Third-party insurance for rental pets covers damages or injuries caused to others, offering essential liability protection and often lower premiums. In-house insurance provided by rental companies may include more comprehensive coverage, such as vet bills and theft protection, but typically comes at a higher cost. Evaluating the specific coverage needs and budget helps determine whether third-party or in-house insurance is the better option for responsible pet rental.

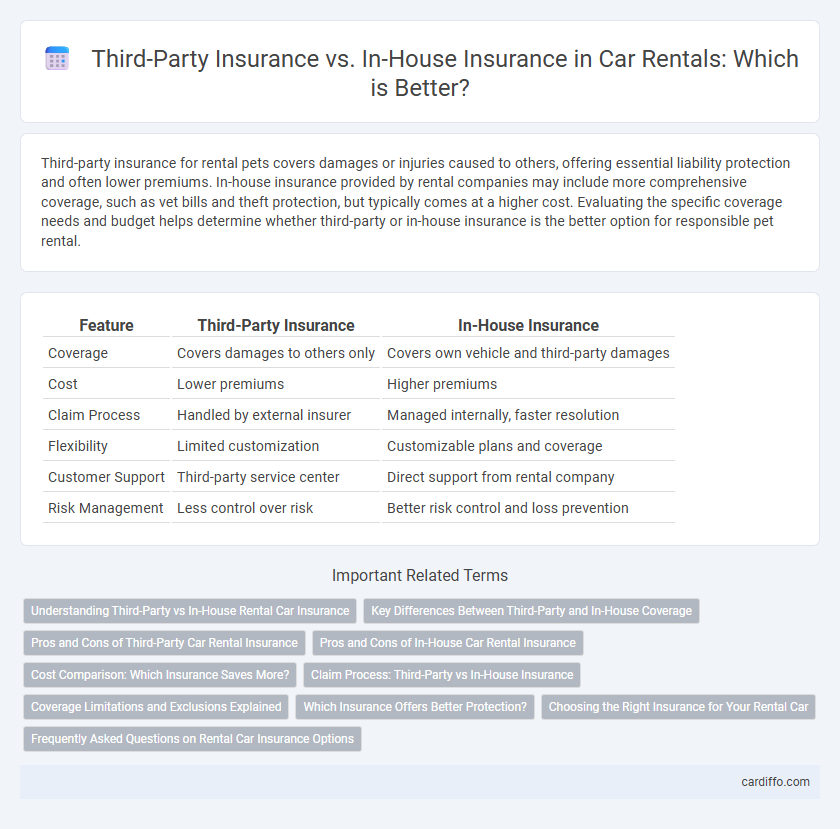

Table of Comparison

| Feature | Third-Party Insurance | In-House Insurance |

|---|---|---|

| Coverage | Covers damages to others only | Covers own vehicle and third-party damages |

| Cost | Lower premiums | Higher premiums |

| Claim Process | Handled by external insurer | Managed internally, faster resolution |

| Flexibility | Limited customization | Customizable plans and coverage |

| Customer Support | Third-party service center | Direct support from rental company |

| Risk Management | Less control over risk | Better risk control and loss prevention |

Understanding Third-Party vs In-House Rental Car Insurance

Third-party rental car insurance covers damages and liabilities caused to others, offering basic protection with lower premiums compared to in-house insurance, which provides comprehensive coverage including theft, damage to the rental vehicle, and personal accident protection. Understanding the distinctions helps renters evaluate the cost-benefit balance, as in-house insurance often includes added convenience and fewer claim restrictions, while third-party insurance may require additional documentation in case of incidents. Opting for in-house insurance can reduce out-of-pocket expenses during a rental period, whereas third-party options rely on external providers and might pose higher financial risks for the renter.

Key Differences Between Third-Party and In-House Coverage

Third-party insurance covers damages and liabilities to external parties only, while in-house insurance provides comprehensive protection including damages to the rental vehicle itself. Third-party policies often come with lower premiums but limited benefits, whereas in-house insurance usually offers broader coverage and additional services like roadside assistance. Understanding these distinctions helps renters choose the appropriate level of protection based on risk tolerance and rental duration.

Pros and Cons of Third-Party Car Rental Insurance

Third-party car rental insurance offers the advantage of lower premiums and coverage limited to damages caused to others, making it cost-effective for budget-conscious renters. However, it excludes protection for the renter's own vehicle and personal injuries, potentially leading to significant out-of-pocket expenses after an accident. Renters should weigh the risk of uninsured damage against the savings when choosing third-party coverage over comprehensive in-house insurance.

Pros and Cons of In-House Car Rental Insurance

In-house car rental insurance offers streamlined claims processing and immediate coverage tailored specifically for the rental fleet, reducing dependency on external insurers and potential delays. However, it requires significant investment in risk management and administrative resources, exposing the rental company to higher financial liability in case of accidents or damages. This approach may limit coverage options for renters compared to third-party insurance, which often provides broader protection and flexibility.

Cost Comparison: Which Insurance Saves More?

Third-party insurance typically offers lower premiums compared to in-house insurance, making it a cost-effective option for budget-conscious renters. In-house insurance often includes wider coverage and added benefits, which can justify higher costs for those seeking comprehensive protection. Evaluating the balance between upfront premiums and potential out-of-pocket expenses is crucial to determine which insurance saves more in the long term.

Claim Process: Third-Party vs In-House Insurance

The claim process for third-party insurance often involves multiple steps, including notifying the third-party insurer, providing detailed documentation, and awaiting their investigation before approval, which can extend the timeline. In-house insurance typically streamlines claims by handling assessments and approvals internally, resulting in faster resolution and enhanced communication. Renters should evaluate these procedural differences to determine which insurance option best supports efficient claim handling during rental agreements.

Coverage Limitations and Exclusions Explained

Third-party insurance in rental agreements typically covers damages or injuries caused to others but excludes damages to the rental vehicle itself, leading to significant coverage limitations for renters. In-house insurance often provides more comprehensive protection, including collision damage waivers and theft protection, reducing out-of-pocket expenses for vehicle repairs or replacements. Understanding these exclusions and limitations is crucial to avoid unexpected liabilities during the rental period.

Which Insurance Offers Better Protection?

Third-party insurance covers damages and injuries caused to others, making it a cost-effective option but with limited personal vehicle protection. In-house insurance often includes comprehensive coverage, offering broader protection against theft, damage, and liability, tailored to rental companies' specific needs. Renters seeking maximum security should consider in-house insurance for its extensive benefits and faster claims processing.

Choosing the Right Insurance for Your Rental Car

Choosing the right insurance for your rental car hinges on understanding the differences between third-party insurance and in-house insurance offered by rental companies. Third-party insurance typically covers damages to other vehicles and property but may leave gaps in personal coverage, while in-house insurance often includes comprehensive protection such as collision damage waiver (CDW), theft protection, and liability coverage. Evaluating your existing personal auto insurance and credit card benefits can help determine whether supplemental in-house insurance is necessary to avoid costly out-of-pocket expenses.

Frequently Asked Questions on Rental Car Insurance Options

Third-party insurance covers damages caused to other vehicles or property during a rental, protecting the renter from liability but not damage to the rental car itself. In-house insurance, often referred to as Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW), covers repair or replacement costs for the rental vehicle in case of accidents or theft. Renters frequently inquire about coverage limits, deductibles, and whether their personal auto insurance or credit card benefits extend to rental cars, which vary by policy and provider.

Third-party insurance vs In-house insurance Infographic

cardiffo.com

cardiffo.com