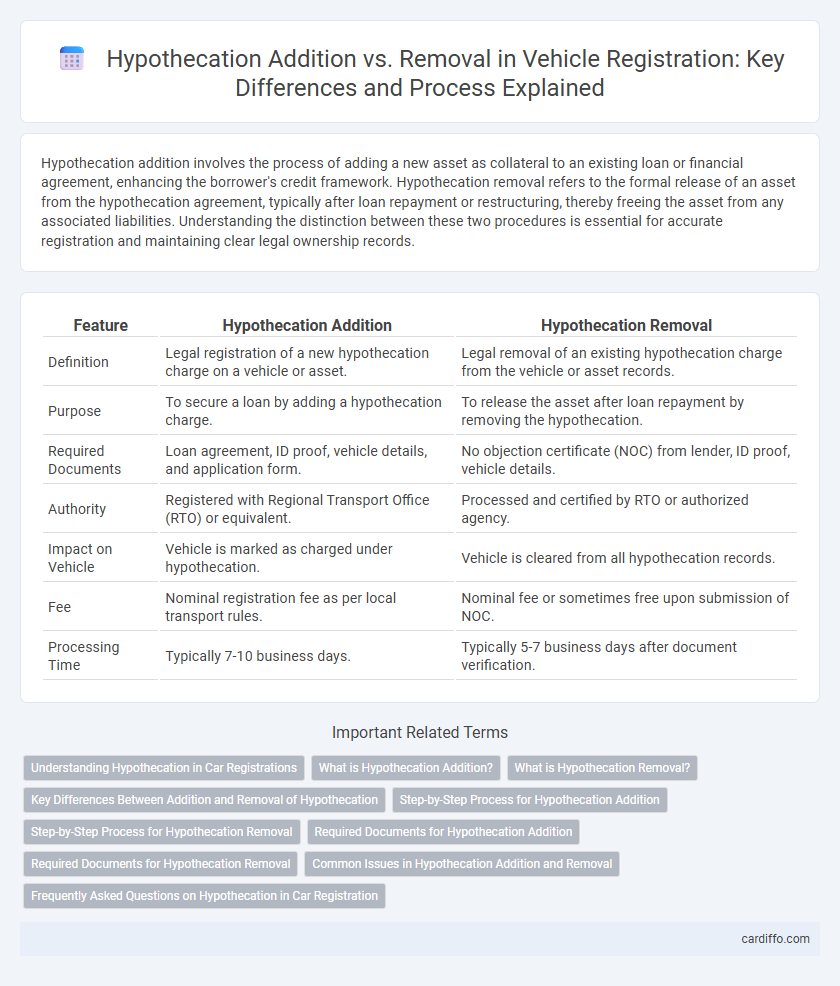

Hypothecation addition involves the process of adding a new asset as collateral to an existing loan or financial agreement, enhancing the borrower's credit framework. Hypothecation removal refers to the formal release of an asset from the hypothecation agreement, typically after loan repayment or restructuring, thereby freeing the asset from any associated liabilities. Understanding the distinction between these two procedures is essential for accurate registration and maintaining clear legal ownership records.

Table of Comparison

| Feature | Hypothecation Addition | Hypothecation Removal |

|---|---|---|

| Definition | Legal registration of a new hypothecation charge on a vehicle or asset. | Legal removal of an existing hypothecation charge from the vehicle or asset records. |

| Purpose | To secure a loan by adding a hypothecation charge. | To release the asset after loan repayment by removing the hypothecation. |

| Required Documents | Loan agreement, ID proof, vehicle details, and application form. | No objection certificate (NOC) from lender, ID proof, vehicle details. |

| Authority | Registered with Regional Transport Office (RTO) or equivalent. | Processed and certified by RTO or authorized agency. |

| Impact on Vehicle | Vehicle is marked as charged under hypothecation. | Vehicle is cleared from all hypothecation records. |

| Fee | Nominal registration fee as per local transport rules. | Nominal fee or sometimes free upon submission of NOC. |

| Processing Time | Typically 7-10 business days. | Typically 5-7 business days after document verification. |

Understanding Hypothecation in Car Registrations

Hypothecation in car registrations refers to the legal process where a vehicle is used as collateral for a loan, recorded on the registration document to protect the lender's interest. Hypothecation addition occurs when a new loan is taken against the vehicle, updating the registration to reflect the lender's rights. Hypothecation removal happens once the loan is fully repaid, allowing the owner to clear the lender's name from the registration and regain full ownership rights.

What is Hypothecation Addition?

Hypothecation addition refers to the legal process of including a new asset or property under an existing hypothecation agreement with a lender, thereby extending the security interest to cover the newly added asset. This process requires registration with the relevant authority to update the hypothecation details, ensuring the lender's rights over the additional collateral are officially recorded. Hypothecation addition enhances the lender's security without altering the original loan terms or creating a new agreement.

What is Hypothecation Removal?

Hypothecation Removal refers to the formal process of discharging a hypothecation lien on a property or asset once the associated loan or debt is fully repaid. This procedure involves submitting a No Objection Certificate (NOC) from the lender to the Registrar's office, enabling the removal of the hypothecation entry from the property's registration records. Completing Hypothecation Removal ensures clear title transfer and eliminates any legal liabilities tied to the hypothecation, facilitating subsequent sale or transfer of the asset.

Key Differences Between Addition and Removal of Hypothecation

Hypothecation addition involves creating a new charge or lien on a property, typically to secure additional financial obligations or loans, while hypothecation removal refers to the discharge or cancellation of an existing charge once the underlying debt is fully paid. The registration process for addition requires submitting updated documents and approval from the registering authority, whereas removal necessitates a no-dues certificate and formal application proving complete settlement. Key differences include the purpose--securing new obligations versus releasing encumbrances--and the documentation required, impacting the registration fees and timeline for completion.

Step-by-Step Process for Hypothecation Addition

The step-by-step process for hypothecation addition begins with submitting a formal application to the relevant registration authority, along with necessary documents such as the original Registration Certificate (RC), loan agreement, and identity proof. The Hypothecation Addition involves the verification of submitted documents and physical inspection of the vehicle by registration officials to ensure compliance. Once verified, the hypothecation addition is recorded in the vehicle's registration records, and an updated Registration Certificate reflecting the financier's interest is issued to the owner.

Step-by-Step Process for Hypothecation Removal

The step-by-step process for hypothecation removal involves obtaining a No Objection Certificate (NOC) from the financer after loan repayment, submitting Form 35 to the Regional Transport Office (RTO) along with the original Registration Certificate (RC) and NOC, and paying the applicable fees for updating the hypothecation status. Verification by the RTO is conducted to ensure all documents are authentic before the hypothecation entry is removed from the RC. Finally, the updated RC without the hypothecation clause is issued to the vehicle owner, confirming the successful removal of the lien.

Required Documents for Hypothecation Addition

Required documents for hypothecation addition during vehicle registration include a duly filled application form, original registration certificate (RC), valid insurance policy, and a no-objection certificate (NOC) from the financier. The owner must also submit a copy of the loan agreement or hypothecation agreement reflecting the addition of the financier's name and a clearance certificate from the finance company confirming the lien. These documents ensure legal acknowledgment of the financier's interest and facilitate smooth processing of the hypothecation addition.

Required Documents for Hypothecation Removal

Required documents for hypothecation removal include the original Registration Certificate (RC), no objection certificate (NOC) from the financier, and a written application for hypothecation removal. A copy of the financer's letter confirming loan closure and a valid identity proof of the applicant are also essential. Timely submission of these documents to the Regional Transport Office (RTO) ensures smooth processing of hypothecation removal from vehicle registration records.

Common Issues in Hypothecation Addition and Removal

Common issues in hypothecation addition and removal often involve delays due to incomplete documentation and verification processes by the registering authority. Discrepancies in the registered owner's details or vehicle information can lead to rejection or prolonged processing times. Clarifying lien status and ensuring submission of accurate No Objection Certificates (NOCs) are critical to avoid complications during both addition and removal of hypothecation.

Frequently Asked Questions on Hypothecation in Car Registration

Hypothecation addition in car registration involves legally recording a lender's interest, securing a loan against the vehicle until full repayment, while hypothecation removal indicates the clearance of this charge after loan settlement, releasing the lien. Frequently asked questions include the process duration for hypothecation removal, documentation required such as the No Objection Certificate (NOC) from the financer, and how to update the Registration Certificate (RC) to reflect these changes. Understanding these aspects ensures seamless transfer of ownership and accurate vehicular records in the Registration Department.

Hypothecation Addition vs Hypothecation Removal Infographic

cardiffo.com

cardiffo.com