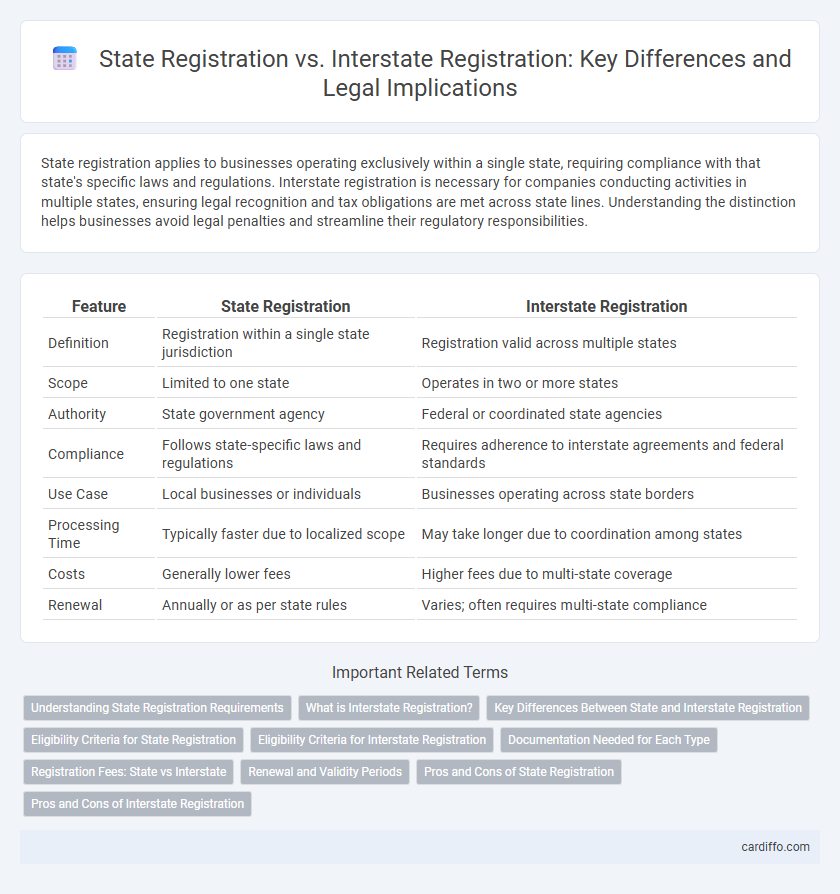

State registration applies to businesses operating exclusively within a single state, requiring compliance with that state's specific laws and regulations. Interstate registration is necessary for companies conducting activities in multiple states, ensuring legal recognition and tax obligations are met across state lines. Understanding the distinction helps businesses avoid legal penalties and streamline their regulatory responsibilities.

Table of Comparison

| Feature | State Registration | Interstate Registration |

|---|---|---|

| Definition | Registration within a single state jurisdiction | Registration valid across multiple states |

| Scope | Limited to one state | Operates in two or more states |

| Authority | State government agency | Federal or coordinated state agencies |

| Compliance | Follows state-specific laws and regulations | Requires adherence to interstate agreements and federal standards |

| Use Case | Local businesses or individuals | Businesses operating across state borders |

| Processing Time | Typically faster due to localized scope | May take longer due to coordination among states |

| Costs | Generally lower fees | Higher fees due to multi-state coverage |

| Renewal | Annually or as per state rules | Varies; often requires multi-state compliance |

Understanding State Registration Requirements

State registration requires businesses to comply with local regulations, including obtaining specific licenses, adhering to tax obligations, and meeting zoning laws within that state. Each state has unique forms, fees, and renewal processes that businesses must follow to remain compliant. Understanding these requirements ensures smooth operations and avoids penalties related to non-compliance in state-specific jurisdictions.

What is Interstate Registration?

Interstate registration refers to the process of registering a business or vehicle to operate legally across multiple states, enabling compliance with various state regulations. Unlike state registration, which confines legal recognition and operational scope to a single state, interstate registration facilitates broader market access and transportation rights. This registration often requires adherence to federal guidelines and coordination among state authorities to ensure uniformity and legality.

Key Differences Between State and Interstate Registration

State registration applies to businesses operating within a single state and requires compliance with that state's specific regulations and tax obligations. Interstate registration is necessary for businesses conducting operations across multiple states, involving additional federal compliance and coordination with each state's authorities. Key differences include the scope of operations, regulatory requirements, and tax filing procedures specific to either state or multiple jurisdictions.

Eligibility Criteria for State Registration

Eligibility criteria for State Registration require applicants to reside within the specific state or have a physical presence such as a business address or property. Applicants must comply with state-specific regulations and submit necessary documentation proving local ties and compliance with relevant state laws. State Registration typically mandates proof of identity, residency, and adherence to local tax and legal obligations.

Eligibility Criteria for Interstate Registration

Interstate registration eligibility requires businesses to operate across state lines or engage in commerce beyond their home state. Entities must typically have a physical presence, such as a branch or warehouse, or significant sales volume in other states to qualify. Compliance with both home state regulations and the destination state's registration requirements ensures lawful operation and tax obligations across jurisdictions.

Documentation Needed for Each Type

State registration requires submitting proof of residency, a valid state-issued ID, and vehicle title documents specific to the registering state; emissions and safety inspection certificates may also be mandated based on local regulations. Interstate registration necessitates providing similar documentation, including proof of residency in the home state, vehicle title, and identification, but often demands compliance with federal requirements such as the U.S. DOT number and evidence of insurance valid in multiple states. Both registration types involve completing application forms, payment of applicable fees, and in some cases, notarized affidavits to verify ownership and compliance.

Registration Fees: State vs Interstate

State registration fees vary widely depending on the state's specific requirements and vehicle type, often ranging from $20 to over $100 annually. Interstate registration fees, such as those under the International Registration Plan (IRP), are calculated based on the percentage of miles traveled in each member jurisdiction, distributing costs fairly across states and provinces. These fees generally exceed typical state registration costs due to the broader, multi-jurisdictional coverage and compliance requirements for commercial vehicles.

Renewal and Validity Periods

State registration typically requires renewal every 1 to 3 years, depending on local regulations, with validity limited to the issuing state's jurisdiction. Interstate registration offers extended validity periods, often up to 5 years, enabling seamless operation across multiple states without frequent renewals. Renewal processes for interstate registrations also tend to be centralized, reducing administrative burden compared to managing multiple state-specific renewals.

Pros and Cons of State Registration

State registration offers localized control and typically faster processing times, benefiting businesses operating primarily within one state. However, it limits legal recognition and business operations beyond state borders, potentially hindering expansion. Costs and requirements vary by state, which can complicate compliance for businesses with ambitions to operate interstate.

Pros and Cons of Interstate Registration

Interstate registration allows businesses to operate legally across multiple states without obtaining separate registrations in each state, significantly reducing administrative costs and time. It facilitates uniform compliance and simplifies tax reporting for companies engaged in multistate operations. However, it may limit flexibility as businesses must adhere to broader federal requirements that can sometimes override specific state regulations, potentially causing conflicts or added complexity in certain jurisdictions.

State Registration vs Interstate Registration Infographic

cardiffo.com

cardiffo.com