Credit card holds provide a temporary authorization that secures funds without immediate withdrawal, offering renters greater flexibility and protection for rental pets. Debit card payments withdraw funds instantly, which can limit available balance and complicate refunds or disputes. Choosing a credit card hold often ensures smoother transaction handling and reduced risk during pet rentals.

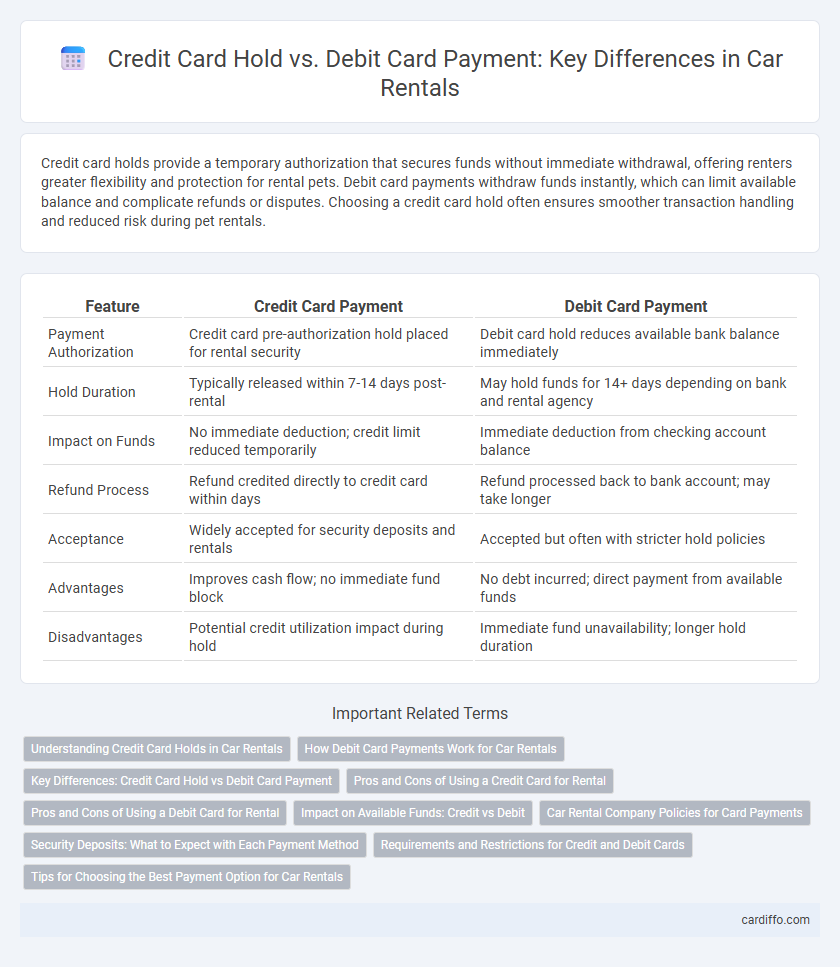

Table of Comparison

| Feature | Credit Card Payment | Debit Card Payment |

|---|---|---|

| Payment Authorization | Credit card pre-authorization hold placed for rental security | Debit card hold reduces available bank balance immediately |

| Hold Duration | Typically released within 7-14 days post-rental | May hold funds for 14+ days depending on bank and rental agency |

| Impact on Funds | No immediate deduction; credit limit reduced temporarily | Immediate deduction from checking account balance |

| Refund Process | Refund credited directly to credit card within days | Refund processed back to bank account; may take longer |

| Acceptance | Widely accepted for security deposits and rentals | Accepted but often with stricter hold policies |

| Advantages | Improves cash flow; no immediate fund block | No debt incurred; direct payment from available funds |

| Disadvantages | Potential credit utilization impact during hold | Immediate fund unavailability; longer hold duration |

Understanding Credit Card Holds in Car Rentals

Credit card holds in car rentals temporarily block a specific amount on your credit card to cover potential damages or extra charges, ensuring funds are available without immediately deducting money. Unlike debit card payments that withdraw funds instantly, credit card holds only affect your available credit limit until released post-rental. Understanding this process helps renters avoid unexpected holds on their accounts and manage their finances effectively during the rental period.

How Debit Card Payments Work for Car Rentals

Debit card payments for car rentals typically require the renter to have sufficient funds or an approved overdraft in their bank account to cover the security deposit and rental charges. Rental companies often place a hold on the debit card equal to the estimated rental cost plus a security deposit, temporarily restricting access to those funds until the vehicle is returned. Unlike credit cards, debit card holds directly impact available bank balances, and some rental agencies may also require additional identification or proof of a return travel ticket to mitigate risk.

Key Differences: Credit Card Hold vs Debit Card Payment

Credit card holds temporarily reserve funds on a borrower's account without immediately deducting money, ensuring payment security for rental companies, whereas debit card payments directly withdraw the exact amount from the renter's bank account at the time of transaction. Credit card holds can affect available credit but do not appear as completed charges until finalized, while debit payments reduce the available balance instantly, impacting liquidity. Credit card holds offer renters added protection against unauthorized charges and easier dispute resolution compared to debit card payments, which may result in longer processing times for refunds.

Pros and Cons of Using a Credit Card for Rental

Using a credit card for rental payments offers the advantage of building credit history and provides stronger fraud protection compared to debit cards. Credit cards typically allow for easier dispute resolution and may include rental car insurance benefits, reducing out-of-pocket costs in case of damage. However, they can lead to overspending, and some rental companies impose holds that temporarily reduce available credit, potentially impacting credit utilization ratios if balances are not paid promptly.

Pros and Cons of Using a Debit Card for Rental

Using a debit card for rental payments offers the convenience of direct access to funds without incurring credit debt, making it easier to manage monthly budgets. However, debit card transactions often place a hold on your available balance, temporarily freezing funds and potentially causing overdrafts if unexpected expenses arise. Unlike credit cards, debit cards usually lack robust fraud protection and may result in delayed reimbursements if rental disputes occur.

Impact on Available Funds: Credit vs Debit

Credit card holds temporarily reduce your available credit without immediately withdrawing funds, allowing you to maintain cash flow while securing rental payments. Debit card payments, however, directly deduct funds from your checking account, immediately impacting your available cash balance. This distinction is crucial for renters managing liquidity, as credit holds offer more flexibility compared to instant debit transactions.

Car Rental Company Policies for Card Payments

Car rental companies often require a credit card hold as a security deposit, placing a temporary freeze on funds to cover potential damages or additional charges, ensuring customer accountability. Debit card payments may be accepted but typically involve stricter policies, such as additional identification, proof of return travel, or holding a larger deposit for a longer period, reflecting higher risk for the company. Understanding these policies helps renters prepare adequate payment methods and avoid delays or denials at pickup.

Security Deposits: What to Expect with Each Payment Method

Credit card holds place a temporary authorization on funds, securing the security deposit without immediate withdrawal, ensuring the amount is available while allowing renters to retain access to their funds until charges are finalized. Debit card payments withdraw the security deposit immediately, which can limit renters' available balance and delay refunds depending on the financial institution's processing time. Understanding the differences helps renters anticipate fund availability and protects landlords by securing deposits efficiently.

Requirements and Restrictions for Credit and Debit Cards

Credit card holds typically require a pre-authorization amount that temporarily reduces available credit until the hold is released, ensuring coverage for potential damages or incidentals. Debit card payments demand immediate fund availability and often involve stricter holds or longer release times, as the actual money is withdrawn from the account. Rental agencies may restrict debit card usage based on the renter's credit score, require proof of return travel plans, or impose higher deposits compared to credit card holders.

Tips for Choosing the Best Payment Option for Car Rentals

When choosing between a credit card hold and a debit card payment for car rentals, prioritize credit cards to avoid immediate fund freezes and improve reservation flexibility. Verify the rental company's policies on debit card holds, as they often require additional documentation or a higher deposit, affecting your available balance. Consider your credit limit, potential holds, and personal budgeting needs to select the payment method that minimizes financial impact while ensuring smooth rental approval.

Credit Card Hold vs Debit Card Payment Infographic

cardiffo.com

cardiffo.com