Roadside Assistance provides immediate help with vehicle breakdowns, including towing, tire changes, and battery boosts, ensuring you stay safe and mobile during unexpected car troubles. Trip Interruption Coverage reimburses expenses like lodging, meals, and transportation if a breakdown forces you to cut your trip short or delay your plans. Choosing a pet warranty with both benefits offers comprehensive protection, minimizing stress and costs during travel disruptions.

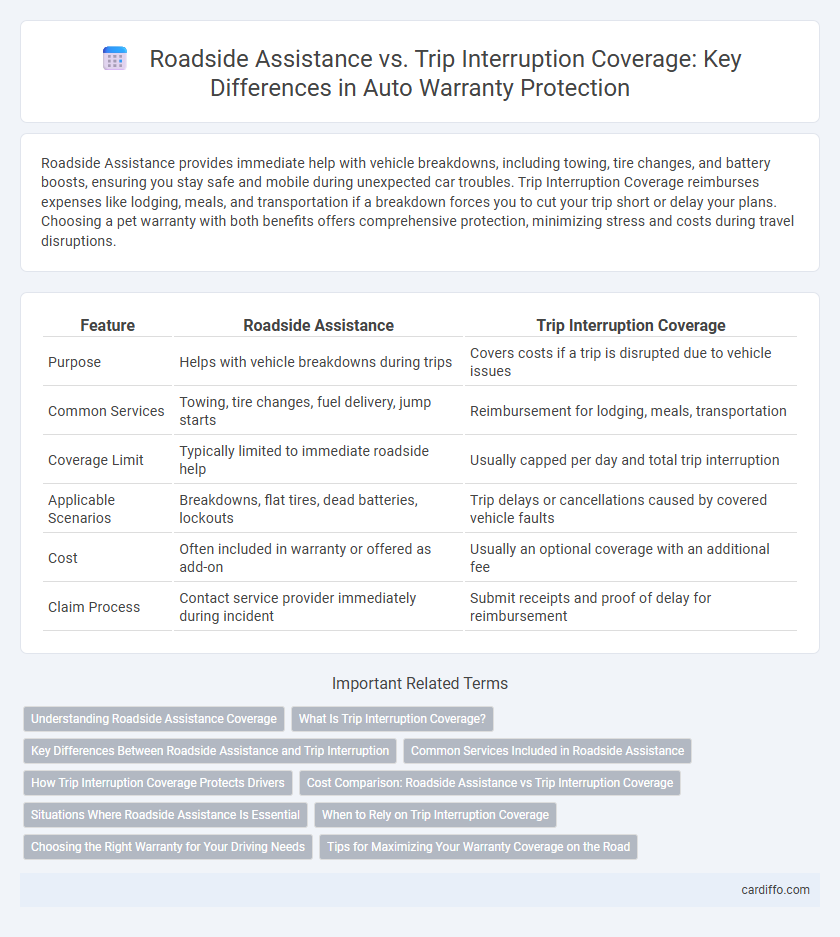

Table of Comparison

| Feature | Roadside Assistance | Trip Interruption Coverage |

|---|---|---|

| Purpose | Helps with vehicle breakdowns during trips | Covers costs if a trip is disrupted due to vehicle issues |

| Common Services | Towing, tire changes, fuel delivery, jump starts | Reimbursement for lodging, meals, transportation |

| Coverage Limit | Typically limited to immediate roadside help | Usually capped per day and total trip interruption |

| Applicable Scenarios | Breakdowns, flat tires, dead batteries, lockouts | Trip delays or cancellations caused by covered vehicle faults |

| Cost | Often included in warranty or offered as add-on | Usually an optional coverage with an additional fee |

| Claim Process | Contact service provider immediately during incident | Submit receipts and proof of delay for reimbursement |

Understanding Roadside Assistance Coverage

Roadside Assistance coverage provides immediate support for vehicle breakdowns, including services like towing, battery jump-starts, flat tire changes, and fuel delivery. This coverage ensures drivers receive prompt help during unexpected roadside emergencies, minimizing delays and safety risks. It differs from Trip Interruption Coverage, which reimburses expenses if a trip is disrupted due to vehicle issues, focusing on financial protection rather than on-the-spot assistance.

What Is Trip Interruption Coverage?

Trip Interruption Coverage reimburses policyholders for expenses incurred when a vehicle breaks down or is involved in an accident during a trip, such as lodging, meals, and alternative transportation. This coverage ensures financial protection against unexpected travel disruptions, helping drivers avoid out-of-pocket costs while their vehicle is being repaired. Unlike Roadside Assistance, which provides immediate help like towing or battery jump-starts, Trip Interruption Coverage addresses the broader impact of travel delays caused by mechanical failure or accidents.

Key Differences Between Roadside Assistance and Trip Interruption

Roadside Assistance provides emergency services such as towing, tire changes, and battery jump-starts directly at the location of a vehicle breakdown. Trip Interruption Coverage reimburses expenses for lodging, meals, and transportation if a breakdown occurs far from home, causing a trip to be delayed or canceled. The key difference lies in Roadside Assistance offering on-site mechanical help, while Trip Interruption Coverage covers additional travel costs due to unexpected defects or failures during a trip.

Common Services Included in Roadside Assistance

Roadside Assistance commonly includes services such as tire changes, emergency fuel delivery, battery jump-starts, and lockout assistance, ensuring drivers receive immediate help during vehicle breakdowns. This coverage typically extends to towing services up to a specified mileage limit, providing convenience and minimizing disruption. Unlike Trip Interruption Coverage, which reimburses expenses due to travel delays, Roadside Assistance focuses on on-the-spot support to keep vehicles operational.

How Trip Interruption Coverage Protects Drivers

Trip Interruption Coverage protects drivers by reimbursing expenses such as lodging, meals, and transportation if a breakdown or covered event disables the vehicle far from home. This coverage ensures financial support during unforeseen disruptions, minimizing out-of-pocket costs and stress while stranded. Unlike Roadside Assistance, which provides immediate help for repairs or towing, Trip Interruption Coverage addresses the broader impact of travel delays on the driver's itinerary and budget.

Cost Comparison: Roadside Assistance vs Trip Interruption Coverage

Roadside Assistance typically costs less than Trip Interruption Coverage, with average plans ranging from $20 to $50 per year compared to $100 to $300 annually for trip interruption insurance. Roadside Assistance covers vehicle repairs and towing services during breakdowns, resulting in lower premiums due to limited coverage. Trip Interruption Coverage offers broader protection by reimbursing trip expenses like lodging and transportation if delays occur, which increases its cost relative to roadside services.

Situations Where Roadside Assistance Is Essential

Roadside Assistance is essential during unexpected vehicle breakdowns, flat tires, dead batteries, or when a driver gets locked out of their car, providing immediate help on the spot. It offers services such as towing, fuel delivery, and jump-starts, ensuring minimal disruption and enhanced safety during emergencies. Unlike Trip Interruption Coverage, which reimburses expenses after a covered travel delay, Roadside Assistance delivers real-time solutions critical for vehicle operability and driver safety.

When to Rely on Trip Interruption Coverage

Trip Interruption Coverage becomes essential when your vehicle breaks down far from home, covering expenses such as lodging, meals, and alternate transportation. It compensates for unexpected costs incurred during a trip disruption, providing financial relief beyond immediate mechanical repairs. This coverage is ideal for extended travel scenarios where repairs cannot be completed quickly, ensuring your trip can continue smoothly despite unforeseen delays.

Choosing the Right Warranty for Your Driving Needs

Roadside Assistance provides immediate help for vehicle issues such as flat tires, dead batteries, or lockouts, ensuring safety and convenience during unexpected breakdowns. Trip Interruption Coverage reimburses expenses like lodging and meals if your vehicle breaks down far from home, protecting your travel plans and budget. Selecting the right warranty depends on your typical driving patterns, frequency of long-distance trips, and priority between emergency support and travel expense coverage.

Tips for Maximizing Your Warranty Coverage on the Road

To maximize your warranty coverage on the road, always carry your warranty documentation and understand the specific terms of roadside assistance and trip interruption coverage. Keep contact information for your warranty provider readily available to quickly access emergency services or claim reimbursements during unexpected breakdowns or travel delays. Regular vehicle maintenance aligned with warranty guidelines also helps prevent issues that could void roadside assistance or trip interruption benefits.

Roadside Assistance vs Trip Interruption Coverage Infographic

cardiffo.com

cardiffo.com