A Deductible Warranty requires pet owners to pay a set amount out-of-pocket for each claim, which often results in lower monthly premiums. Zero-Deductible Warranty plans eliminate these upfront costs, offering hassle-free coverage but typically come with higher monthly payments. Choosing between the two depends on your budget flexibility and willingness to pay more initially or spread costs over time.

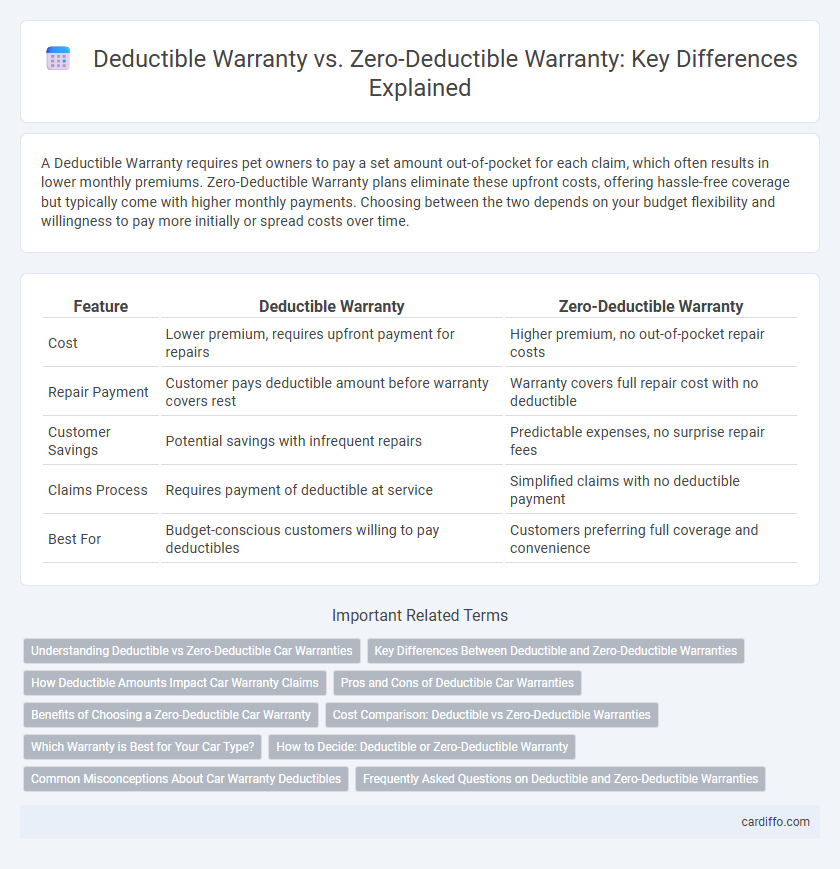

Table of Comparison

| Feature | Deductible Warranty | Zero-Deductible Warranty |

|---|---|---|

| Cost | Lower premium, requires upfront payment for repairs | Higher premium, no out-of-pocket repair costs |

| Repair Payment | Customer pays deductible amount before warranty covers rest | Warranty covers full repair cost with no deductible |

| Customer Savings | Potential savings with infrequent repairs | Predictable expenses, no surprise repair fees |

| Claims Process | Requires payment of deductible at service | Simplified claims with no deductible payment |

| Best For | Budget-conscious customers willing to pay deductibles | Customers preferring full coverage and convenience |

Understanding Deductible vs Zero-Deductible Car Warranties

Deductible warranties require vehicle owners to pay a fixed amount out-of-pocket for repairs before coverage kicks in, which can reduce the overall cost of the warranty but result in higher immediate expenses when repairs arise. Zero-deductible warranties cover all repair costs without requiring upfront payments, offering peace of mind and predictable expenses at a potentially higher premium. Understanding the trade-off between deductible and zero-deductible car warranties helps consumers balance cost savings against convenience and financial risk during vehicle repairs.

Key Differences Between Deductible and Zero-Deductible Warranties

Deductible warranties require customers to pay a predetermined amount out-of-pocket before the warranty coverage takes effect, often lowering the overall premium costs but imposing upfront expenses during repairs. Zero-deductible warranties eliminate this initial payment, providing full coverage without extra charges at the time of service, which typically results in higher premium rates. Key differences include cost structure, customer financial responsibility during claims, and the impact on warranty pricing and consumer choice.

How Deductible Amounts Impact Car Warranty Claims

Deductible amounts directly affect the out-of-pocket costs during car warranty claims, with higher deductibles lowering premium expenses but increasing immediate claim payments. Zero-deductible warranties offer the advantage of no upfront costs when making a claim, enhancing owner convenience but often resulting in higher overall premiums. Understanding the balance between deductible size and potential claim frequency helps vehicle owners choose the most cost-effective warranty option.

Pros and Cons of Deductible Car Warranties

Deductible car warranties require the vehicle owner to pay a set amount for repairs before the warranty coverage applies, often resulting in lower upfront warranty costs. These warranties can lead to significant savings on premiums but may cause higher out-of-pocket expenses when repairs are needed. However, the deductible model incentivizes careful vehicle maintenance, while zero-deductible warranties typically offer more convenience with no initial payment required for covered repairs, but at a higher purchase price.

Benefits of Choosing a Zero-Deductible Car Warranty

A zero-deductible car warranty offers significant financial protection by eliminating out-of-pocket costs for covered repairs, making vehicle maintenance more predictable and affordable. Vehicle owners benefit from quicker approval and repair processes since no deductible payment is required upfront, enhancing overall convenience. This warranty type also increases resale value by providing reassurance to future buyers that major repairs are fully covered without additional expenses.

Cost Comparison: Deductible vs Zero-Deductible Warranties

Deductible warranties often have lower upfront premiums but require policyholders to pay a specified amount out-of-pocket for repairs, reducing initial costs but increasing potential expenses during claims. Zero-deductible warranties eliminate out-of-pocket repair costs, resulting in higher premium fees but offering greater financial predictability and peace of mind. Evaluating the total cost over the warranty period is essential, as zero-deductible options may save money for frequent repairs while deductible plans benefit those with infrequent or minor issues.

Which Warranty is Best for Your Car Type?

Choosing between a deductible warranty and a zero-deductible warranty depends on your car type and driving habits. For high-mileage or older vehicles, a deductible warranty can lower upfront costs while still providing essential coverage against common repairs. Newer or luxury cars benefit more from zero-deductible warranties, ensuring comprehensive protection without out-of-pocket expenses during repairs.

How to Decide: Deductible or Zero-Deductible Warranty

Choosing between a deductible warranty and a zero-deductible warranty depends on your financial risk tolerance and expected repair costs. Deductible warranties often have lower upfront costs but require paying a fixed amount before coverage applies, making them suitable if you anticipate minor repairs. Zero-deductible warranties eliminate out-of-pocket expenses for covered repairs, offering peace of mind for frequent or costly maintenance needs despite higher initial premiums.

Common Misconceptions About Car Warranty Deductibles

Common misconceptions about car warranty deductibles often confuse deductible warranty with zero-deductible warranty, leading vehicle owners to overlook critical cost differences during repairs. Deductible warranties require a fixed out-of-pocket payment for each repair, while zero-deductible warranties eliminate this cost, offering full coverage but typically at a higher upfront price. Understanding these distinctions helps consumers make informed decisions, avoiding unexpected expenses and ensuring better coverage alignment with their budget.

Frequently Asked Questions on Deductible and Zero-Deductible Warranties

Deductible warranties require policyholders to pay a specific amount out-of-pocket before coverage begins, impacting upfront costs during repairs or claims. Zero-deductible warranties eliminate this expense, offering full coverage without any initial payment, often resulting in higher premium prices. Consumers frequently ask about the cost-effectiveness and coverage differences between these options to determine which warranty best meets their financial and protection needs.

Deductible Warranty vs Zero-Deductible Warranty Infographic

cardiffo.com

cardiffo.com