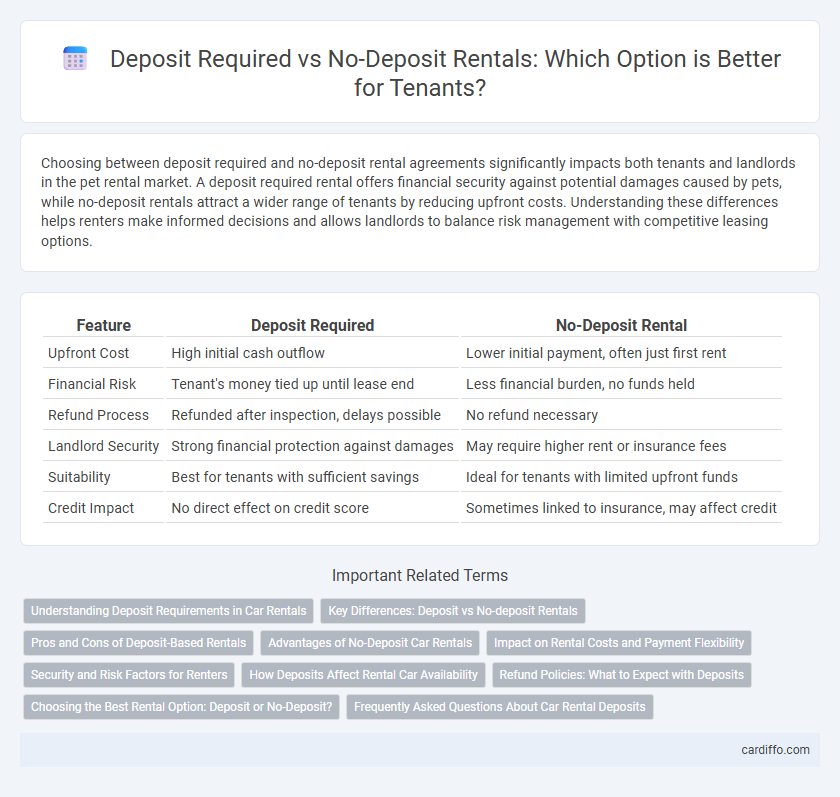

Choosing between deposit required and no-deposit rental agreements significantly impacts both tenants and landlords in the pet rental market. A deposit required rental offers financial security against potential damages caused by pets, while no-deposit rentals attract a wider range of tenants by reducing upfront costs. Understanding these differences helps renters make informed decisions and allows landlords to balance risk management with competitive leasing options.

Table of Comparison

| Feature | Deposit Required | No-Deposit Rental |

|---|---|---|

| Upfront Cost | High initial cash outflow | Lower initial payment, often just first rent |

| Financial Risk | Tenant's money tied up until lease end | Less financial burden, no funds held |

| Refund Process | Refunded after inspection, delays possible | No refund necessary |

| Landlord Security | Strong financial protection against damages | May require higher rent or insurance fees |

| Suitability | Best for tenants with sufficient savings | Ideal for tenants with limited upfront funds |

| Credit Impact | No direct effect on credit score | Sometimes linked to insurance, may affect credit |

Understanding Deposit Requirements in Car Rentals

Car rentals typically require a deposit to cover potential damages or unpaid fees, which can range from $200 to $1,000 depending on the rental company and vehicle type. No-deposit rentals offer convenience and lower upfront costs but may include higher daily rates or stricter eligibility criteria such as good credit scores or membership in loyalty programs. Understanding deposit requirements helps renters compare costs, avoid unexpected holds on their credit cards, and choose the best option based on their budget and risk tolerance.

Key Differences: Deposit vs No-deposit Rentals

Deposit-required rentals involve tenants paying a security deposit upfront, typically equivalent to one month's rent, serving as financial protection against damages or unpaid rent. No-deposit rentals eliminate this upfront cost, attracting tenants seeking lower move-in expenses but may include higher monthly rent or additional fees. The key difference lies in initial financial commitment and risk allocation, where deposits provide landlords security while no-deposit options increase affordability for renters.

Pros and Cons of Deposit-Based Rentals

Deposit-based rentals provide landlords with financial security against damages and unpaid rent, reducing overall risk and encouraging tenant accountability. However, such deposits can pose financial barriers to tenants, delaying move-in and potentially limiting rental market accessibility. Balancing security deposits with affordable housing incentives is crucial to fostering fair rental agreements.

Advantages of No-Deposit Car Rentals

No-deposit car rentals eliminate upfront financial barriers, enhancing accessibility for renters with limited cash flow or tight budgets. They expedite the rental process by removing the need for credit card holds or security checks, leading to quicker vehicle access and greater convenience. This approach reduces customers' financial risk since no large sums are tied up, fostering increased trust and satisfaction among renters.

Impact on Rental Costs and Payment Flexibility

Deposits required in rentals typically increase upfront costs, tying up funds that could be used elsewhere, while no-deposit rentals reduce initial financial burden, enhancing payment flexibility for tenants. Traditional security deposits often amount to one or two months' rent, significantly impacting cash flow, whereas no-deposit options may include alternative guarantees or insurance fees that can lower immediate expenses. Tenants seeking affordability and smoother move-in experiences benefit from no-deposit rentals, yet landlords may price these properties higher to offset perceived risks.

Security and Risk Factors for Renters

Deposit required rentals provide landlords with a financial safety net against potential damages or unpaid rent, reducing risk and ensuring compensation. No-deposit rentals appeal to renters seeking immediate affordability and lower upfront costs but often involve higher monthly rent or stricter credit checks to mitigate landlord risk. Renters must weigh security benefits against financial flexibility when choosing between deposit-required and no-deposit lease agreements.

How Deposits Affect Rental Car Availability

Deposit requirements for rental cars directly impact vehicle availability, as companies often limit fleet access based on a renter's ability to provide a security deposit. Rentals with no-deposit options tend to offer more flexible booking, attracting a broader range of customers and increasing fleet turnover. High deposit demands can reduce short-term rental accessibility by restricting reservations to those with sufficient credit or funds.

Refund Policies: What to Expect with Deposits

Deposit-required rentals typically involve a refundable security deposit held to cover potential damages or unpaid rent, with refund policies stipulating full return if the property is left in good condition. No-deposit rentals often replace traditional deposits with higher rent or third-party insurance, which might limit direct refund opportunities but reduce upfront cash requirements. Tenants should carefully review the terms regarding deposit deductions, timelines for refund processing, and any conditions that could affect the amount returned.

Choosing the Best Rental Option: Deposit or No-Deposit?

Choosing between deposit required and no-deposit rental options depends on financial flexibility and risk tolerance. Deposit rentals typically offer lower monthly payments and greater landlord security, while no-deposit rentals eliminate upfront costs but may involve higher monthly fees or stricter terms. Evaluating personal cash flow and lease conditions helps determine the best rental option for long-term affordability and convenience.

Frequently Asked Questions About Car Rental Deposits

Car rental deposits serve as a security hold on a renter's credit card to cover potential damages or fees, typically ranging from $200 to $500 depending on the vehicle type and rental duration. No-deposit rentals eliminate this upfront hold but may include higher daily rates or stricter rental conditions to mitigate risk for the rental company. Common FAQs address how deposits are refunded, the impact on credit card limits, and the conditions under which deposits may be withheld.

Deposit Required vs No-deposit Rental Infographic

cardiffo.com

cardiffo.com