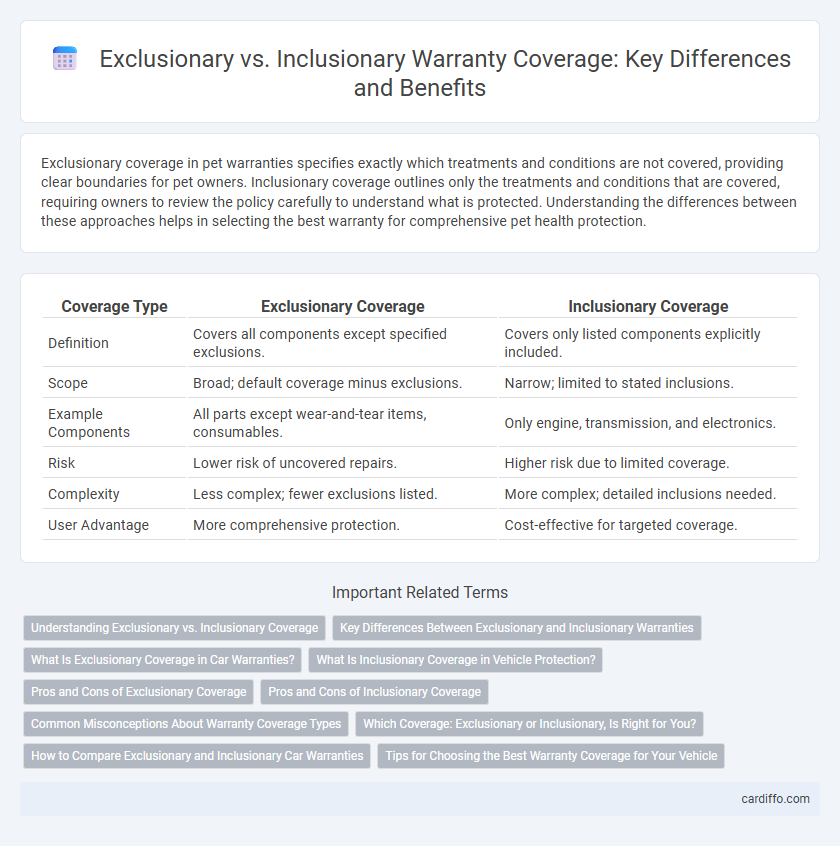

Exclusionary coverage in pet warranties specifies exactly which treatments and conditions are not covered, providing clear boundaries for pet owners. Inclusionary coverage outlines only the treatments and conditions that are covered, requiring owners to review the policy carefully to understand what is protected. Understanding the differences between these approaches helps in selecting the best warranty for comprehensive pet health protection.

Table of Comparison

| Coverage Type | Exclusionary Coverage | Inclusionary Coverage |

|---|---|---|

| Definition | Covers all components except specified exclusions. | Covers only listed components explicitly included. |

| Scope | Broad; default coverage minus exclusions. | Narrow; limited to stated inclusions. |

| Example Components | All parts except wear-and-tear items, consumables. | Only engine, transmission, and electronics. |

| Risk | Lower risk of uncovered repairs. | Higher risk due to limited coverage. |

| Complexity | Less complex; fewer exclusions listed. | More complex; detailed inclusions needed. |

| User Advantage | More comprehensive protection. | Cost-effective for targeted coverage. |

Understanding Exclusionary vs. Inclusionary Coverage

Exclusionary coverage limits warranty protection by specifying what is not covered, requiring customers to carefully review exclusions to avoid unexpected costs. Inclusionary coverage defines exactly what components or issues are protected, providing clearer expectations and more comprehensive protection. Understanding the distinction helps consumers make informed decisions about warranty plans tailored to their needs.

Key Differences Between Exclusionary and Inclusionary Warranties

Exclusionary warranties specify which components or damages are not covered, providing broad coverage except for listed exceptions, while inclusionary warranties detail exactly what is covered, often limiting protection to specified parts or issues. Exclusionary coverage is typically more comprehensive, offering peace of mind by covering most repairs except exclusions, whereas inclusionary coverage restricts claims to predefined conditions, reducing uncertainty but potentially increasing out-of-pocket costs. Understanding these key differences helps consumers choose warranties that align with their risk tolerance and expected repair needs.

What Is Exclusionary Coverage in Car Warranties?

Exclusionary coverage in car warranties specifies which parts and repairs are not covered, limiting the warranty protection by listing exclusions. This type of warranty typically covers only repairs explicitly mentioned, placing the burden on the vehicle owner to understand what is omitted. Exclusionary coverage often results in fewer surprises but may require additional extended warranties for comprehensive protection.

What Is Inclusionary Coverage in Vehicle Protection?

Inclusionary coverage in vehicle protection explicitly lists the specific components or systems covered under the warranty, ensuring clear understanding of what repairs or replacements are guaranteed. This type of coverage typically includes essential parts like the engine, transmission, and electrical systems, providing targeted protection tailored to the vehicle's most critical functions. Inclusionary coverage helps vehicle owners manage repair costs by defining exact inclusions, reducing ambiguity in claim approvals.

Pros and Cons of Exclusionary Coverage

Exclusionary coverage in warranties outlines specific items or damages not covered, offering clear limitations that simplify claim processing and reduce premium costs. However, this approach may lead to unexpected out-of-pocket expenses for consumers due to its narrower protection scope, increasing the risk of uncovered damages. The trade-off includes enhanced policy transparency and cost-effectiveness against potential gaps in coverage and customer dissatisfaction.

Pros and Cons of Inclusionary Coverage

Inclusionary coverage under warranty provides explicit protection for listed components or issues, ensuring clear expectations and reducing disputes over coverage. This type of coverage offers transparency and tailored protection, but may leave consumers vulnerable to unexpected repairs not specified in the inclusion list. While it simplifies claim verification, the limited scope can result in higher out-of-pocket costs for uncovered damages.

Common Misconceptions About Warranty Coverage Types

Common misconceptions about warranty coverage types often result from confusing exclusionary coverage, which specifies what is not covered, with inclusionary coverage that details the limited list of items protected. Many consumers mistakenly assume exclusionary warranties provide broader protection, while inclusionary warranties are restrictive; in reality, the scope and clarity of terms determine coverage comprehensiveness. Understanding the precise wording within warranty documents is crucial to avoid false expectations about repair, replacement, or service obligations.

Which Coverage: Exclusionary or Inclusionary, Is Right for You?

Exclusionary coverage offers broader protection by covering all parts and systems except those specifically excluded, ideal for those seeking comprehensive peace of mind. Inclusionary coverage limits protection only to the parts and systems explicitly listed, making it suitable for budget-conscious consumers who want coverage for major components. Choosing between exclusionary and inclusionary warranty coverage depends on your risk tolerance, budget, and the level of protection desired for your vehicle.

How to Compare Exclusionary and Inclusionary Car Warranties

Comparing exclusionary and inclusionary car warranties involves analyzing coverage scope and cost implications, where exclusionary warranties offer broad protection with specific exclusions, while inclusionary warranties cover only listed components. Exclusionary warranties typically provide extensive peace of mind by covering most repairs except for explicitly excluded parts, whereas inclusionary warranties require careful review to understand which components are protected. Evaluating factors such as deductible amounts, duration, maintenance requirements, and repair service conditions can help determine the best warranty type for your vehicle needs.

Tips for Choosing the Best Warranty Coverage for Your Vehicle

When choosing the best vehicle warranty coverage, prioritize understanding the differences between exclusionary and inclusionary policies: exclusionary coverage offers broader protection by covering most components except specified exclusions, while inclusionary coverage only covers listed parts. Assess your vehicle's age, mileage, and reliability to determine which type aligns with your risk tolerance and driving habits. Review warranty terms meticulously to avoid unexpected expenses and ensure comprehensive protection tailored to your vehicle's needs.

Exclusionary Coverage vs Inclusionary Coverage Infographic

cardiffo.com

cardiffo.com