Lienholder registration records the financial institution or individual holding the loan on a pet, ensuring their legal interest is documented. Owner registration identifies the primary caregiver responsible for the pet's care and legal decisions. Understanding the distinction between lienholder and owner registration helps clarify rights and responsibilities in pet ownership and financing.

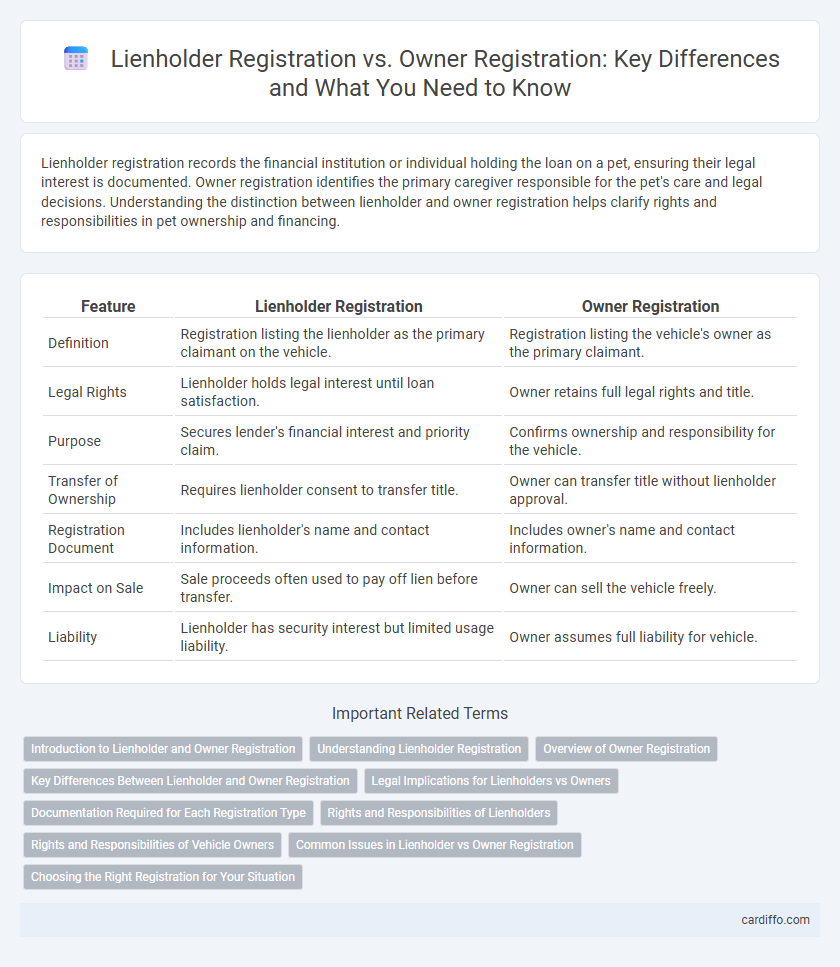

Table of Comparison

| Feature | Lienholder Registration | Owner Registration |

|---|---|---|

| Definition | Registration listing the lienholder as the primary claimant on the vehicle. | Registration listing the vehicle's owner as the primary claimant. |

| Legal Rights | Lienholder holds legal interest until loan satisfaction. | Owner retains full legal rights and title. |

| Purpose | Secures lender's financial interest and priority claim. | Confirms ownership and responsibility for the vehicle. |

| Transfer of Ownership | Requires lienholder consent to transfer title. | Owner can transfer title without lienholder approval. |

| Registration Document | Includes lienholder's name and contact information. | Includes owner's name and contact information. |

| Impact on Sale | Sale proceeds often used to pay off lien before transfer. | Owner can sell the vehicle freely. |

| Liability | Lienholder has security interest but limited usage liability. | Owner assumes full liability for vehicle. |

Introduction to Lienholder and Owner Registration

Lienholder registration records the financial institution or individual holding the lien on a vehicle, ensuring their legal interest is documented in case of default or sale. Owner registration establishes the primary individual or entity responsible for the vehicle, reflecting legal ownership and accountability for taxes and legal compliance. Accurate lienholder and owner registrations are critical for clear title management and protect both parties during vehicle transactions.

Understanding Lienholder Registration

Lienholder registration records the financial institution or entity holding a lien on a vehicle, ensuring legal claims are officially documented and protected against unauthorized sales or transfers. This registration differs from owner registration, which identifies the individual or entity with primary ownership rights and responsibilities for the vehicle. Understanding lienholder registration is crucial for lenders to secure their interests and for buyers to verify any outstanding financial obligations tied to the vehicle.

Overview of Owner Registration

Owner registration establishes the legal individual or entity responsible for the vehicle, linking ownership to an official record maintained by motor vehicle departments. This process ensures the registered owner has full rights, responsibilities, and liabilities associated with the vehicle, such as taxation, insurance, and transfer of ownership. Unlike lienholder registration, which indicates a secured interest by a lender, owner registration confirms the primary holder's identity for legal and administrative purposes.

Key Differences Between Lienholder and Owner Registration

Lienholder registration records a financial institution or individual with a legal claim on the vehicle until the loan is paid off, ensuring protection of their interest. Owner registration designates the individual or entity holding full ownership rights, responsible for the vehicle's use, taxes, and legal obligations. Key differences include lienholders having secured interest without full ownership rights, while owners have complete control and responsibility over the vehicle.

Legal Implications for Lienholders vs Owners

Lienholder registration legally establishes the lienholder's financial interest in the vehicle, providing protection against ownership transfer without lienholder consent. Owner registration grants the individual full legal ownership and responsibility for the vehicle, including liabilities and rights to sell or modify the asset. Failing to properly register as a lienholder can result in the loss of priority claims during disputes, whereas improper owner registration may lead to legal complications regarding asset control and liability.

Documentation Required for Each Registration Type

Lienholder registration requires a signed lease or security agreement and proof of the lienholder's legal interest, such as a financing statement or lien certificate. Owner registration mandates submission of the vehicle title, proof of identity, and a completed registration application to verify ownership. Both registrations may require proof of insurance and payment of applicable fees to complete the process.

Rights and Responsibilities of Lienholders

Lienholder registration secures the financial institution's legal claim on the vehicle until the loan is paid off, ensuring their right to repossession in case of default. Owners retain possession and usage rights but must acknowledge the lienholder's interest, limiting their ability to sell or transfer the vehicle without lienholder consent. Lienholders bear responsibilities such as maintaining accurate records and promptly releasing the lien upon loan repayment to clear the owner's title.

Rights and Responsibilities of Vehicle Owners

Lienholder registration secures the lender's legal interest in the vehicle, ensuring they have priority rights in case of default, while the owner registration establishes full control and use rights over the vehicle. Vehicle owners bear responsibilities such as maintaining valid registration, ensuring insurance coverage, and complying with state regulations, whereas lienholders primarily oversee the financial interest without direct control of the vehicle's daily use. Understanding the distinction clarifies the obligations and protections afforded to both parties throughout the vehicle's ownership lifecycle.

Common Issues in Lienholder vs Owner Registration

Common issues in lienholder registration versus owner registration include inaccuracies in recording the primary financial interest, which may lead to legal disputes or delays in title transfers. Owner registration errors often involve mismatched personal information or failure to update ownership after a sale, causing verification challenges. Both registration types require precise documentation to ensure proper lien recording and clear ownership status within state motor vehicle departments.

Choosing the Right Registration for Your Situation

Choosing between lienholder registration and owner registration depends on the legal and financial responsibilities linked to vehicle ownership. Lienholder registration is essential when a lender holds a security interest, ensuring their rights are protected until the loan is paid off. Owner registration applies when full ownership is held, granting complete control and responsibility over the vehicle's title and obligations.

Lienholder Registration vs Owner Registration Infographic

cardiffo.com

cardiffo.com