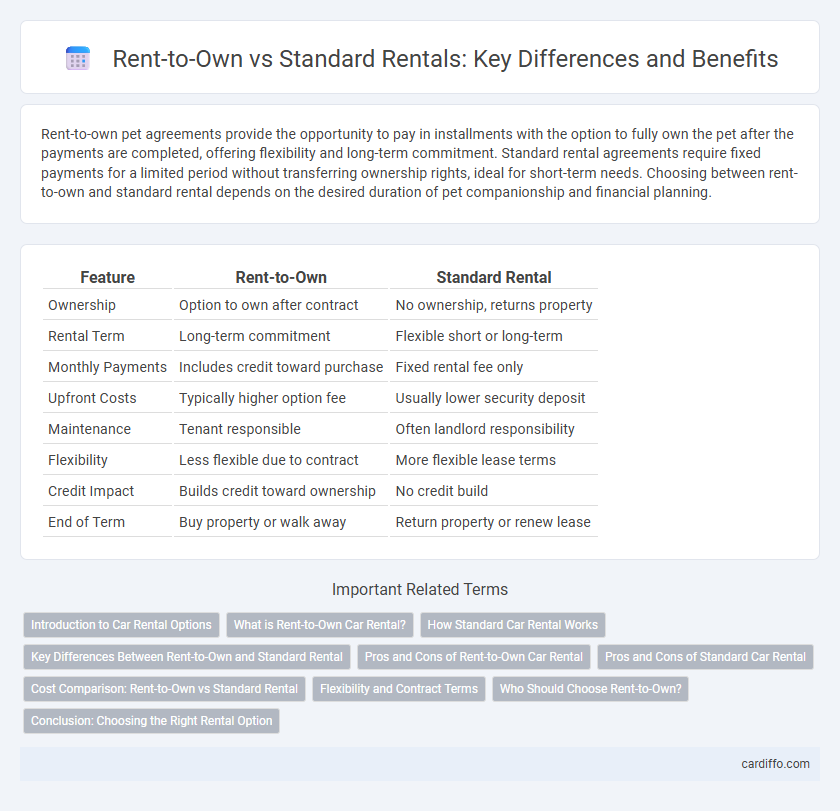

Rent-to-own pet agreements provide the opportunity to pay in installments with the option to fully own the pet after the payments are completed, offering flexibility and long-term commitment. Standard rental agreements require fixed payments for a limited period without transferring ownership rights, ideal for short-term needs. Choosing between rent-to-own and standard rental depends on the desired duration of pet companionship and financial planning.

Table of Comparison

| Feature | Rent-to-Own | Standard Rental |

|---|---|---|

| Ownership | Option to own after contract | No ownership, returns property |

| Rental Term | Long-term commitment | Flexible short or long-term |

| Monthly Payments | Includes credit toward purchase | Fixed rental fee only |

| Upfront Costs | Typically higher option fee | Usually lower security deposit |

| Maintenance | Tenant responsible | Often landlord responsibility |

| Flexibility | Less flexible due to contract | More flexible lease terms |

| Credit Impact | Builds credit toward ownership | No credit build |

| End of Term | Buy property or walk away | Return property or renew lease |

Introduction to Car Rental Options

Rent-to-own car rental allows customers to apply a portion of their rental payments toward the eventual purchase of the vehicle, offering a flexible alternative to outright ownership. Standard rental agreements provide temporary vehicle access without any ownership benefits, ideal for short-term needs. Choosing between these options depends on long-term goals, financial plans, and usage frequency.

What is Rent-to-Own Car Rental?

Rent-to-own car rental allows consumers to rent a vehicle with the option to purchase it after a specified rental period, combining elements of leasing and buying. This model often includes a portion of the rental payments applying toward the eventual purchase price, making it an alternative financing solution for those with limited credit. Unlike standard rentals, which only provide temporary vehicle use without ownership rights, rent-to-own agreements offer a pathway to car ownership after fulfilling the rental terms.

How Standard Car Rental Works

Standard car rental involves paying a fixed daily or weekly fee to use a vehicle for a specified period, with no ownership transfer at the end of the rental term. Customers typically provide a security deposit and meet age and licensing requirements, while insurance options can be purchased or confirmed through personal coverage. This method offers flexible short-term transportation without long-term financial commitment or equity buildup, distinguishing it from rent-to-own agreements.

Key Differences Between Rent-to-Own and Standard Rental

Rent-to-own agreements allow tenants to apply a portion of their monthly payments toward the eventual purchase of the property, unlike standard rentals where payments only cover temporary occupancy. Rent-to-own offers more financial flexibility and a pathway to homeownership, while standard rentals require less commitment and typically involve shorter lease terms. Tenants in rent-to-own contracts often face stricter maintenance responsibilities compared to standard renters who rely on landlords for property upkeep.

Pros and Cons of Rent-to-Own Car Rental

Rent-to-own car rental offers the advantage of applying rental payments toward vehicle ownership, providing flexibility for those with limited credit or uncertain long-term needs. However, this option often involves higher monthly payments and potential penalties compared to standard rental agreements, which typically have lower costs and simpler terms but no path to ownership. Rent-to-own suits customers seeking eventual ownership, while standard rentals better serve short-term use without long-term commitments.

Pros and Cons of Standard Car Rental

Standard car rental offers flexibility with short-term commitments and immediate availability, making it ideal for temporary transportation needs. However, renters face higher long-term costs without equity or ownership benefits, and they must adhere to mileage limits and strict return policies. This type of rental is advantageous for short stays but lacks the financial advantages and asset accumulation of rent-to-own options.

Cost Comparison: Rent-to-Own vs Standard Rental

Rent-to-own agreements generally have higher monthly payments compared to standard rentals, as a portion of each payment contributes toward eventual ownership, accumulating equity over time. Standard rentals involve lower monthly costs but offer no investment return since payments only cover usage without ownership benefits. Over extended periods, rent-to-own can be more cost-effective for occupants planning to purchase, while standard rentals minimize upfront and ongoing expenses without equity accumulation.

Flexibility and Contract Terms

Rent-to-own agreements offer greater flexibility by allowing tenants to apply a portion of their rent toward purchasing the property, often accompanied by adjustable contract terms that cater to long-term goals. Standard rental contracts typically have fixed lease durations and limited options for early termination or ownership, prioritizing short-term occupancy and stability. The choice between rent-to-own and standard rental hinges on the tenant's need for adaptability in contract length and potential homeownership.

Who Should Choose Rent-to-Own?

Rent-to-own is ideal for renters aiming to build equity while living in a property, especially those with limited credit history or saving for a future purchase. It suits individuals planning long-term residence who want to lock in purchase price while improving financial stability. Standard rentals benefit short-term tenants or those not ready for homeownership commitments.

Conclusion: Choosing the Right Rental Option

Rent-to-own offers a pathway to ownership by applying rental payments toward the purchase price, ideal for tenants aiming to build equity without immediate full investment. Standard rental provides flexibility and lower upfront costs without long-term commitment or ownership benefits, suited for those seeking short-term housing solutions. Prioritizing financial goals and length of stay will guide the best choice between rent-to-own and standard rental agreements.

Rent-to-own vs Standard Rental Infographic

cardiffo.com

cardiffo.com