Rental pets with insurance included provide immediate financial protection against unexpected veterinary costs, offering peace of mind with no additional fees. Insurance optional plans allow renters to decide based on their risk tolerance and budget, potentially lowering upfront costs but risking higher out-of-pocket expenses. Understanding the balance between convenience and cost helps renters make informed decisions about pet rental insurance coverage.

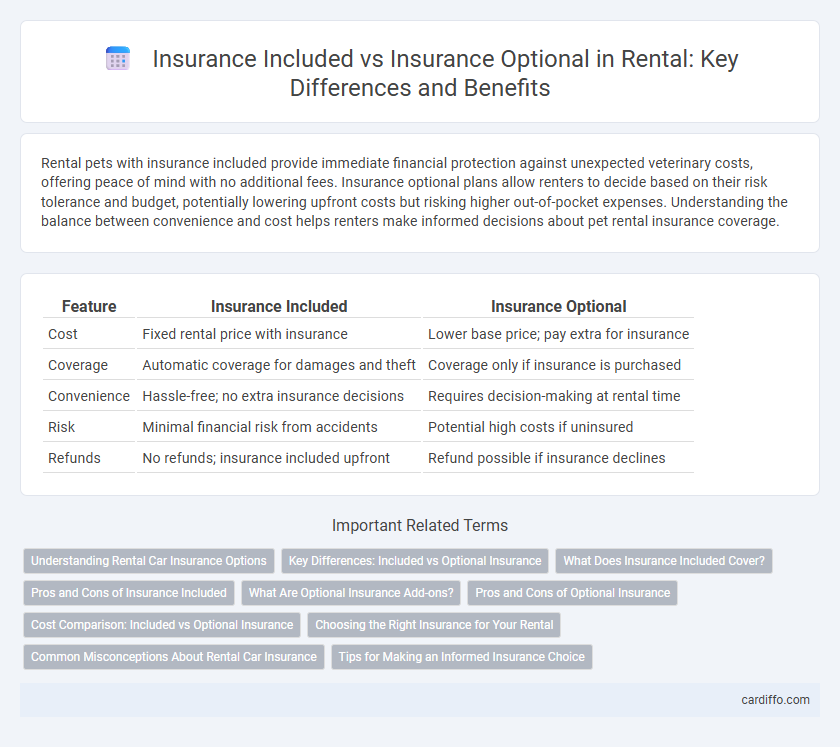

Table of Comparison

| Feature | Insurance Included | Insurance Optional |

|---|---|---|

| Cost | Fixed rental price with insurance | Lower base price; pay extra for insurance |

| Coverage | Automatic coverage for damages and theft | Coverage only if insurance is purchased |

| Convenience | Hassle-free; no extra insurance decisions | Requires decision-making at rental time |

| Risk | Minimal financial risk from accidents | Potential high costs if uninsured |

| Refunds | No refunds; insurance included upfront | Refund possible if insurance declines |

Understanding Rental Car Insurance Options

Rental car insurance options typically include insurance included in the rental price or optional coverage that renters can choose to purchase. Insurance included often covers basic protection such as collision damage waiver (CDW) and liability, while optional insurance packages may offer enhanced coverage like personal accident insurance and theft protection. Understanding these distinctions helps renters make informed decisions based on their existing personal auto insurance and travel needs.

Key Differences: Included vs Optional Insurance

Included insurance in rental agreements offers comprehensive coverage as part of the total price, eliminating the need for separate purchases and providing immediate financial protection against damages or theft. Optional insurance allows renters to decide on additional coverage based on their risk preference, often involving separate fees and selective protection levels. The key difference lies in cost structure and convenience, with included insurance streamlining coverage while optional insurance grants flexibility and potential cost savings if risk is minimal.

What Does Insurance Included Cover?

Insurance included in rental agreements typically covers collision damage, theft protection, and liability for bodily injury or property damage, providing renters with comprehensive financial protection during the rental period. This coverage often reduces or eliminates the need for purchasing additional insurance, safeguarding renters against unexpected costs from accidents or damages. Understanding the specific limits and exclusions of included insurance helps renters ensure they have adequate protection for accidents, theft, and third-party claims.

Pros and Cons of Insurance Included

Insurance included in rental agreements offers seamless protection by covering damages and liability without extra fees, providing peace of mind and simplifying the rental process. However, this option often results in higher upfront costs and may include coverage duplicates if renters already have personal insurance policies. Renters benefit from guaranteed coverage but should evaluate potential redundancies and overall cost-effectiveness before choosing insurance included.

What Are Optional Insurance Add-ons?

Optional insurance add-ons in rental agreements provide tailored coverage beyond the basic protection included in standard policies. These add-ons often cover areas such as collision damage waiver (CDW), theft protection, personal accident insurance, and liability coverage, allowing renters to customize their risk management based on individual needs. Choosing optional insurance enhances peace of mind by reducing out-of-pocket expenses in case of accidents, damage, or theft during the rental period.

Pros and Cons of Optional Insurance

Optional insurance in rental agreements offers flexibility by allowing renters to tailor coverage to their specific needs, potentially lowering upfront costs if they already have adequate protection. However, the risk lies in insufficient coverage during unforeseen events, which can lead to significant out-of-pocket expenses and liability. Renters must carefully evaluate existing insurance policies and the rental company's terms to avoid gaps in protection.

Cost Comparison: Included vs Optional Insurance

Insurance included in rental agreements typically results in higher upfront rental costs but provides comprehensive coverage with no additional fees, reducing the risk of unexpected expenses. Optional insurance offers a lower base rental price, allowing renters to decide if they want coverage based on their needs, often leading to potential savings for those confident in their existing insurance policies. Comparing total costs, included insurance simplifies budgeting, while optional insurance can be more cost-effective if the renter opts out or has adequate personal coverage.

Choosing the Right Insurance for Your Rental

Choosing the right insurance for your rental involves evaluating coverage options and risk tolerance. Insurance included in the rental price offers convenience and peace of mind, covering damages and liability with no additional decision-making at pick-up. Optional insurance allows customization, enabling renters to select policies tailored to their needs and potentially reduce overall costs if they already have personal coverage.

Common Misconceptions About Rental Car Insurance

Many renters mistakenly believe that their personal auto insurance or credit card coverage automatically applies to rental cars, leading to unnecessary insurance purchases. Rental companies often present insurance as optional, causing confusion about what is truly mandatory for protection. Understanding the specific terms of personal or credit card insurance policies is crucial to avoid redundant costs and ensure adequate coverage during the rental period.

Tips for Making an Informed Insurance Choice

When choosing between insurance included and insurance optional in rental agreements, prioritize understanding coverage limits and exclusions to avoid unexpected costs. Evaluate your existing personal insurance policies and credit card protections to determine if additional rental insurance is necessary. Obtain detailed quotes and read the fine print to ensure the selected insurance option aligns with your risk tolerance and budget.

Insurance Included vs Insurance Optional Infographic

cardiffo.com

cardiffo.com