Car leasing offers long-term use with lower monthly payments and the option to buy at the end of the contract, making it ideal for users seeking ownership flexibility. Car renting provides short-term access without long commitments, perfect for travelers or those needing occasional vehicle use. Both options cater to different needs depending on the duration and financial goals of the user.

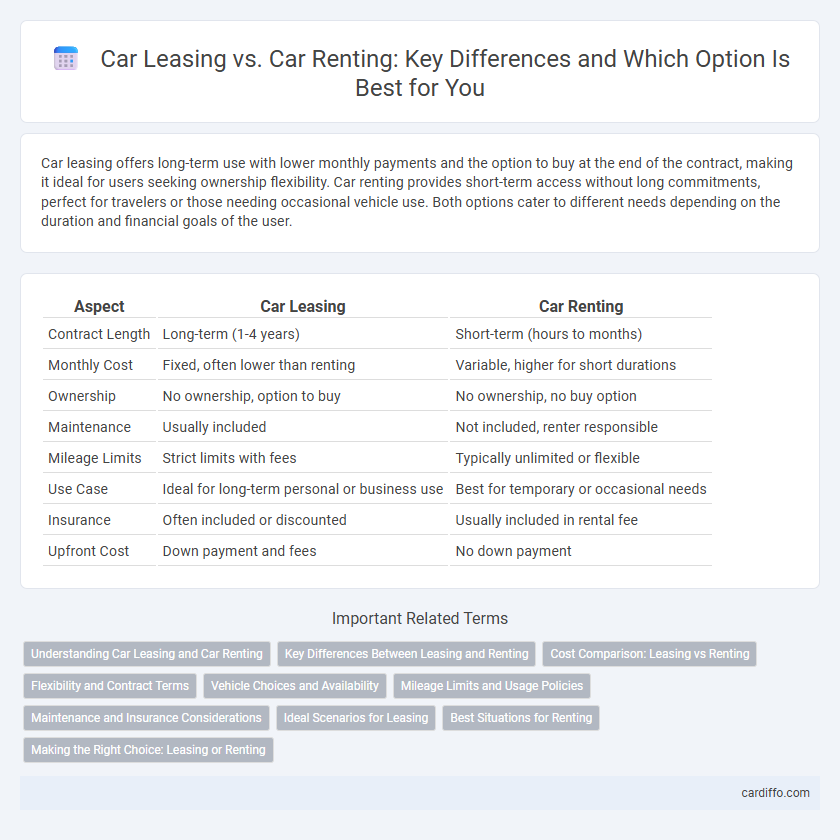

Table of Comparison

| Aspect | Car Leasing | Car Renting |

|---|---|---|

| Contract Length | Long-term (1-4 years) | Short-term (hours to months) |

| Monthly Cost | Fixed, often lower than renting | Variable, higher for short durations |

| Ownership | No ownership, option to buy | No ownership, no buy option |

| Maintenance | Usually included | Not included, renter responsible |

| Mileage Limits | Strict limits with fees | Typically unlimited or flexible |

| Use Case | Ideal for long-term personal or business use | Best for temporary or occasional needs |

| Insurance | Often included or discounted | Usually included in rental fee |

| Upfront Cost | Down payment and fees | No down payment |

Understanding Car Leasing and Car Renting

Car leasing involves a long-term contract where individuals or businesses pay monthly installments to use a vehicle, often with mileage limits and maintenance included. Car renting refers to short-term use, typically from daily to weekly periods, offering flexible access without long-term commitments. Understanding the differences helps consumers choose based on usage needs, budget constraints, and vehicle preference.

Key Differences Between Leasing and Renting

Car leasing typically involves long-term contracts, often spanning two to four years, with lower monthly payments and the option to purchase the vehicle at the end of the lease term. In contrast, car renting offers short-term flexibility, usually on a daily, weekly, or monthly basis, and includes maintenance and insurance in the rental price. Leasing suits individuals seeking long-term use without ownership, while renting is ideal for temporary transportation needs or short trips.

Cost Comparison: Leasing vs Renting

Car leasing typically involves lower monthly payments compared to renting, as leases are long-term agreements spreading depreciation costs over time. Renting cars usually incurs higher daily or weekly rates, making it more expensive for extended use but flexible for short-term needs. Lease agreements may include maintenance and insurance, potentially lowering overall expenses compared to rental agreements with separate fees.

Flexibility and Contract Terms

Car leasing typically involves long-term contracts ranging from 12 to 48 months, offering lower monthly payments but limited flexibility for early termination. In contrast, car renting allows short-term usage options from daily to monthly rentals, providing greater adaptability without long-term commitment. Businesses and individuals seeking temporary transportation often prefer renting, while those aiming for predictable costs over several years usually opt for leasing.

Vehicle Choices and Availability

Car leasing typically offers a wider selection of new or nearly new vehicles with customizable terms, appealing to drivers seeking long-term commitments and the latest models. Car renting provides greater flexibility with immediate access to a diverse fleet, ideal for short-term or spontaneous needs. Availability in leasing depends on manufacturer deals and supply chains, while rental companies maintain extensive inventories to meet varying customer demands quickly.

Mileage Limits and Usage Policies

Car leasing agreements typically impose strict mileage limits ranging from 10,000 to 15,000 miles per year, with excess mileage fees that can significantly increase the overall cost. Car renting usually offers flexible usage policies with no mileage restrictions, making it ideal for short-term or irregular travel needs. Understanding these differences is crucial for selecting between leasing and renting based on your expected driving frequency and distance.

Maintenance and Insurance Considerations

Car leasing typically includes regular maintenance and comprehensive insurance coverage as part of the contract, reducing unexpected costs for lessees. In contrast, car renting often places maintenance responsibilities on the rental company but may offer limited insurance options that require renters to purchase additional coverage. Understanding these differences helps consumers choose between long-term cost savings in leasing and the short-term flexibility of renting.

Ideal Scenarios for Leasing

Leasing a car is ideal for individuals who prefer driving new vehicles every few years without the commitment of ownership, typically business professionals seeking tax advantages and predictable monthly payments. It suits drivers with consistent, moderate mileage needs--generally under 15,000 miles annually--to avoid excess wear fees. Long-term use beyond typical rental periods offers cost-effectiveness compared to renting, making leasing a strategic choice for those prioritizing lower upfront costs and maintenance coverage.

Best Situations for Renting

Car renting is best suited for short-term needs such as vacations, business trips, or temporary transportation when flexibility and immediate availability are priorities. It offers straightforward terms without long-term commitments, making it ideal for occasional use or when the duration of use is uncertain. Renting also provides access to the latest vehicle models with minimal upfront costs, perfect for individuals who want convenience without long-term financial obligations.

Making the Right Choice: Leasing or Renting

Car leasing offers lower monthly payments and long-term use, making it ideal for individuals who prefer driving new models with maintenance included. Car renting provides flexibility for short-term needs without long-term commitments or depreciation concerns. Evaluating usage duration, budget constraints, and vehicle preferences helps determine whether leasing or renting is the optimal choice.

Car leasing vs car renting Infographic

cardiffo.com

cardiffo.com