A registration certificate serves as official documentation that a pet is formally registered with local authorities, ensuring compliance with legal requirements and enabling identification. Proof of insurance, on the other hand, demonstrates that the pet owner has financial protection against potential liabilities or veterinary costs. While the registration certificate is essential for pet ownership validation, proof of insurance provides security and peace of mind in managing unforeseen expenses.

Table of Comparison

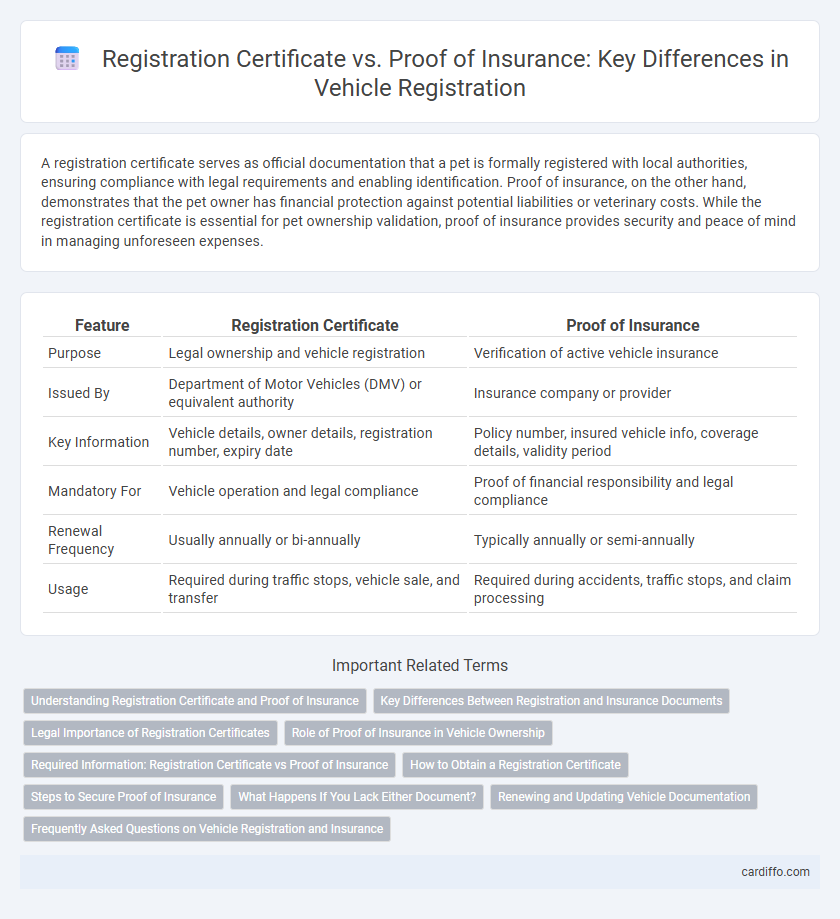

| Feature | Registration Certificate | Proof of Insurance |

|---|---|---|

| Purpose | Legal ownership and vehicle registration | Verification of active vehicle insurance |

| Issued By | Department of Motor Vehicles (DMV) or equivalent authority | Insurance company or provider |

| Key Information | Vehicle details, owner details, registration number, expiry date | Policy number, insured vehicle info, coverage details, validity period |

| Mandatory For | Vehicle operation and legal compliance | Proof of financial responsibility and legal compliance |

| Renewal Frequency | Usually annually or bi-annually | Typically annually or semi-annually |

| Usage | Required during traffic stops, vehicle sale, and transfer | Required during accidents, traffic stops, and claim processing |

Understanding Registration Certificate and Proof of Insurance

A registration certificate is an official document issued by the Department of Motor Vehicles (DMV) that verifies a vehicle's legal registration status and includes details such as the owner's name, vehicle identification number (VIN), and registration expiration date. Proof of insurance, on the other hand, is evidence provided by an insurance company confirming that the vehicle is covered by an active insurance policy, which is required to protect against financial liabilities from accidents. Understanding the difference is crucial for vehicle owners to comply with state laws and avoid penalties while ensuring legal and financial protection on the road.

Key Differences Between Registration and Insurance Documents

Registration certificates validate vehicle ownership and legal authorization to operate on public roads, while proof of insurance confirms financial responsibility and coverage against liabilities in accidents. Registration documents typically include vehicle identification details, owner information, and expiration dates, whereas insurance proof provides policy numbers, coverage limits, and insurer contact data. Understanding these distinctions is critical for compliance with traffic laws and avoiding penalties.

Legal Importance of Registration Certificates

Registration certificates serve as legally recognized documents that verify vehicle ownership and establish compliance with governmental regulations, playing a crucial role in law enforcement and legal proceedings. They provide essential information such as the vehicle identification number (VIN), registration number, and owner's details, ensuring accountability and traceability. Unlike proof of insurance, which demonstrates financial responsibility, registration certificates confer the legal authority to operate a vehicle on public roads.

Role of Proof of Insurance in Vehicle Ownership

Proof of Insurance verifies that a vehicle owner has the legally required liability coverage to protect against financial loss from accidents, complementing the Registration Certificate which confirms vehicle registration status. This insurance documentation ensures compliance with state laws and safeguards both the driver and other parties by covering damages and medical expenses. Maintaining valid Proof of Insurance is essential for legal vehicle operation and avoiding penalties during traffic stops or accidents.

Required Information: Registration Certificate vs Proof of Insurance

A Registration Certificate typically includes vehicle details such as make, model, year, vehicle identification number (VIN), and registered owner information, serving as legal proof of vehicle registration with the relevant transport authority. Proof of Insurance contains insurer details, policy number, coverage dates, and vehicle information to demonstrate active insurance coverage required by law. Both documents are essential for legal vehicle operation, but the Registration Certificate verifies ownership and registration status, while Proof of Insurance confirms financial responsibility for potential damages or liabilities.

How to Obtain a Registration Certificate

To obtain a registration certificate, visit your local Department of Motor Vehicles (DMV) or its official website and submit a completed application form along with proof of vehicle ownership, such as a title or bill of sale. Provide valid identification and proof of insurance to meet state requirements before paying the applicable registration fees. After processing, the DMV issues the registration certificate, which serves as official documentation to legally operate your vehicle.

Steps to Secure Proof of Insurance

To secure proof of insurance, first select a reputable insurance provider and choose a policy that meets state minimum coverage requirements. Complete the application process by providing necessary personal and vehicle information, then pay the premium to activate the policy. Once the policy is active, the insurer will issue a certificate of insurance, which serves as the official proof of insurance required for vehicle registration.

What Happens If You Lack Either Document?

Lacking a registration certificate typically results in fines, vehicle impoundment, or inability to legally operate the vehicle, as law enforcement requires proof of ownership and registration. Without proof of insurance, drivers may face penalties including fines, license suspension, or higher insurance premiums, since insurance verifies financial responsibility in case of accidents. Driving without either document significantly increases legal risks and may complicate accident claims or traffic stops.

Renewing and Updating Vehicle Documentation

Renewing vehicle documentation requires both a valid Registration Certificate and Proof of Insurance to ensure compliance with state laws. The Registration Certificate verifies vehicle ownership and registration status, while Proof of Insurance confirms active coverage against liabilities. Timely updates of these documents prevent penalties and enable seamless vehicle operation.

Frequently Asked Questions on Vehicle Registration and Insurance

A Registration Certificate serves as official proof that a vehicle is legally registered with the relevant motor vehicle department, containing details such as owner information, vehicle identification number (VIN), and registration expiry date. Proof of Insurance verifies the vehicle is covered under a valid insurance policy, often required during registration or traffic stops to demonstrate compliance with mandatory insurance laws. Vehicle owners frequently ask if the Registration Certificate alone suffices for driving legally, but both documents must be carried to satisfy legal requirements and avoid fines.

Registration Certificate vs Proof of Insurance Infographic

cardiffo.com

cardiffo.com