The registration fee covers the administrative costs of officially recording a vehicle under the owner's name, while road tax is an ongoing charge for the use and maintenance of public roads. Unlike the one-time registration fee, road tax must be paid periodically, often annually, to ensure legal operation of the vehicle on public highways. Both fees are essential for vehicle compliance but serve distinct purposes within the transportation system.

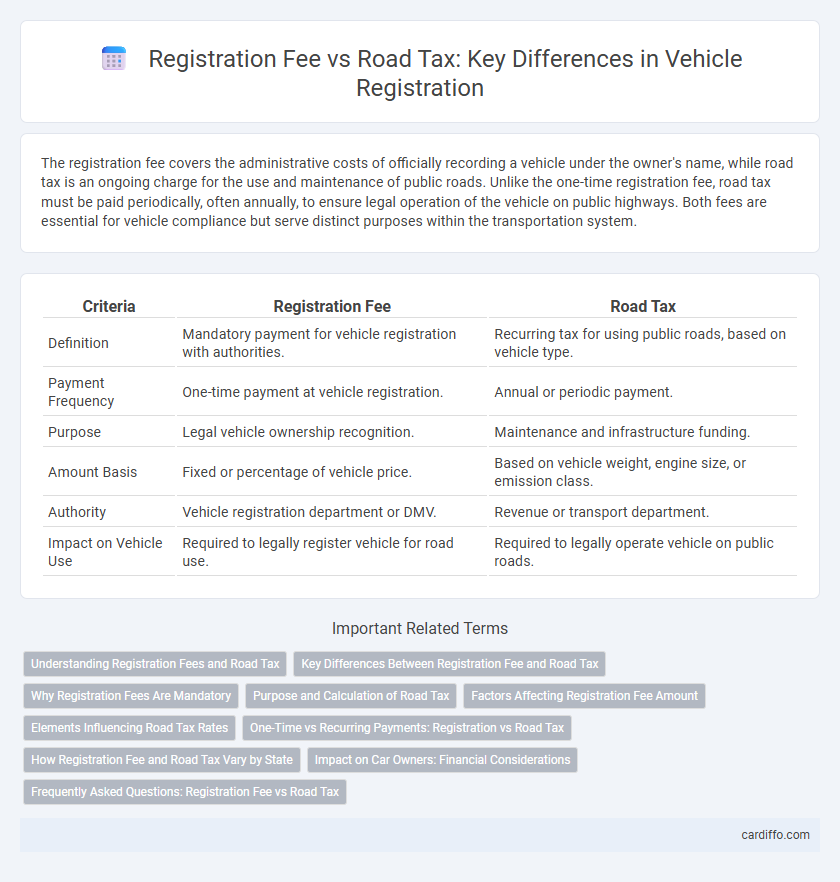

Table of Comparison

| Criteria | Registration Fee | Road Tax |

|---|---|---|

| Definition | Mandatory payment for vehicle registration with authorities. | Recurring tax for using public roads, based on vehicle type. |

| Payment Frequency | One-time payment at vehicle registration. | Annual or periodic payment. |

| Purpose | Legal vehicle ownership recognition. | Maintenance and infrastructure funding. |

| Amount Basis | Fixed or percentage of vehicle price. | Based on vehicle weight, engine size, or emission class. |

| Authority | Vehicle registration department or DMV. | Revenue or transport department. |

| Impact on Vehicle Use | Required to legally register vehicle for road use. | Required to legally operate vehicle on public roads. |

Understanding Registration Fees and Road Tax

Registration fees cover administrative costs associated with vehicle ownership transfer and documentation processing, while road tax is a mandatory annual charge based on vehicle type, weight, and emissions for maintaining public infrastructure. Understanding the distinction helps vehicle owners budget accurately, as registration fees are typically a one-time payment during initial registration or transfer. Road tax varies by jurisdiction but is essential for legal road use and environmental compliance monitoring.

Key Differences Between Registration Fee and Road Tax

Registration fee is a one-time payment made at the time of vehicle registration, primarily covering administrative expenses and legal ownership documentation. Road tax is a recurring fee imposed periodically, based on the vehicle's type, weight, and usage, designated for road maintenance and infrastructure development. The registration fee is paid once when initially registering the vehicle, whereas road tax must be paid regularly to legally operate the vehicle on public roads.

Why Registration Fees Are Mandatory

Registration fees are mandatory because they cover the administrative costs involved in officially recording a vehicle under a government database, ensuring legal ownership and accountability. These fees fund the issuance of registration certificates and number plates, which are essential for vehicle identification and law enforcement. Unlike road tax, which is a recurring charge for using public roads, registration fees are typically a one-time expense required to legitimize the vehicle's presence on the road.

Purpose and Calculation of Road Tax

Road tax is a mandatory fee imposed on vehicle owners to fund road maintenance and infrastructure development, distinct from the registration fee which covers initial vehicle documentation and legal ownership transfer. The calculation of road tax typically depends on factors such as vehicle type, engine capacity, weight, and usage category, ensuring the fee aligns with the wear and tear imposed on road networks. Unlike one-time registration fees, road tax is usually an annual or periodic charge reflecting ongoing contributions to public road upkeep and safety.

Factors Affecting Registration Fee Amount

Registration fee amounts are primarily influenced by vehicle type, engine capacity, and vehicle age, with electric and hybrid models often receiving reduced fees due to environmental incentives. Regional regulations and local tax policies significantly impact the fee structure, causing variations between states or municipalities. Vehicle price and intended use, such as commercial versus private, also affect the registration fee determination process.

Elements Influencing Road Tax Rates

Road tax rates are influenced by multiple factors such as vehicle type, engine size, fuel efficiency, and emission standards, which differ significantly from the fixed registration fee applied during vehicle registration. Registration fees are generally a one-time charge, whereas road tax is recurrent and reflects ongoing road maintenance costs and environmental policies. Understanding these elements helps vehicle owners anticipate the total cost of vehicle ownership beyond the initial registration process.

One-Time vs Recurring Payments: Registration vs Road Tax

Registration fees are typically one-time payments required when a vehicle is first registered, covering administrative costs and legal documentation. Road tax, however, is a recurring payment imposed annually or biannually to fund road maintenance and infrastructure. Understanding the distinction helps vehicle owners budget for initial costs versus ongoing financial obligations.

How Registration Fee and Road Tax Vary by State

Registration fees and road taxes vary significantly by state due to differing local regulations and funding requirements. States with higher population densities or enhanced infrastructure needs often impose higher registration fees and road taxes to support maintenance and development. These variations ensure that vehicle owners contribute proportionally to the specific transportation costs and environmental policies of their state.

Impact on Car Owners: Financial Considerations

Car owners face distinct financial implications when managing registration fees versus road tax, as registration fees are typically one-time costs associated with vehicle ownership transfer and initial roadworthiness certification. Road tax represents recurring expenses based on vehicle type, engine size, or emissions, significantly affecting long-term budgeting for maintenance and operation. Understanding the variance in frequency and criteria between registration fees and road tax enables car owners to anticipate total annual expenditure and plan accordingly.

Frequently Asked Questions: Registration Fee vs Road Tax

Registration fee covers the administrative costs for vehicle documentation, while road tax is a recurring charge used for road maintenance and infrastructure. Frequently asked questions often highlight the difference in payment frequency: registration fees are typically a one-time expense, whereas road tax must be paid annually or biannually. Understanding these distinctions helps vehicle owners comply with legal requirements and budget for ongoing vehicle expenses.

Registration Fee vs Road Tax Infographic

cardiffo.com

cardiffo.com