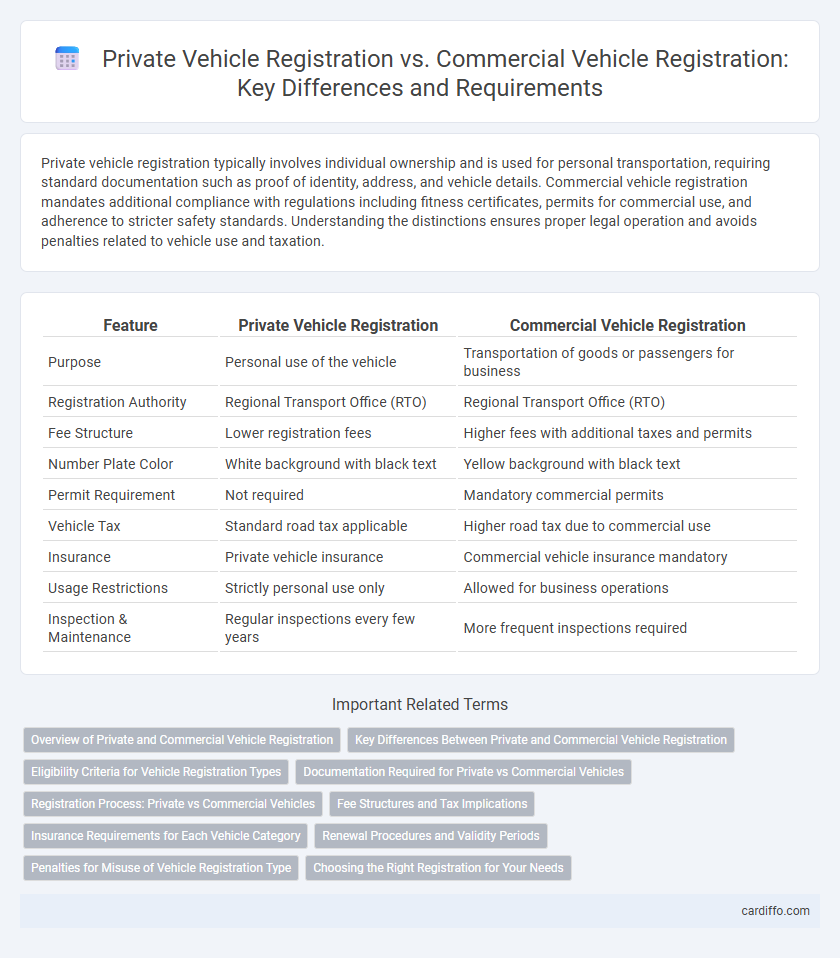

Private vehicle registration typically involves individual ownership and is used for personal transportation, requiring standard documentation such as proof of identity, address, and vehicle details. Commercial vehicle registration mandates additional compliance with regulations including fitness certificates, permits for commercial use, and adherence to stricter safety standards. Understanding the distinctions ensures proper legal operation and avoids penalties related to vehicle use and taxation.

Table of Comparison

| Feature | Private Vehicle Registration | Commercial Vehicle Registration |

|---|---|---|

| Purpose | Personal use of the vehicle | Transportation of goods or passengers for business |

| Registration Authority | Regional Transport Office (RTO) | Regional Transport Office (RTO) |

| Fee Structure | Lower registration fees | Higher fees with additional taxes and permits |

| Number Plate Color | White background with black text | Yellow background with black text |

| Permit Requirement | Not required | Mandatory commercial permits |

| Vehicle Tax | Standard road tax applicable | Higher road tax due to commercial use |

| Insurance | Private vehicle insurance | Commercial vehicle insurance mandatory |

| Usage Restrictions | Strictly personal use only | Allowed for business operations |

| Inspection & Maintenance | Regular inspections every few years | More frequent inspections required |

Overview of Private and Commercial Vehicle Registration

Private vehicle registration involves registering vehicles used for personal purposes, such as cars, motorcycles, and SUVs, ensuring ownership records, road tax compliance, and insurance verification. Commercial vehicle registration pertains to vehicles used for business activities, like trucks, taxis, and delivery vans, requiring additional permits, higher fees, and adherence to stricter safety and operational regulations. Both registration types mandate submitting legal documents, passing inspections, and updating information to maintain vehicle legality and roadworthiness.

Key Differences Between Private and Commercial Vehicle Registration

Private vehicle registration involves individual ownership for personal use, with lower fees and insurance requirements tailored to non-commercial purposes. Commercial vehicle registration applies to vehicles used for business operations, necessitating higher fees, stricter regulatory compliance, and specialized insurance coverage to accommodate commercial liability. The distinctions impact tax obligations, permit requirements, and operational restrictions based on vehicle classification.

Eligibility Criteria for Vehicle Registration Types

Private vehicle registration requires ownership by an individual or family, with eligibility criteria focusing on personal use, age of the vehicle, and compliance with local emission and safety standards. Commercial vehicle registration mandates ownership by a business entity or operator, and eligibility often includes proof of commercial use, adherence to stricter safety regulations, and specific insurance requirements. Both types require valid identification, proper documentation, and payment of applicable fees to complete the registration process.

Documentation Required for Private vs Commercial Vehicles

Private vehicle registration requires documents such as proof of identity, address proof, vehicle invoice, insurance certificate, pollution control certificate, and valid form 20, 21, or 22. Commercial vehicle registration demands additional documents including the route permit, fitness certificate, commercial insurance, road tax receipts, and proof of payment of advance tax or permits, reflecting stricter regulatory compliance. Both processes necessitate submission of the original vehicle's ECU (Engine Control Unit) number and chassis number for verification.

Registration Process: Private vs Commercial Vehicles

The registration process for private vehicles typically involves submitting personal identification, proof of vehicle ownership, and insurance documents, followed by a vehicle inspection to ensure roadworthiness. Commercial vehicle registration requires additional steps including obtaining special licenses, adherence to higher safety and emission standards, and providing details about the intended commercial use and operating routes. Both processes necessitate payment of registration fees, but commercial registrations often involve higher fees and more stringent regulatory compliance.

Fee Structures and Tax Implications

Private vehicle registration typically involves lower fee structures and reduced tax rates compared to commercial vehicle registration, which includes higher fees reflecting the vehicle's business use and payload capacity. Commercial vehicle registration fees often incorporate additional costs such as permit charges, road use taxes, and stricter emission compliance fees. These distinctions aim to account for the increased wear on infrastructure and regulatory oversight associated with commercial transportation.

Insurance Requirements for Each Vehicle Category

Private vehicle registration requires insurance policies that cover personal liability and comprehensive coverage tailored for individual use, often including collision and uninsured motorist protection. Commercial vehicle registration mandates more extensive insurance, such as higher liability limits and cargo insurance, to accommodate business operations and protect against the increased risks associated with commercial use. Insurance for commercial vehicles must comply with Department of Transportation regulations and often includes coverage for employee injuries, environmental damages, and vehicle-specific hazards.

Renewal Procedures and Validity Periods

Private vehicle registration renewal typically requires submission of proof of insurance, emission test certificates, and payment of renewal fees, with validity periods commonly ranging from one to five years depending on state regulations. Commercial vehicle registration renewal involves more stringent procedures, including additional safety inspections, compliance with federal and state transport regulations, and payment of higher fees reflecting commercial use, usually valid for one year before mandatory renewal. Understanding differences in documentation, fee structures, and renewal intervals is essential for timely compliance in both private and commercial vehicle registrations.

Penalties for Misuse of Vehicle Registration Type

Misuse of private vehicle registration for commercial purposes typically results in fines ranging from $500 to $2,000, along with possible suspension of registration privileges. Commercial vehicle registration misuse can lead to more severe penalties, including heavier fines, license suspension, and legal action due to the higher liability associated with commercial operations. Both types of registration require accurate classification to avoid these penalties and ensure compliance with state motor vehicle regulations.

Choosing the Right Registration for Your Needs

Private vehicle registration applies to personal-use cars, offering benefits such as lower fees and simpler renewal processes, ideal for individuals seeking convenience and cost-efficiency. Commercial vehicle registration is mandatory for vehicles used in business operations, requiring compliance with stricter regulations, higher fees, and additional documentation to ensure safety and accountability. Selecting the appropriate registration type depends on the vehicle's primary use, with private registration suited for personal travel and commercial registration necessary for business activities involving transportation of goods or passengers.

Private Vehicle Registration vs Commercial Vehicle Registration Infographic

cardiffo.com

cardiffo.com