Third-party liability in rental pet agreements covers damages or injuries caused to others by the rented animal, protecting the renter from legal claims. Supplemental liability offers an extra layer of protection beyond basic coverage, often including higher limits and additional scenarios. Choosing supplemental liability ensures more comprehensive financial security against potential risks associated with renting pets.

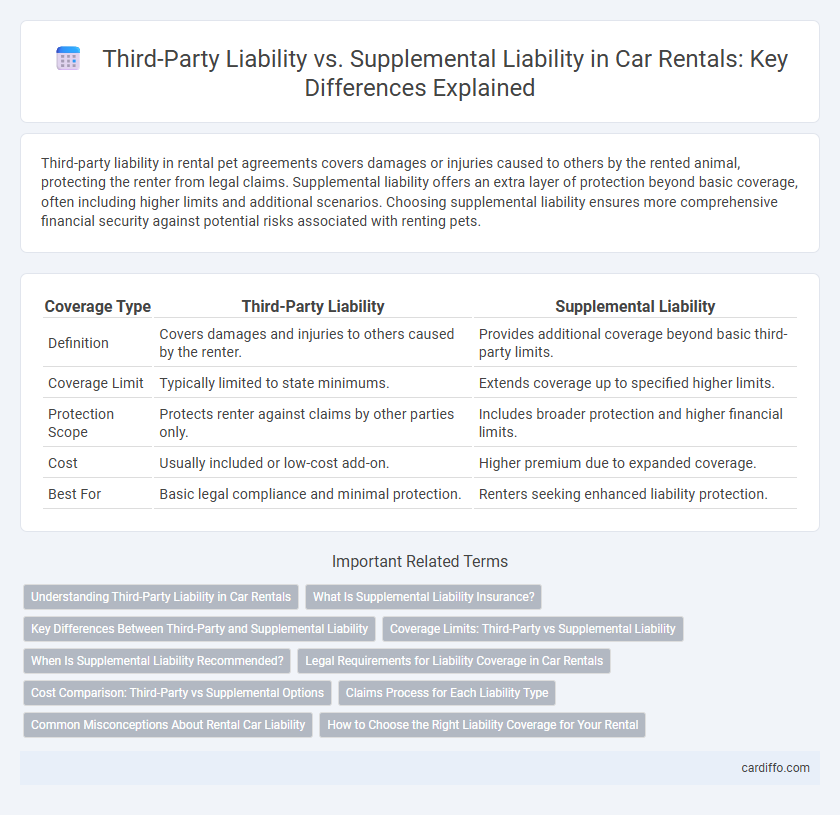

Table of Comparison

| Coverage Type | Third-Party Liability | Supplemental Liability |

|---|---|---|

| Definition | Covers damages and injuries to others caused by the renter. | Provides additional coverage beyond basic third-party limits. |

| Coverage Limit | Typically limited to state minimums. | Extends coverage up to specified higher limits. |

| Protection Scope | Protects renter against claims by other parties only. | Includes broader protection and higher financial limits. |

| Cost | Usually included or low-cost add-on. | Higher premium due to expanded coverage. |

| Best For | Basic legal compliance and minimal protection. | Renters seeking enhanced liability protection. |

Understanding Third-Party Liability in Car Rentals

Third-party liability in car rentals covers damages or injuries caused to others outside the rental vehicle, protecting the renter from financial responsibility for these claims. Supplemental liability insurance offers additional coverage beyond the minimum third-party liability requirements, often increasing protection limits. Rental agreements typically include state-mandated third-party liability, but opting for supplemental liability can provide greater peace of mind and broader financial security.

What Is Supplemental Liability Insurance?

Supplemental Liability Insurance (SLI) offers renters additional coverage for third-party bodily injury and property damage beyond the basic liability limits included in a rental agreement. Unlike standard Third-Party Liability, which typically provides minimal protection, SLI increases the coverage limit, reducing financial risk in the event of an accident caused to others. This insurance is essential for renters seeking enhanced security against lawsuits or claims resulting from incidents during the rental period.

Key Differences Between Third-Party and Supplemental Liability

Third-party liability insurance covers damages or injuries a renter causes to others or their property during the rental period, protecting the renter from legal and financial responsibility. Supplemental liability insurance offers additional coverage beyond basic third-party limits, increasing protection against larger claims for bodily injury or property damage. Key differences include the coverage limits and scope, with supplemental liability serving as an optional upgrade to extend financial protection beyond standard third-party liability.

Coverage Limits: Third-Party vs Supplemental Liability

Third-party liability coverage typically offers state-mandated minimum limits, protecting renters against claims for bodily injury or property damage caused to others in an accident. Supplemental liability insurance provides higher coverage limits, extending protection beyond basic third-party limits to cover more extensive damages and legal costs. Renters seeking comprehensive protection often opt for supplemental liability to bridge gaps left by minimum third-party limits.

When Is Supplemental Liability Recommended?

Supplemental liability insurance is recommended when renting a vehicle in areas with low or uncertain third-party liability coverage limits, providing additional protection beyond standard policies. It offers extended financial security against claims for bodily injury or property damage caused to others, especially in high-risk locations or when driving high-value vehicles. Renters seeking peace of mind and reduced out-of-pocket expenses should consider supplemental liability insurance to mitigate potential legal and financial risks.

Legal Requirements for Liability Coverage in Car Rentals

Third-party liability coverage is legally mandated in most jurisdictions, ensuring that drivers are financially protected against damages or injuries caused to others during a car rental. Supplemental liability insurance offers enhanced protection beyond the minimum legal requirements, covering higher limits or additional scenarios not addressed by standard third-party policies. Understanding the specific liability coverage requirements and options is essential for renters to comply with local laws and avoid significant out-of-pocket expenses in the event of an accident.

Cost Comparison: Third-Party vs Supplemental Options

Third-party liability coverage generally offers lower daily rental costs, typically ranging from $7 to $15, while supplemental liability insurance can cost between $10 to $25 per day depending on the provider and coverage limits. Comparing cost efficiency, third-party liability is often the more affordable option for basic protection against damages to others, whereas supplemental liability provides broader coverage but at a higher premium. Renters should balance their risk tolerance with budget constraints when choosing between third-party liability and supplemental liability insurance during vehicle rentals.

Claims Process for Each Liability Type

Third-party liability claims require renters to notify the rental company immediately and provide detailed incident reports along with contact information of all parties involved for proper investigation. Supplemental liability claims often involve an additional insurance provider and may require submitting extra documentation, such as proof of coverage and a formal claim form, to expedite processing. Understanding the distinct claims process for each liability type ensures faster resolution and minimizes potential out-of-pocket expenses.

Common Misconceptions About Rental Car Liability

Many renters mistakenly believe that third-party liability coverage automatically protects against all damages involving other vehicles or property, while it only covers injuries or damages caused to others. Supplemental liability insurance, often offered as an add-on, extends this protection by increasing coverage limits or filling gaps not covered by a renter's personal auto policy. Understanding the distinction between these liabilities helps avoid unexpected out-of-pocket expenses and ensures adequate financial protection during a rental car period.

How to Choose the Right Liability Coverage for Your Rental

Choosing the right liability coverage for your rental requires understanding the key differences between third-party liability and supplemental liability insurance. Third-party liability typically covers damages or injuries you cause to others, protecting you from costly lawsuits, while supplemental liability offers extra protection beyond basic limits for enhanced peace of mind. Evaluate your rental duration, location, and personal risk tolerance to determine if adding supplemental liability coverage is necessary for comprehensive financial security.

Third-party liability vs Supplemental liability Infographic

cardiffo.com

cardiffo.com