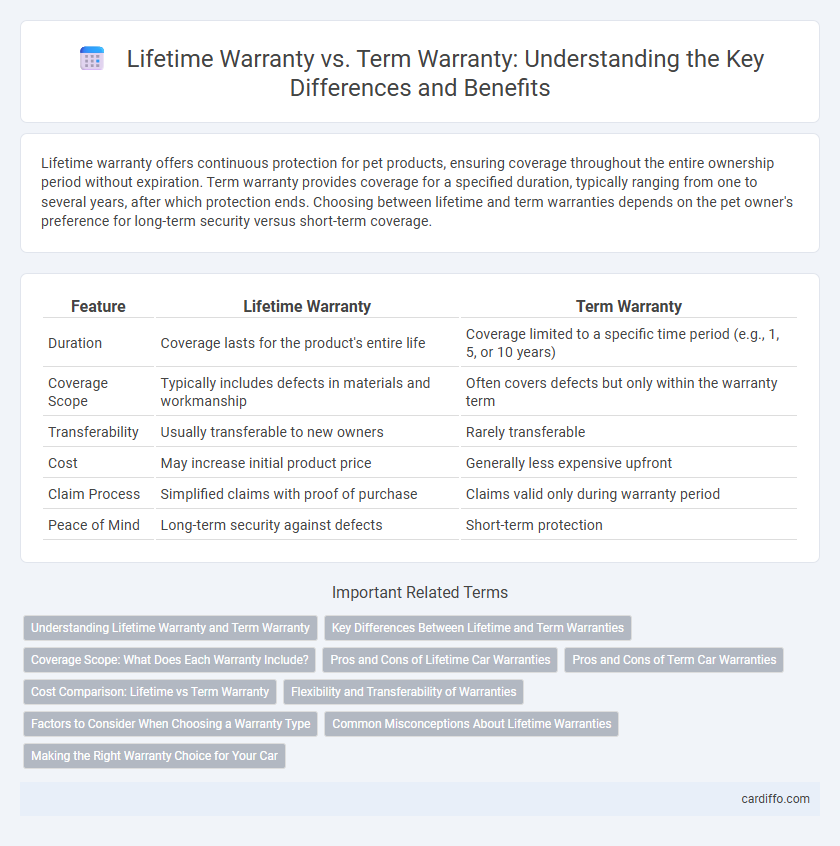

Lifetime warranty offers continuous protection for pet products, ensuring coverage throughout the entire ownership period without expiration. Term warranty provides coverage for a specified duration, typically ranging from one to several years, after which protection ends. Choosing between lifetime and term warranties depends on the pet owner's preference for long-term security versus short-term coverage.

Table of Comparison

| Feature | Lifetime Warranty | Term Warranty |

|---|---|---|

| Duration | Coverage lasts for the product's entire life | Coverage limited to a specific time period (e.g., 1, 5, or 10 years) |

| Coverage Scope | Typically includes defects in materials and workmanship | Often covers defects but only within the warranty term |

| Transferability | Usually transferable to new owners | Rarely transferable |

| Cost | May increase initial product price | Generally less expensive upfront |

| Claim Process | Simplified claims with proof of purchase | Claims valid only during warranty period |

| Peace of Mind | Long-term security against defects | Short-term protection |

Understanding Lifetime Warranty and Term Warranty

Lifetime warranty offers coverage for the entire lifespan of the product, ensuring repairs or replacements without time limitations as long as the original owner retains the item. Term warranty provides protection for a specific period, typically ranging from one to ten years, during which defects and malfunctions are covered under the policy conditions. Understanding the difference helps consumers choose warranty options based on product durability, usage duration, and long-term value assurance.

Key Differences Between Lifetime and Term Warranties

Lifetime warranties provide coverage for the entire lifespan of the product, ensuring repairs or replacements without time limitations, while term warranties cover a fixed duration, typically ranging from one to ten years. Key differences include the scope of coverage, with lifetime warranties often covering more components and offering greater long-term value, whereas term warranties may have specific limitations and exclusions after expiration. Cost variations also exist, as lifetime warranties usually entail higher initial investments but can reduce future expenses compared to term warranties.

Coverage Scope: What Does Each Warranty Include?

Lifetime warranty typically covers defects in materials and workmanship for the expected life of the product, including repairs or replacements without additional cost. Term warranty offers coverage for a specified period, often limited to parts and labor, with exclusions such as wear and tear or accidental damage. Understanding the scope of coverage is crucial for assessing long-term protection and potential out-of-pocket expenses.

Pros and Cons of Lifetime Car Warranties

Lifetime car warranties offer unlimited coverage for the vehicle's entire lifespan, providing peace of mind and potential savings on repairs; however, these warranties often come with higher upfront costs and may include strict eligibility requirements or coverage limitations. Term warranties cover a fixed period or mileage, typically resulting in lower initial expenses but requiring renewal or renewal fees after expiration. Consumers should weigh the comprehensive protection of lifetime warranties against the cost and fine print to determine the best option for long-term vehicle maintenance.

Pros and Cons of Term Car Warranties

Term car warranties offer defined coverage periods, typically ranging from one to seven years, providing predictable protection against specific mechanical failures. Their main advantage lies in affordability and clear expiration dates, which help consumers plan for future repairs or replacement costs. However, term warranties may exclude certain components and leave owners vulnerable to unexpected issues once the coverage ends, unlike lifetime warranties that promise prolonged protection without time limitations.

Cost Comparison: Lifetime vs Term Warranty

Lifetime warranties often entail a higher initial cost compared to term warranties, reflecting the extended coverage period and comprehensive protection they provide. Term warranties typically have lower upfront costs but may incur additional expenses if repairs or replacements are needed after the coverage period ends. Evaluating long-term value involves balancing the higher premium of lifetime warranties against the potential for recurring expenses associated with term warranties.

Flexibility and Transferability of Warranties

Lifetime warranties often provide greater flexibility by covering defects for the entire product lifespan, accommodating repairs or replacements as needed without a fixed end date. Term warranties, however, offer coverage for a specified period, which can limit flexibility but may include clear terms for claims within that timeframe. Transferability is usually more common in lifetime warranties, allowing the warranty to be passed to subsequent owners, enhancing product value and buyer confidence, whereas term warranties frequently restrict transfer options, limiting benefits to the original purchaser.

Factors to Consider When Choosing a Warranty Type

Evaluate product durability, usage frequency, and potential repair costs to determine if a lifetime warranty provides meaningful long-term value compared to a term warranty. Consider the warranty's coverage details, including exclusions and claim process efficiency, which can impact overall satisfaction and cost-effectiveness. Assess financial investment and product lifespan to decide whether the upfront premium of a lifetime warranty justifies protection beyond a standard term warranty's limited duration.

Common Misconceptions About Lifetime Warranties

Lifetime warranties often mislead consumers into believing coverage lasts indefinitely without conditions, but many include specific limitations or require proof of regular maintenance. Unlike term warranties that clearly define coverage periods, lifetime warranties may have hidden exclusions or reduced coverage over time. Understanding the fine print is essential to avoid unexpected repair costs despite the "lifetime" label.

Making the Right Warranty Choice for Your Car

Choosing between a lifetime warranty and a term warranty for your car depends on your long-term vehicle usage and resale plans. A lifetime warranty offers extensive coverage without expiration, providing peace of mind for high-mileage drivers or those planning to keep their car indefinitely. Term warranties, often ranging from 3 to 7 years, can be more cost-effective for short-term ownership and may influence your car's resale value.

Lifetime Warranty vs Term Warranty Infographic

cardiffo.com

cardiffo.com