Rental pets with insurance coverage provide owners peace of mind by protecting against unexpected veterinary expenses and potential damages, ensuring financial security throughout the rental period. Non-insurance rentals may offer lower upfront costs but carry higher risks, leaving renters responsible for costly medical treatments or property damage. Choosing insurance-included rentals enhances confidence, reduces liability, and supports a worry-free pet rental experience.

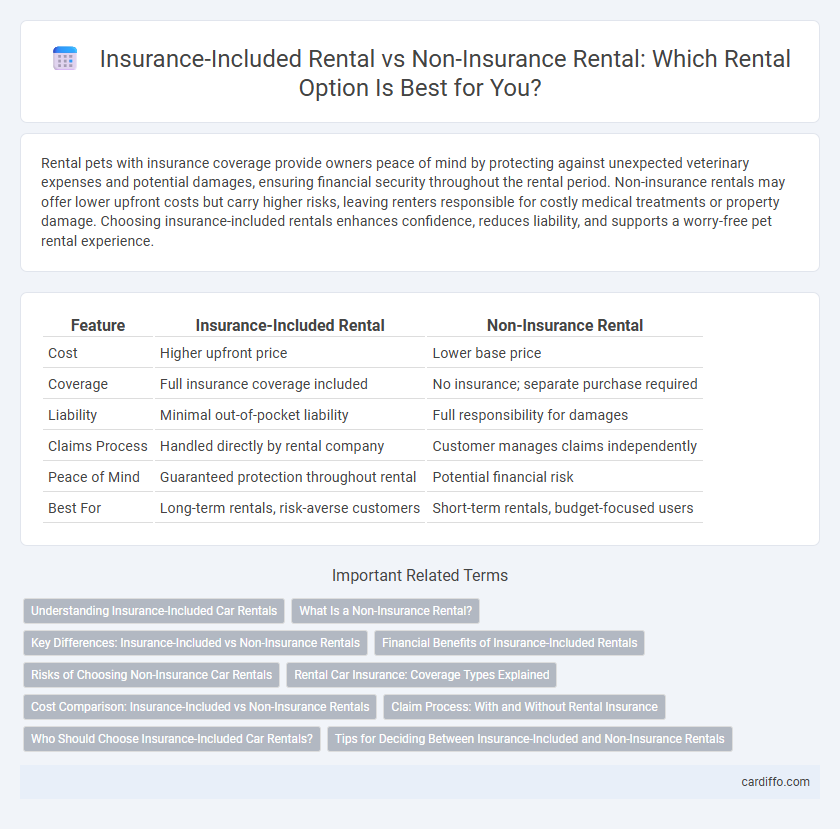

Table of Comparison

| Feature | Insurance-Included Rental | Non-Insurance Rental |

|---|---|---|

| Cost | Higher upfront price | Lower base price |

| Coverage | Full insurance coverage included | No insurance; separate purchase required |

| Liability | Minimal out-of-pocket liability | Full responsibility for damages |

| Claims Process | Handled directly by rental company | Customer manages claims independently |

| Peace of Mind | Guaranteed protection throughout rental | Potential financial risk |

| Best For | Long-term rentals, risk-averse customers | Short-term rentals, budget-focused users |

Understanding Insurance-Included Car Rentals

Insurance-included car rentals offer comprehensive coverage that protects renters against potential damages, theft, and liability, reducing out-of-pocket expenses during the rental period. Unlike non-insurance rentals, where customers must purchase separate insurance or risk uncovered costs, insurance-included options streamline the rental process and provide peace of mind. This integrated coverage often includes collision damage waivers, personal accident insurance, and third-party liability, making it a preferred choice for hassle-free travel.

What Is a Non-Insurance Rental?

A non-insurance rental refers to renting a vehicle or property without any insurance coverage included in the rental agreement. Renters assume full responsibility for any damage, theft, or liability incurred during the rental period, potentially facing significant out-of-pocket expenses. Choosing a non-insurance rental often requires the renter to have separate personal or third-party insurance to mitigate financial risks.

Key Differences: Insurance-Included vs Non-Insurance Rentals

Insurance-included rentals provide comprehensive coverage for damages, theft, and liability, reducing financial risks for renters, while non-insurance rentals require customers to purchase separate insurance or accept full responsibility for any loss. Key distinctions include the upfront cost, with insurance-included rentals often having higher initial fees but fewer unexpected expenses. Non-insurance rentals offer lower base prices but can result in significant out-of-pocket costs if incidents occur during the rental period.

Financial Benefits of Insurance-Included Rentals

Insurance-included rentals provide significant financial benefits by eliminating unexpected out-of-pocket expenses related to damages, theft, or accidents, ensuring predictable overall costs. These rentals often reduce the need for separate insurance policies, lowering total expenditure and simplifying the claims process. Choosing insurance-included rentals enhances financial security and protects renters from potentially costly liabilities during the rental period.

Risks of Choosing Non-Insurance Car Rentals

Non-insurance car rentals expose drivers to significant financial risks, including liability for damage, theft, or accidents, which can lead to costly out-of-pocket expenses. Without insurance coverage, renters may face large deductibles, legal fees, and potentially suspended driving privileges if involved in an incident. Opting for insurance-included rentals ensures protection and peace of mind by transferring these liabilities to the rental company or insurer.

Rental Car Insurance: Coverage Types Explained

Rental car insurance coverage includes collision damage waiver (CDW), liability coverage, and personal injury protection, each addressing specific risks during the rental period. Insurance-included rentals incorporate these protections within the rental price, reducing the renter's financial liability in case of accidents or damage. Non-insurance rentals require customers to provide their own coverage or purchase insurance separately, which can lead to additional costs and potential coverage gaps.

Cost Comparison: Insurance-Included vs Non-Insurance Rentals

Insurance-included rentals typically have higher upfront costs but offer comprehensive coverage that can prevent unexpected expenses from accidents or damages. Non-insurance rentals often come with lower base rates but require purchasing separate insurance or accepting financial risks, potentially increasing overall costs if incidents occur. Evaluating the total cost, including potential damages and liability, is crucial for comparing insurance-included versus non-insurance rental options effectively.

Claim Process: With and Without Rental Insurance

Rental insurance significantly streamlines the claim process by providing clear guidelines and direct support for damages or losses, reducing out-of-pocket expenses for renters. Without rental insurance, claimants often face complex, time-consuming negotiations with rental companies and must cover costs upfront until liability is established. Insurance-included rentals offer faster resolution and financial protection, ensuring renters are safeguarded against unexpected incidents during the rental period.

Who Should Choose Insurance-Included Car Rentals?

Travelers prioritizing peace of mind and comprehensive protection should opt for insurance-included car rentals, as these plans cover damages, theft, and liability without extra hassle. Business travelers and families often benefit from the convenience and reduced financial risk insurance provides during the rental period. Those unfamiliar with local driving laws or renting in high-risk areas find insurance coverage essential to avoid unexpected expenses.

Tips for Deciding Between Insurance-Included and Non-Insurance Rentals

Evaluate the potential risks and costs associated with the rental period when deciding between insurance-included and non-insurance rentals. Review coverage details such as liability limits, damage protection, and deductibles to ensure comprehensive protection without redundancy, especially if you have personal or credit card insurance. Compare the total rental cost with insurance fees and consider your risk tolerance to select the most cost-effective option tailored to your specific needs.

Insurance-included rental vs Non-insurance rental Infographic

cardiffo.com

cardiffo.com