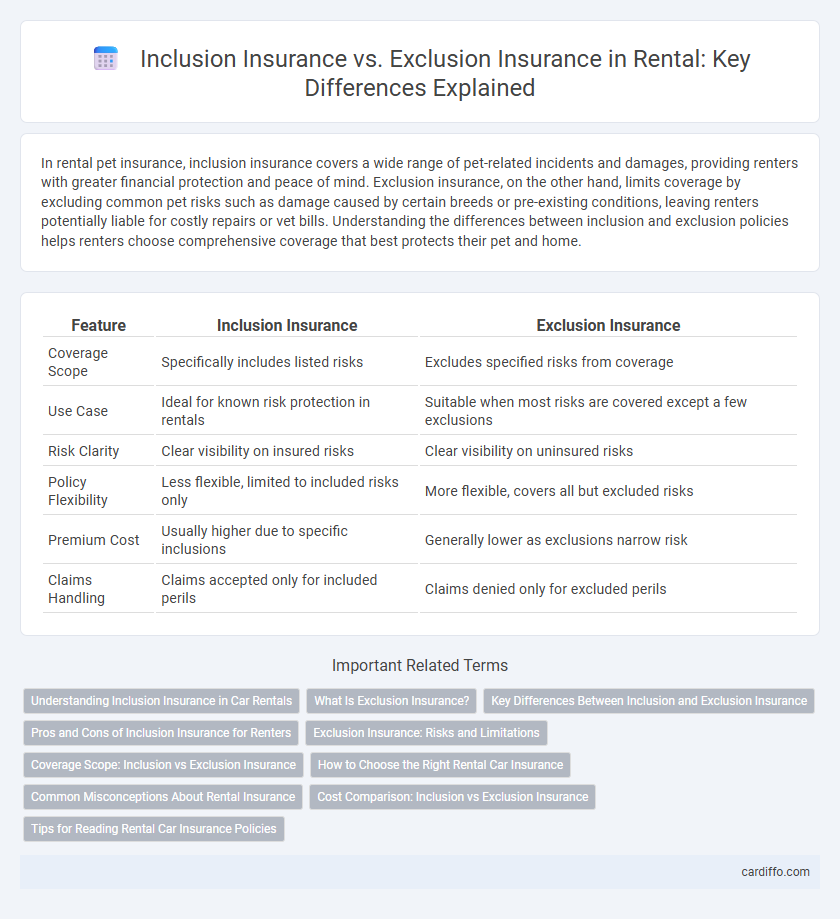

In rental pet insurance, inclusion insurance covers a wide range of pet-related incidents and damages, providing renters with greater financial protection and peace of mind. Exclusion insurance, on the other hand, limits coverage by excluding common pet risks such as damage caused by certain breeds or pre-existing conditions, leaving renters potentially liable for costly repairs or vet bills. Understanding the differences between inclusion and exclusion policies helps renters choose comprehensive coverage that best protects their pet and home.

Table of Comparison

| Feature | Inclusion Insurance | Exclusion Insurance |

|---|---|---|

| Coverage Scope | Specifically includes listed risks | Excludes specified risks from coverage |

| Use Case | Ideal for known risk protection in rentals | Suitable when most risks are covered except a few exclusions |

| Risk Clarity | Clear visibility on insured risks | Clear visibility on uninsured risks |

| Policy Flexibility | Less flexible, limited to included risks only | More flexible, covers all but excluded risks |

| Premium Cost | Usually higher due to specific inclusions | Generally lower as exclusions narrow risk |

| Claims Handling | Claims accepted only for included perils | Claims denied only for excluded perils |

Understanding Inclusion Insurance in Car Rentals

Inclusion insurance in car rentals refers to coverage explicitly built into the rental agreement, protecting renters from financial liabilities such as collision damage, theft, and third-party claims. This type of insurance ensures that essential protections are provided as part of the rental package, often eliminating the need for additional policies. Understanding inclusion insurance helps renters avoid unexpected costs and enhances confidence when driving a rented vehicle.

What Is Exclusion Insurance?

Exclusion insurance is a policy type that explicitly omits coverage for specific risks, events, or property conditions often excluded due to high risk or uninsurability. This contrasts with inclusion insurance, which clearly defines covered perils, providing protection against those listed risks within rental properties. Landlords and tenants should carefully review exclusion clauses to understand potential gaps in coverage that could affect liability or property damage claims.

Key Differences Between Inclusion and Exclusion Insurance

Inclusion insurance specifies the risks and damages covered under a rental policy, clearly outlining the protections available to renters such as theft, fire, or liability coverage. Exclusion insurance, in contrast, lists the risks and situations that are not covered, like intentional damage or certain natural disasters, helping renters understand their financial responsibilities. Understanding these distinctions is crucial for renters to assess their coverage adequacy and avoid unexpected expenses during their rental period.

Pros and Cons of Inclusion Insurance for Renters

Inclusion insurance for renters provides comprehensive coverage by automatically including various risks like theft, fire, and liability, reducing the need for multiple separate policies. It offers the advantage of simplified claims processing and often lower overall costs, but may come with higher premiums and less flexibility in customizing coverage. Renters benefit from broader protection and peace of mind, though they should evaluate if the standardized coverage aligns with their specific rental property risks.

Exclusion Insurance: Risks and Limitations

Exclusion insurance in rental agreements explicitly lists risks and damages not covered, creating potential financial exposure for landlords and tenants if those exclusions materialize. Common exclusions may involve natural disasters, tenant negligence, and certain liability claims, which can lead to costly repairs or legal fees not reimbursed by the insurer. Understanding these limitations is crucial for both parties to assess supplemental coverage options and mitigate unforeseen risks in rental property management.

Coverage Scope: Inclusion vs Exclusion Insurance

Inclusion insurance provides coverage for specific risks explicitly listed in the policy, ensuring renters are protected against clearly defined perils such as fire, theft, or natural disasters. Exclusion insurance, on the other hand, covers all risks except those specifically excluded, offering broader protection but requiring careful attention to the exclusion list to understand the limitations. Understanding the difference in coverage scope between inclusion and exclusion insurance helps renters select the appropriate policy based on their risk tolerance and asset protection needs.

How to Choose the Right Rental Car Insurance

Choosing the right rental car insurance involves understanding the differences between inclusion insurance, which covers most damages and liabilities as part of the rental package, and exclusion insurance, which requires additional coverage for specific risks. Evaluate your existing auto insurance policy and credit card benefits to identify gaps that exclusion insurance might fill, ensuring comprehensive protection without redundant costs. Prioritize coverage that shields against high-risk scenarios such as collision, theft, and liability to optimize both safety and budget during your rental period.

Common Misconceptions About Rental Insurance

Common misconceptions about rental insurance often confuse inclusion insurance with exclusion insurance, leading renters to misunderstand their coverage scope. Inclusion insurance explicitly lists covered perils, ensuring renters know precisely what damages are protected, while exclusion insurance covers all risks except those specifically excluded, which can result in unexpected gaps in protection. Understanding these fundamental differences helps renters avoid costly surprises when filing claims for damages such as theft, fire, or water loss.

Cost Comparison: Inclusion vs Exclusion Insurance

Inclusion insurance typically incurs higher premiums as it covers a broader array of risks within rental agreements, offering comprehensive protection for landlords and tenants. Exclusion insurance presents a cost-effective alternative by limiting coverage to specific risks explicitly outlined, reducing overall premium expenses but increasing potential liability exposure. Renters and property owners must weigh the trade-off between higher upfront costs of inclusion insurance versus the affordability and risk of exclusion insurance in rental property management.

Tips for Reading Rental Car Insurance Policies

When reviewing rental car insurance policies, carefully distinguish between inclusion insurance, which covers specified risks, and exclusion insurance, which explicitly omits coverage for certain situations. Pay close attention to terms outlining liability limits, damage coverage, and exclusions to understand your financial responsibility fully. Verify if coverage extends to additional drivers, international travel, and theft protection to avoid unexpected expenses during your rental period.

Inclusion Insurance vs Exclusion Insurance Infographic

cardiffo.com

cardiffo.com