Mechanical Breakdown Insurance covers repairs for specific vehicle components after the manufacturer's warranty expires, providing flexible protection based on selected plans. Vehicle Service Contracts often include more comprehensive coverage, such as routine maintenance and additional services, resembling an extended warranty with broader benefits. Both options aim to reduce unexpected repair costs but differ in coverage scope and terms tailored to individual drivers' needs.

Table of Comparison

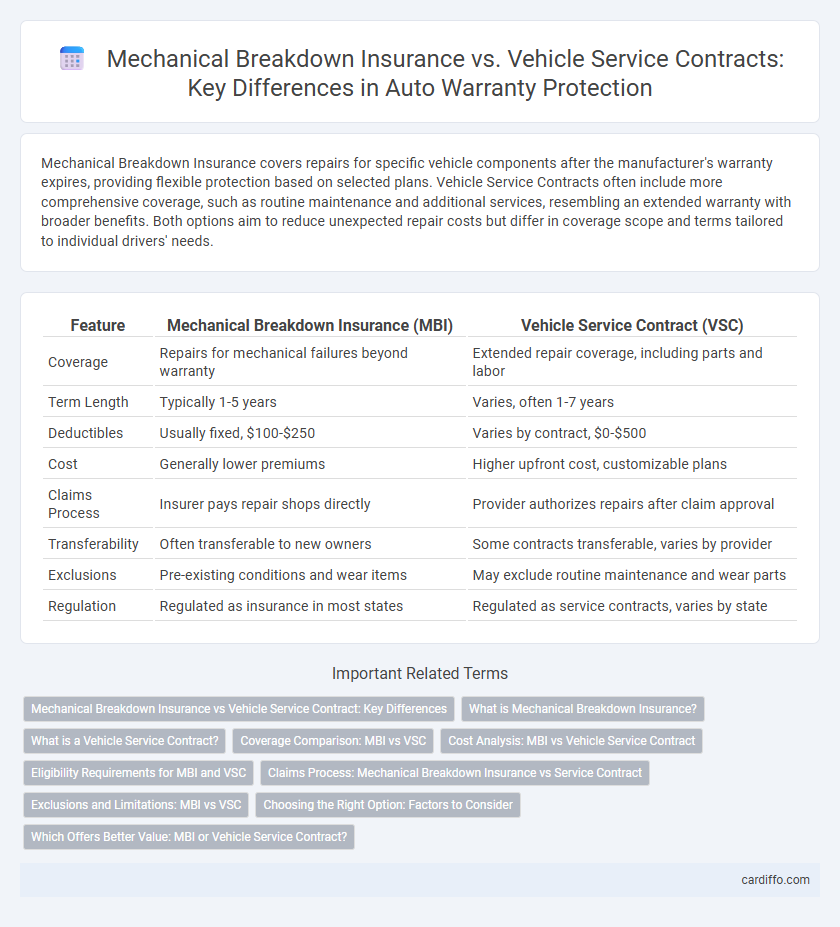

| Feature | Mechanical Breakdown Insurance (MBI) | Vehicle Service Contract (VSC) |

|---|---|---|

| Coverage | Repairs for mechanical failures beyond warranty | Extended repair coverage, including parts and labor |

| Term Length | Typically 1-5 years | Varies, often 1-7 years |

| Deductibles | Usually fixed, $100-$250 | Varies by contract, $0-$500 |

| Cost | Generally lower premiums | Higher upfront cost, customizable plans |

| Claims Process | Insurer pays repair shops directly | Provider authorizes repairs after claim approval |

| Transferability | Often transferable to new owners | Some contracts transferable, varies by provider |

| Exclusions | Pre-existing conditions and wear items | May exclude routine maintenance and wear parts |

| Regulation | Regulated as insurance in most states | Regulated as service contracts, varies by state |

Mechanical Breakdown Insurance vs Vehicle Service Contract: Key Differences

Mechanical Breakdown Insurance (MBI) covers repairs for mechanical failures beyond the manufacturer's warranty, typically offering broader coverage for major vehicle components without the need for pre-inspection. Vehicle Service Contracts (VSC) function like extended warranties, often providing customizable coverage plans with specific terms and exclusions, requiring vehicle condition assessment before issuance. MBIs are usually regulated as insurance, offering consumer protections and claim processes, whereas VSCs are service agreements managed by third-party providers with varying contract terms and service networks.

What is Mechanical Breakdown Insurance?

Mechanical Breakdown Insurance (MBI) is a specialized insurance policy that covers the cost of repairs for specific mechanical failures in a vehicle, typically beyond the manufacturer's warranty period. Unlike a Vehicle Service Contract, which is a service agreement offered by dealers or third parties, MBI functions as traditional insurance, protecting against unexpected mechanical breakdowns such as engine, transmission, or electrical system failures. This coverage helps vehicle owners avoid high out-of-pocket repair expenses by reimbursing costs related to covered mechanical repairs.

What is a Vehicle Service Contract?

A Vehicle Service Contract is a type of coverage that protects against the cost of repairs for mechanical failures beyond the manufacturer's warranty period. Unlike Mechanical Breakdown Insurance, which functions like traditional insurance with monthly premiums, a Vehicle Service Contract is often purchased as a one-time agreement covering specific parts and systems. These contracts can include benefits such as roadside assistance, rental car reimbursement, and provide peace of mind by limiting out-of-pocket repair expenses.

Coverage Comparison: MBI vs VSC

Mechanical Breakdown Insurance (MBI) covers repairs for specific mechanical failures similar to a manufacturer's warranty, typically excluding routine maintenance and wear items. Vehicle Service Contracts (VSC), often called extended warranties, offer broader protection by including additional components, roadside assistance, and sometimes maintenance services beyond basic mechanical issues. MBI usually has more limited coverage terms and claim restrictions compared to the comprehensive and customizable plans provided by VSCs.

Cost Analysis: MBI vs Vehicle Service Contract

Mechanical Breakdown Insurance (MBI) generally offers lower upfront costs compared to Vehicle Service Contracts, but MBI often requires separate deductibles and may have limited coverage components. Vehicle Service Contracts tend to have higher initial premiums yet provide more comprehensive repairs and fewer out-of-pocket expenses during claims. Evaluating total ownership costs, including deductibles, coverage limits, and claim frequency, is essential when choosing between MBI and Vehicle Service Contracts for optimal financial protection.

Eligibility Requirements for MBI and VSC

Mechanical Breakdown Insurance (MBI) typically requires vehicles to be within a certain age and mileage limit, often under 10 years old and 100,000 miles, to qualify for coverage. Vehicle Service Contracts (VSC) may offer more flexible eligibility criteria, including options for both new and used vehicles with varying mileage thresholds depending on the provider. MBI eligibility is often tied to policyholder criteria and insurer approval, while VSCs can be purchased at the point of sale or after the original warranty expires, broadening coverage opportunities.

Claims Process: Mechanical Breakdown Insurance vs Service Contract

Mechanical Breakdown Insurance (MBI) claims typically require policyholders to submit repair invoices and proof of maintenance within a specified timeframe, with approvals often processed through insurance adjusters. Vehicle Service Contract (VSC) claims usually involve notifying the contract provider before repairs, who may recommend authorized repair shops and handle cost estimates directly. The claims process for MBIs tends to resemble traditional insurance workflows, while VSCs emphasize pre-authorization and network-based service management for streamlined approvals.

Exclusions and Limitations: MBI vs VSC

Mechanical Breakdown Insurance (MBI) typically excludes pre-existing conditions, routine maintenance, and wear-and-tear components, whereas Vehicle Service Contracts (VSC) often provide more comprehensive coverage with fewer exclusions but may exclude aftermarket parts and certain high-mileage vehicles. MBI policies have limitations tied to the vehicle's age and mileage, while VSCs usually offer customizable plans that extend beyond standard factory warranties but include specific claim limits and deductible clauses. Understanding these distinctions helps consumers select appropriate coverage avoiding unexpected repair costs due to policy restrictions.

Choosing the Right Option: Factors to Consider

Mechanical Breakdown Insurance (MBI) covers unexpected repairs after the manufacturer's warranty expires, ideal for owners seeking coverage for major mechanical failures without upfront costs. Vehicle Service Contracts (VSC), often known as extended warranties, offer customizable plans including routine maintenance and wear-and-tear protection, best suited for drivers wanting comprehensive long-term coverage. When choosing between MBI and VSC, consider factors such as vehicle age, mileage, expected repair costs, and personal budget to ensure the selected option aligns with your coverage needs and financial plans.

Which Offers Better Value: MBI or Vehicle Service Contract?

Mechanical Breakdown Insurance (MBI) typically offers broader coverage with lower upfront costs, protecting essential vehicle components against unexpected mechanical failures beyond the manufacturer's warranty. Vehicle Service Contracts (VSC), often sold by dealerships, provide customizable plans with specific repair services and added benefits like roadside assistance, but usually come at a higher price and may include exclusions. Choosing between MBI and VSC depends on factors such as coverage scope, cost-effectiveness, repair frequency, and consumer preferences for flexible terms or comprehensive protection.

Mechanical Breakdown Insurance vs Vehicle Service Contract Infographic

cardiffo.com

cardiffo.com