CO2 credits represent permits that allow companies to emit a certain amount of carbon dioxide, which can be traded on carbon markets to meet regulatory limits. Carbon offsets involve projects that reduce or capture emissions elsewhere, compensating for emissions produced by funding activities like reforestation or renewable energy. Understanding the difference is crucial for businesses aiming to achieve net-zero goals through compliance versus voluntary emission reduction strategies.

Table of Comparison

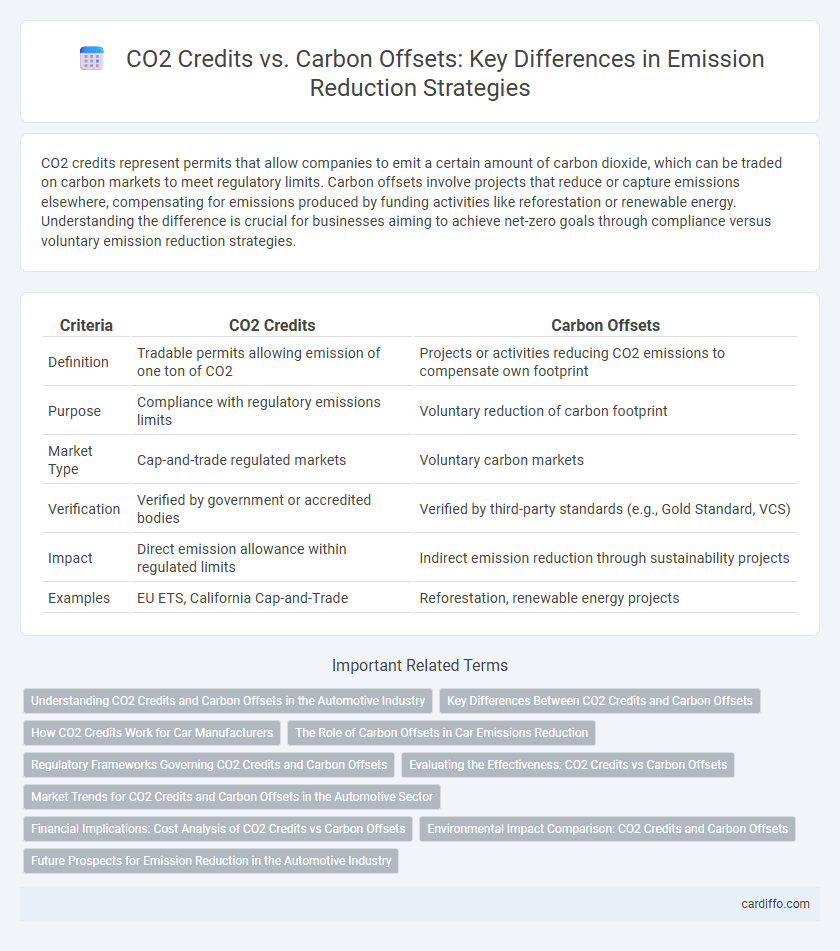

| Criteria | CO2 Credits | Carbon Offsets |

|---|---|---|

| Definition | Tradable permits allowing emission of one ton of CO2 | Projects or activities reducing CO2 emissions to compensate own footprint |

| Purpose | Compliance with regulatory emissions limits | Voluntary reduction of carbon footprint |

| Market Type | Cap-and-trade regulated markets | Voluntary carbon markets |

| Verification | Verified by government or accredited bodies | Verified by third-party standards (e.g., Gold Standard, VCS) |

| Impact | Direct emission allowance within regulated limits | Indirect emission reduction through sustainability projects |

| Examples | EU ETS, California Cap-and-Trade | Reforestation, renewable energy projects |

Understanding CO2 Credits and Carbon Offsets in the Automotive Industry

CO2 credits and carbon offsets serve distinct roles in the automotive industry's emission reduction strategies, with CO2 credits representing legally binding permits to emit a specific amount of carbon dioxide, often traded within regulated markets. Carbon offsets involve funding projects that reduce or capture emissions elsewhere, such as reforestation or renewable energy initiatives, to compensate for emissions generated by vehicle production or usage. Understanding the market dynamics and regulatory frameworks surrounding these mechanisms enables automotive companies to optimize compliance and invest in sustainable innovation.

Key Differences Between CO2 Credits and Carbon Offsets

CO2 credits represent a verified reduction of one metric ton of CO2 emissions allowed for emission trading under regulated cap-and-trade systems, while carbon offsets are voluntary projects reducing or capturing emissions to compensate for an equivalent amount elsewhere. CO2 credits are typically tied to compliance markets with strict certification standards, such as the EU Emissions Trading Scheme (EU ETS), whereas carbon offsets are often generated by independent initiatives like reforestation or renewable energy projects. The primary distinction lies in CO2 credits being regulatory compliance mechanisms, whereas carbon offsets serve as voluntary tools enabling individuals and companies to mitigate their carbon footprint beyond mandated limits.

How CO2 Credits Work for Car Manufacturers

CO2 credits allow car manufacturers to meet regulatory emissions targets by earning credits for producing low-emission or zero-emission vehicles, which can be sold or traded to manufacturers exceeding emissions limits. These credits incentivize the development and deployment of cleaner automotive technologies by establishing a market-driven approach to reducing greenhouse gases. Compliance with emissions standards through CO2 credits helps manufacturers avoid fines and supports industry-wide decarbonization efforts.

The Role of Carbon Offsets in Car Emissions Reduction

Carbon offsets play a crucial role in reducing car emissions by allowing individuals and companies to compensate for their CO2 output through investments in renewable energy, reforestation, and methane capture projects. Unlike CO2 credits, which are regulatory instruments traded within capped emission systems, carbon offsets directly finance projects that reduce or remove greenhouse gases from the atmosphere. This targeted approach helps balance unavoidable car emissions and supports the transition to a low-carbon transportation sector.

Regulatory Frameworks Governing CO2 Credits and Carbon Offsets

Regulatory frameworks governing CO2 credits and carbon offsets are established by international agreements such as the Kyoto Protocol and Paris Agreement, setting legally binding limits on greenhouse gas emissions. CO2 credits operate under cap-and-trade systems where entities can buy and sell emission allowances within government-mandated caps, ensuring compliance with emission reduction targets. Carbon offsets are regulated through voluntary and compliance markets with standards like the Verified Carbon Standard (VCS) and Gold Standard verifying emission reductions from projects like reforestation and renewable energy to ensure transparency and accountability.

Evaluating the Effectiveness: CO2 Credits vs Carbon Offsets

Evaluating the effectiveness of CO2 credits versus carbon offsets requires analyzing their impact on reducing greenhouse gas emissions and incentivizing sustainable practices. CO2 credits, often regulated under cap-and-trade systems, provide measurable allowances that companies can trade to comply with emission limits, ensuring a direct connection to emission reductions. In contrast, carbon offsets fund projects like reforestation or renewable energy, but their effectiveness depends on the accuracy of carbon accounting and additionality, sometimes leading to challenges in verifying real-world emission reductions.

Market Trends for CO2 Credits and Carbon Offsets in the Automotive Sector

The automotive sector is rapidly expanding its engagement with CO2 credits and carbon offsets as part of broader emission reduction strategies. Market trends indicate a growing preference for carbon offsets due to their flexibility in addressing residual emissions beyond regulatory compliance. Corporate commitments toward net-zero emissions are driving increased investments in verified carbon offset projects alongside participation in regulated CO2 credit trading schemes.

Financial Implications: Cost Analysis of CO2 Credits vs Carbon Offsets

CO2 credits often involve regulatory pricing mechanisms that can create a fluctuating market value based on emission caps and compliance requirements, affecting corporate budgeting strategies. Carbon offsets are typically priced based on project-driven factors such as location, type of intervention, and verification standards, often resulting in more variable and project-specific costs. Businesses must analyze the cost stability of CO2 credits against the potentially lower but inconsistent pricing of carbon offsets to optimize their environmental investments.

Environmental Impact Comparison: CO2 Credits and Carbon Offsets

CO2 credits represent verified reductions in greenhouse gas emissions within regulated markets, ensuring measurable and enforceable environmental benefits that directly contribute to emissions caps. Carbon offsets typically involve funding projects such as reforestation or renewable energy initiatives to compensate for emissions, though their environmental impact varies depending on project verification and permanence. The effectiveness of CO2 credits generally exceeds carbon offsets due to stringent regulatory oversight, transparency, and guaranteed emissions reductions.

Future Prospects for Emission Reduction in the Automotive Industry

CO2 credits provide a regulatory framework that incentivizes automotive manufacturers to reduce emissions by allowing them to trade emission allowances within cap-and-trade systems. Carbon offsets enable companies to invest in external projects like reforestation or renewable energy to compensate for emissions that cannot be eliminated internally, promoting a holistic approach to carbon neutrality. Future prospects in the automotive industry involve integrating both CO2 credits and carbon offsets with advanced technologies such as electric and hydrogen fuel cell vehicles, enhancing emission reduction and meeting increasingly stringent environmental regulations.

CO2 Credits vs Carbon Offsets Infographic

cardiffo.com

cardiffo.com