Exclusionary coverage in pet warranties limits protection by specifying which components or services are not covered, often leading to unexpected out-of-pocket expenses. Stated component coverage clearly defines the exact parts or issues included, providing pet owners with transparent and predictable warranty terms. Understanding the distinction helps ensure pet owners select a warranty that aligns with their needs and avoids costly surprises.

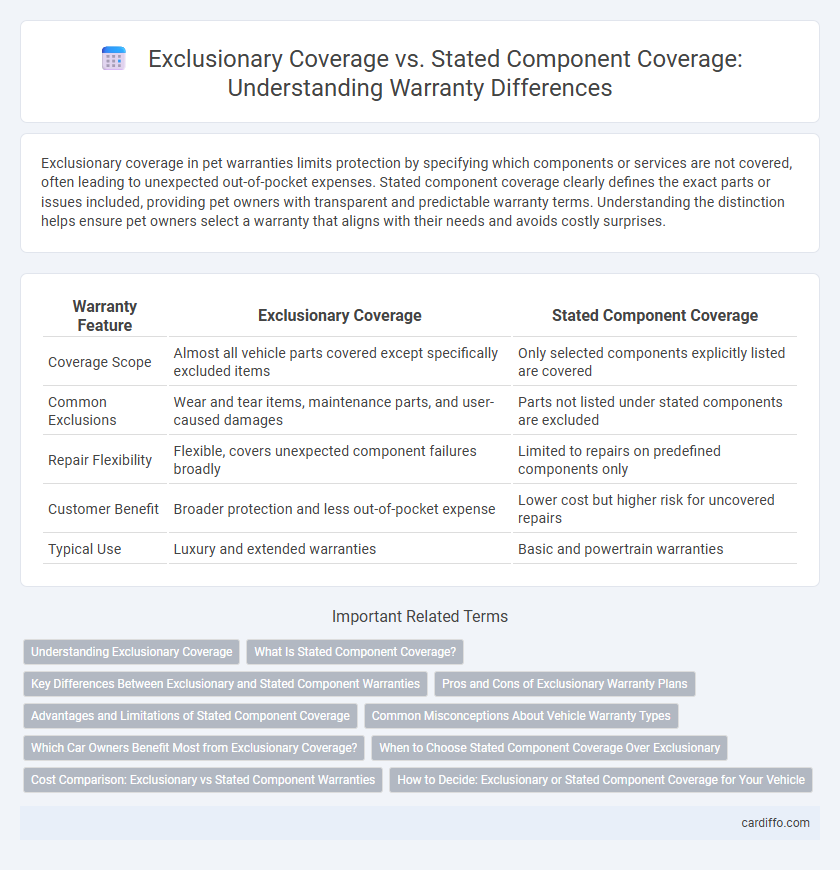

Table of Comparison

| Warranty Feature | Exclusionary Coverage | Stated Component Coverage |

|---|---|---|

| Coverage Scope | Almost all vehicle parts covered except specifically excluded items | Only selected components explicitly listed are covered |

| Common Exclusions | Wear and tear items, maintenance parts, and user-caused damages | Parts not listed under stated components are excluded |

| Repair Flexibility | Flexible, covers unexpected component failures broadly | Limited to repairs on predefined components only |

| Customer Benefit | Broader protection and less out-of-pocket expense | Lower cost but higher risk for uncovered repairs |

| Typical Use | Luxury and extended warranties | Basic and powertrain warranties |

Understanding Exclusionary Coverage

Exclusionary coverage limits warranty protection by specifying components or issues that are not covered under the agreement, reducing the scope compared to comprehensive warranties. This type of warranty explicitly lists exclusions, making it essential for consumers to review these details carefully to avoid unexpected repair costs. Understanding exclusionary coverage helps in evaluating warranty risks and comparing it effectively to stated component coverage, which only guarantees specific parts or systems.

What Is Stated Component Coverage?

Stated Component Coverage specifies protection for particular parts or systems listed in the warranty, limiting repairs to those components only. This targeted coverage helps customers understand exactly which items are covered and avoids ambiguity in claims. Unlike Exclusionary Coverage, which lists items not covered, Stated Component Coverage clearly defines included elements for precise warranty enforcement.

Key Differences Between Exclusionary and Stated Component Warranties

Exclusionary warranties provide comprehensive coverage by covering all parts except those specifically excluded, ensuring broader protection and fewer disputes over included components. Stated component warranties limit coverage to defined parts listed in the agreement, making it crucial to understand which components are covered to avoid unexpected repair costs. Understanding these distinctions helps consumers select the appropriate warranty type based on their repair risk tolerance and the scope of protection needed.

Pros and Cons of Exclusionary Warranty Plans

Exclusionary warranty plans offer comprehensive protection by covering nearly all vehicle components except for explicitly excluded items, minimizing out-of-pocket repairs and enhancing peace of mind. However, these plans often come with higher premiums and may include certain exclusions that limit coverage for wear-and-tear parts or specific systems. The broad coverage reduces claim denials but requires careful review of the exclusions list to avoid unexpected expenses.

Advantages and Limitations of Stated Component Coverage

Stated Component Coverage offers precise protection by covering specific parts explicitly listed in the warranty, reducing ambiguity and potential disputes over repair claims. This targeted approach ensures clarity for both consumers and manufacturers but limits coverage scope, potentially excluding related components commonly affected by a failure. The main limitation lies in the narrow coverage, which may result in out-of-pocket expenses for repairs involving unlisted parts, contrasting with broader exclusions under Exclusionary Coverage.

Common Misconceptions About Vehicle Warranty Types

Exclusionary coverage warranties promise extensive protection by excluding specific parts rather than listing covered components, often leading to misunderstandings about the breadth of coverage. Stated component coverage warranties explicitly specify which parts are covered, causing buyers to mistakenly assume that non-listed components are automatically excluded. Clarifying these distinctions can prevent common misconceptions and ensure vehicle owners understand the scope and limitations of their warranty protection.

Which Car Owners Benefit Most from Exclusionary Coverage?

Exclusionary coverage benefits car owners who drive newer vehicles or those with high repair costs, as it provides comprehensive protection for most components except a few specified exclusions. This type of warranty is ideal for owners seeking extensive coverage that aligns with factory warranties and covers complex electronics and advanced safety systems. Owners of luxury vehicles, high-mileage cars, or those planning to keep their car for an extended period gain the most value from exclusionary coverage due to its broad scope.

When to Choose Stated Component Coverage Over Exclusionary

Stated Component Coverage is ideal when specific high-value parts require defined protection, providing clarity on covered components and avoiding ambiguity in claims. This coverage is preferable over Exclusionary Coverage in cases of unique or expensive systems, such as hybrid batteries or advanced driver-assistance systems, which are often excluded under broader policies. Opting for Stated Component Coverage ensures tailored protection, aligning coverage with precise vehicle needs and reducing unexpected repair costs.

Cost Comparison: Exclusionary vs Stated Component Warranties

Exclusionary warranties generally offer broader coverage but tend to have higher upfront costs compared to stated component warranties, which focus on specific parts and often result in lower initial pricing. Stated component warranties limit coverage to predefined components, reducing repair expenses but potentially increasing out-of-pocket costs for non-covered parts. Customers should evaluate total ownership costs, including deductibles and repair frequency, to determine which warranty type offers greater long-term value.

How to Decide: Exclusionary or Stated Component Coverage for Your Vehicle

Choosing between exclusionary coverage and stated component coverage depends on your vehicle's age, condition, and budget. Exclusionary coverage offers comprehensive protection by covering nearly all parts except those specifically excluded, ideal for newer or high-value vehicles. Stated component coverage limits protection to predefined parts, making it suitable for older vehicles or owners seeking lower premiums with targeted repairs.

Exclusionary Coverage vs Stated Component Coverage Infographic

cardiffo.com

cardiffo.com