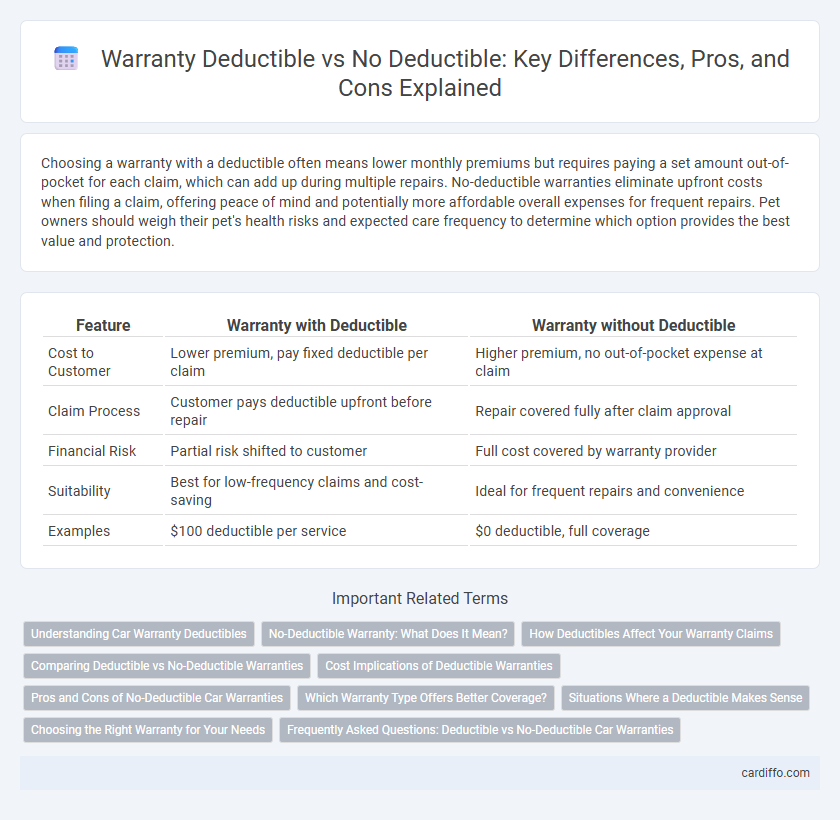

Choosing a warranty with a deductible often means lower monthly premiums but requires paying a set amount out-of-pocket for each claim, which can add up during multiple repairs. No-deductible warranties eliminate upfront costs when filing a claim, offering peace of mind and potentially more affordable overall expenses for frequent repairs. Pet owners should weigh their pet's health risks and expected care frequency to determine which option provides the best value and protection.

Table of Comparison

| Feature | Warranty with Deductible | Warranty without Deductible |

|---|---|---|

| Cost to Customer | Lower premium, pay fixed deductible per claim | Higher premium, no out-of-pocket expense at claim |

| Claim Process | Customer pays deductible upfront before repair | Repair covered fully after claim approval |

| Financial Risk | Partial risk shifted to customer | Full cost covered by warranty provider |

| Suitability | Best for low-frequency claims and cost-saving | Ideal for frequent repairs and convenience |

| Examples | $100 deductible per service | $0 deductible, full coverage |

Understanding Car Warranty Deductibles

Car warranty deductibles require the vehicle owner to pay a set amount out-of-pocket for repairs before the warranty coverage applies, which can lower the overall premium cost. No-deductible warranties eliminate upfront repair costs, offering peace of mind but often come with higher monthly payments or purchase prices. Understanding these deductible options helps consumers balance immediate expenses against long-term financial protection for vehicle maintenance.

No-Deductible Warranty: What Does It Mean?

A no-deductible warranty means the customer pays nothing out of pocket when making a claim for repairs or replacements covered under the warranty terms. This type of warranty enhances convenience by eliminating upfront costs, often leading to higher customer satisfaction and perceived value. Choosing a no-deductible warranty can be especially beneficial for high-cost repairs, ensuring full coverage without unexpected expenses.

How Deductibles Affect Your Warranty Claims

Warranty deductibles require customers to pay a fixed amount when filing a claim, which can reduce the overall cost to the warranty provider but increase out-of-pocket expenses for the consumer. No-deductible warranties simplify the claims process by eliminating upfront payments, often resulting in higher premium costs due to the increased risk borne by the warranty company. Understanding how deductibles impact claim frequency and repair costs helps consumers choose the optimal coverage based on their financial risk tolerance and anticipated repair needs.

Comparing Deductible vs No-Deductible Warranties

Warranty deductible plans require customers to pay a set fee for repairs before coverage applies, often resulting in lower upfront warranty costs but potentially higher out-of-pocket expenses during claims. No-deductible warranties eliminate repair fees, offering more comprehensive coverage with higher initial premiums but reducing unexpected expenses when service is needed. Consumers should weigh the balance between manageable upfront costs and predictable repair expenses when choosing between deductible and no-deductible warranty options.

Cost Implications of Deductible Warranties

Warranty deductible policies often reduce upfront costs by requiring consumers to pay a fixed amount for repairs, lowering premium prices compared to no-deductible warranties. The cost implications include potential savings on monthly payments but increased out-of-pocket expenses when claims are made. Understanding the balance between lower premiums and immediate repair costs is essential for budgeting and evaluating long-term financial impact.

Pros and Cons of No-Deductible Car Warranties

No-deductible car warranties eliminate out-of-pocket expenses for repairs, providing peace of mind and predictable cost management. They often result in higher upfront premiums and may include limited coverage or stricter claim terms to offset the no-deductible feature. Choosing a no-deductible warranty suits drivers seeking hassle-free repairs without unexpected fees, despite potentially higher long-term costs.

Which Warranty Type Offers Better Coverage?

Warranty deductible plans require the customer to pay a fixed amount out-of-pocket before coverage applies, often resulting in lower premiums but higher initial costs during repairs. No-deductible warranties provide full coverage without upfront payments, offering better financial protection and convenience for unexpected repairs. Choosing between these depends on individual risk tolerance and repair frequency, with no-deductible warranties generally offering more comprehensive coverage.

Situations Where a Deductible Makes Sense

A warranty deductible makes sense in situations where minor repairs are infrequent, allowing customers to save on upfront premium costs while still having coverage for major expenses. This approach is beneficial for owners of older or high-mileage vehicles, where the likelihood of small repairs increases but paying full premiums without deductibles may not be cost-effective. Choosing a deductible helps balance risk and cost, especially when customers prefer managing smaller repair expenses independently.

Choosing the Right Warranty for Your Needs

Choosing the right warranty involves weighing the benefits of a warranty deductible versus a no-deductible option based on your budget and risk tolerance. Warranty plans with deductibles typically offer lower upfront costs but require payment for each claim, while no-deductible warranties provide comprehensive coverage without out-of-pocket expenses during repairs. Evaluating the frequency of potential repairs and the total cost of ownership helps determine which warranty aligns best with your financial preferences and protection needs.

Frequently Asked Questions: Deductible vs No-Deductible Car Warranties

A warranty deductible requires the vehicle owner to pay a predetermined amount for repairs before coverage applies, which can lower the overall warranty cost but increases out-of-pocket expenses during claims. No-deductible car warranties eliminate repair fees at the time of service, offering more convenience and financial predictability though often at a higher upfront cost. Consumers frequently inquire about cost differences, claim processes, and long-term savings when comparing deductible versus no-deductible warranties.

Warranty Deductible vs No-Deductible Infographic

cardiffo.com

cardiffo.com