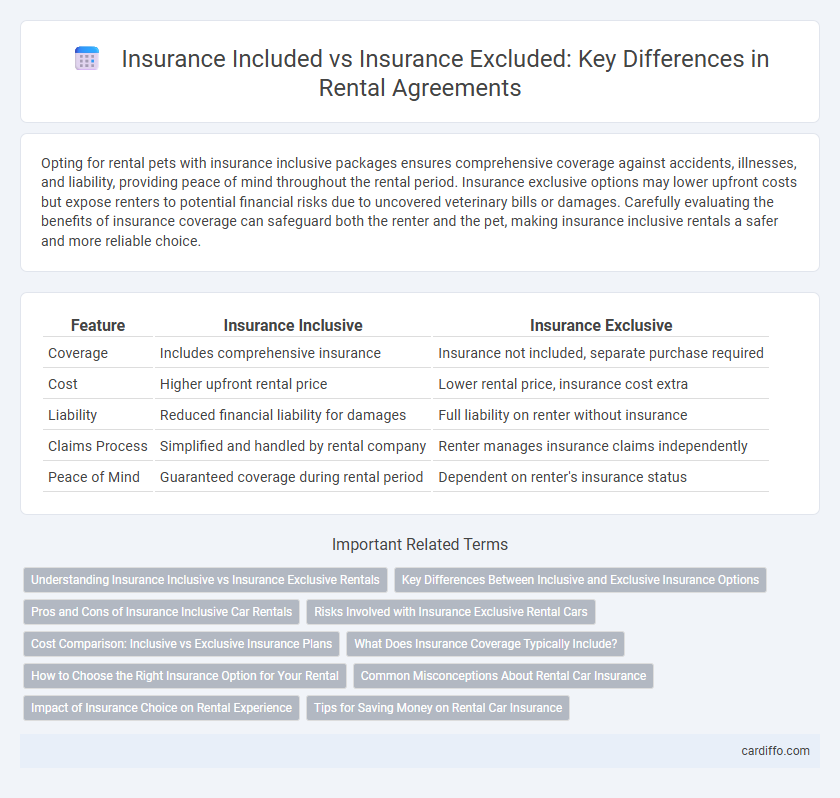

Opting for rental pets with insurance inclusive packages ensures comprehensive coverage against accidents, illnesses, and liability, providing peace of mind throughout the rental period. Insurance exclusive options may lower upfront costs but expose renters to potential financial risks due to uncovered veterinary bills or damages. Carefully evaluating the benefits of insurance coverage can safeguard both the renter and the pet, making insurance inclusive rentals a safer and more reliable choice.

Table of Comparison

| Feature | Insurance Inclusive | Insurance Exclusive |

|---|---|---|

| Coverage | Includes comprehensive insurance | Insurance not included, separate purchase required |

| Cost | Higher upfront rental price | Lower rental price, insurance cost extra |

| Liability | Reduced financial liability for damages | Full liability on renter without insurance |

| Claims Process | Simplified and handled by rental company | Renter manages insurance claims independently |

| Peace of Mind | Guaranteed coverage during rental period | Dependent on renter's insurance status |

Understanding Insurance Inclusive vs Insurance Exclusive Rentals

Insurance inclusive rentals provide coverage within the rental price, protecting renters from potential damages or theft without extra fees. Insurance exclusive rentals require renters to purchase separate insurance policies, which may increase overall costs but offer tailored coverage options. Understanding the differences helps renters make informed decisions based on risk tolerance and budget constraints.

Key Differences Between Inclusive and Exclusive Insurance Options

Insurance inclusive rental agreements cover damage, theft, and liability within the rental price, providing comprehensive protection and peace of mind for customers. Insurance exclusive options require renters to purchase separate coverage, often resulting in additional costs and managing multiple policies. Choosing inclusive insurance simplifies claims and reduces financial risk, while exclusive insurance offers flexibility for those with existing coverage or specific policy preferences.

Pros and Cons of Insurance Inclusive Car Rentals

Insurance inclusive car rentals offer peace of mind by covering damages, theft, and third-party liability within the rental price, reducing out-of-pocket expenses and simplifying claims processes. This option minimizes financial risks and stress for renters, especially in unfamiliar locations where liability laws vary. However, insurance-inclusive rentals typically come with higher upfront costs, which may increase overall rental expenses compared to insurance exclusive options requiring separate policies.

Risks Involved with Insurance Exclusive Rental Cars

Rental cars offered under insurance exclusive agreements carry significant risks, including higher out-of-pocket expenses for damages, liability claims, and theft, as renters are responsible for all insurance coverage. Without inclusive insurance, customers face potential financial exposure from accidents or vehicle damage that exceed basic deposits or security holds. Ensuring comprehensive coverage or opting for insurance inclusive rentals mitigates these risks and provides peace of mind during the rental period.

Cost Comparison: Inclusive vs Exclusive Insurance Plans

Insurance-inclusive rental plans typically have higher upfront costs but eliminate the need for separate insurance purchases, often resulting in predictable total expenses. Insurance-exclusive plans may offer lower base rates but require renters to secure their own coverage, potentially increasing overall costs due to variable insurance premiums and deductible risks. Analyzing anticipated rental duration and insurance needs helps determine which option offers better financial value.

What Does Insurance Coverage Typically Include?

Insurance coverage in rental agreements typically includes protection against property damage, theft, and liability for bodily injury occurring on the rental premises. Policies often cover both the physical rental asset and legal costs arising from accidents or damages caused by the renter. Insurance-inclusive rentals incorporate these protections into the rental fee, while insurance-exclusive agreements require separate purchasers of coverage for full protection.

How to Choose the Right Insurance Option for Your Rental

Choosing the right insurance option for your rental depends on factors such as budget, coverage needs, and risk tolerance. Insurance inclusive rentals often provide peace of mind with comprehensive protection already factored into the rental rate, while insurance exclusive rentals allow for lower upfront costs but require purchasing separate coverage. Evaluating the extent of liability coverage, deductibles, and the potential financial impact of damages helps renters make an informed decision tailored to their specific situation.

Common Misconceptions About Rental Car Insurance

Many renters mistakenly believe that basic insurance coverage included with rental cars fully protects them from all damages or liabilities, overlooking the policy limitations and exclusions. Common misconceptions include assuming personal auto insurance or credit card coverage automatically applies, when in fact, coverage can vary widely by provider and rental location. Understanding the distinction between insurance inclusive rentals, which bundle coverage in the price, and insurance exclusive rentals, which require separate purchases, is crucial to avoid unexpected out-of-pocket expenses.

Impact of Insurance Choice on Rental Experience

Choosing insurance-inclusive rental options minimizes unexpected out-of-pocket expenses and streamlines the claims process, enhancing overall customer satisfaction and peace of mind. Insurance-exclusive rentals often require renters to secure separate coverage, which can lead to confusion, delayed approvals, and potential financial risks in case of damage or accidents. The insurance choice directly affects rental cost transparency, liability exposure, and the efficiency of dispute resolution during the rental period.

Tips for Saving Money on Rental Car Insurance

Choosing insurance exclusive rental options often reduces upfront costs but requires verifying your personal or credit card coverage to avoid unnecessary expenses. Opting for insurance inclusive rentals provides peace of mind by bundling coverage, eliminating the risk of unexpected charges during accidents or theft. Reviewing your existing policies and comparing coverage limits helps identify gaps, allowing you to select cost-effective options tailored to your travel needs.

Insurance Inclusive vs Insurance Exclusive Infographic

cardiffo.com

cardiffo.com