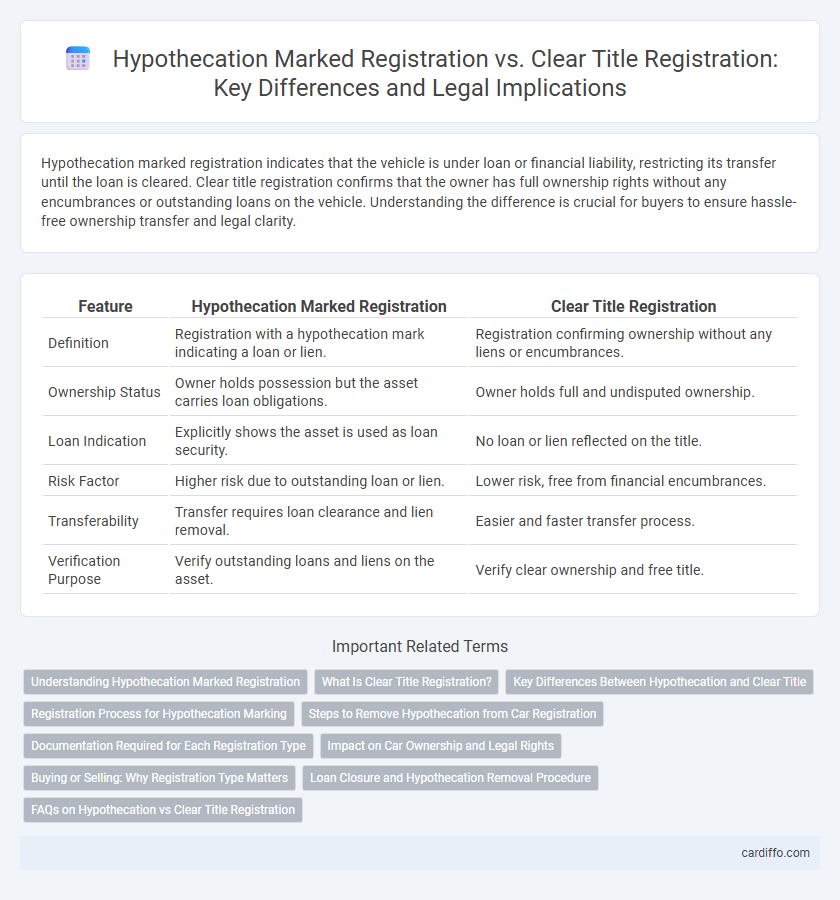

Hypothecation marked registration indicates that the vehicle is under loan or financial liability, restricting its transfer until the loan is cleared. Clear title registration confirms that the owner has full ownership rights without any encumbrances or outstanding loans on the vehicle. Understanding the difference is crucial for buyers to ensure hassle-free ownership transfer and legal clarity.

Table of Comparison

| Feature | Hypothecation Marked Registration | Clear Title Registration |

|---|---|---|

| Definition | Registration with a hypothecation mark indicating a loan or lien. | Registration confirming ownership without any liens or encumbrances. |

| Ownership Status | Owner holds possession but the asset carries loan obligations. | Owner holds full and undisputed ownership. |

| Loan Indication | Explicitly shows the asset is used as loan security. | No loan or lien reflected on the title. |

| Risk Factor | Higher risk due to outstanding loan or lien. | Lower risk, free from financial encumbrances. |

| Transferability | Transfer requires loan clearance and lien removal. | Easier and faster transfer process. |

| Verification Purpose | Verify outstanding loans and liens on the asset. | Verify clear ownership and free title. |

Understanding Hypothecation Marked Registration

Hypothecation marked registration indicates that the vehicle is under a loan or lien, where the financier holds a security interest until the debt is fully repaid. This type of registration helps protect lenders by legally documenting their claim on the asset, preventing unauthorized transfer or sale. Clear title registration, in contrast, confirms full ownership without any encumbrances or claims by third parties.

What Is Clear Title Registration?

Clear Title Registration guarantees the property is free from any encumbrances, liens, or hypothecation marks, ensuring complete ownership rights to the buyer. This type of registration involves verifying and confirming that no third party has a claim or charge against the property, providing legal protection and peace of mind. Unlike hypothecation marked registration, which acknowledges outstanding loans against the property, clear title registration confirms absolute ownership without financial liabilities tied to the asset.

Key Differences Between Hypothecation and Clear Title

Hypothecation marked registration involves using an asset, typically a vehicle or property, as collateral for a loan without transferring ownership, whereas clear title registration indicates full ownership without any encumbrances. In hypothecation, the lender holds a legal claim on the asset until the loan is repaid, but the borrower retains possession and usage rights. Clear title registration guarantees unencumbered ownership, allowing the registered individual to sell, transfer, or mortgage the asset freely.

Registration Process for Hypothecation Marking

The registration process for hypothecation marking involves submitting a hypothecation agreement along with the original documents of the asset, typically a vehicle, to the relevant registration authority. The registrar verifies the particulars, encumbers the asset with a hypothecation mark against the lender's interest, and updates the title records to reflect the lien without transferring clear title ownership. This process ensures the lender's security interest is legally recorded while the borrower retains possession and usage rights until the loan is repaid.

Steps to Remove Hypothecation from Car Registration

Removing hypothecation from car registration requires obtaining a No Objection Certificate (NOC) from the financing bank or lender, confirming full repayment of the loan. Next, submit the NOC along with Form 35 to the Regional Transport Office (RTO) to initiate the removal process. Once verified, the RTO updates the registration certificate to reflect clear title registration, removing the lender's hypothecation mark.

Documentation Required for Each Registration Type

Hypothecation marked registration requires documents including the hypothecation agreement, vehicle ownership proof, identity proof, address proof, and Form 34. Clear title registration mandates submission of the original registration certificate, sale deed, insurance documents, identity proof, and address proof. Both registration types emphasize thorough verification of ownership and lien details to ensure legal compliance and transparent vehicle ownership transfer.

Impact on Car Ownership and Legal Rights

Hypothecation marked registration indicates a vehicle is financed and the lender holds a lien, limiting the owner's ability to transfer ownership until the loan is cleared. Clear title registration signifies full ownership without encumbrances, granting the owner complete legal rights to sell or modify the vehicle. The presence of hypothecation must be disclosed during sale or transfer, directly affecting the buyer's title guarantee and ownership security.

Buying or Selling: Why Registration Type Matters

Hypothecation marked registration indicates that the asset is financed and subject to a lien, affecting ownership transfer during buying or selling. Clear title registration confirms that the seller owns the asset free of any encumbrances, ensuring a smoother transaction and reducing legal risks. Understanding the registration type is crucial for both buyers and sellers to verify ownership status and avoid complications in title transfer.

Loan Closure and Hypothecation Removal Procedure

Hypothecation marked registration holds a charge on the asset until the loan closure, requiring formal steps for hypothecation removal after the borrower settles the outstanding dues. Clear title registration signifies the asset is free from any encumbrances, simplifying property transfer and eliminating the need for additional removal procedures. Loan closure mandates the borrower to obtain a no-objection certificate (NOC) from the lender, which is essential to initiate the hypothecation removal process and update the registration records.

FAQs on Hypothecation vs Clear Title Registration

Hypothecation marked registration allows a borrower to use an asset, such as a vehicle, as collateral while retaining possession and ownership, with the lender having a charge on the asset until the loan is repaid. Clear title registration indicates full ownership rights to the asset without any encumbrances or liens, enabling the owner to sell or transfer the asset freely. Common FAQs include differences in ownership rights, implications on transferability, and the impact on loan default and repossession.

Hypothecation Marked Registration vs Clear Title Registration Infographic

cardiffo.com

cardiffo.com