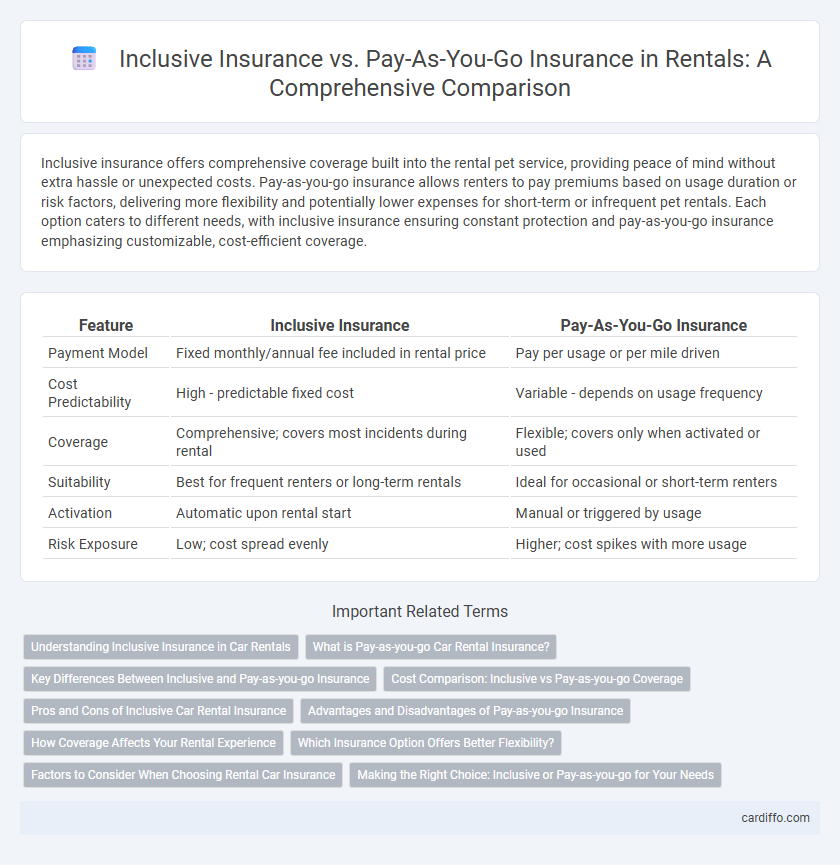

Inclusive insurance offers comprehensive coverage built into the rental pet service, providing peace of mind without extra hassle or unexpected costs. Pay-as-you-go insurance allows renters to pay premiums based on usage duration or risk factors, delivering more flexibility and potentially lower expenses for short-term or infrequent pet rentals. Each option caters to different needs, with inclusive insurance ensuring constant protection and pay-as-you-go insurance emphasizing customizable, cost-efficient coverage.

Table of Comparison

| Feature | Inclusive Insurance | Pay-As-You-Go Insurance |

|---|---|---|

| Payment Model | Fixed monthly/annual fee included in rental price | Pay per usage or per mile driven |

| Cost Predictability | High - predictable fixed cost | Variable - depends on usage frequency |

| Coverage | Comprehensive; covers most incidents during rental | Flexible; covers only when activated or used |

| Suitability | Best for frequent renters or long-term rentals | Ideal for occasional or short-term renters |

| Activation | Automatic upon rental start | Manual or triggered by usage |

| Risk Exposure | Low; cost spread evenly | Higher; cost spikes with more usage |

Understanding Inclusive Insurance in Car Rentals

Inclusive insurance in car rentals provides comprehensive coverage as part of the rental package, eliminating the need for separate insurance purchases and offering peace of mind during the rental period. This type of insurance typically covers collision damage, theft, and third-party liability, ensuring renters are protected against common risks without additional costs. Compared to pay-as-you-go insurance, which charges based on usage or mileage, inclusive insurance offers predictable expenses and simplifies the rental process for customers.

What is Pay-as-you-go Car Rental Insurance?

Pay-as-you-go car rental insurance offers flexible coverage based on actual usage, allowing renters to pay only for the days or miles they drive. This type of insurance provides cost-effective protection by tailoring premiums to individual rental periods, unlike inclusive insurance which is bundled into the overall rental price regardless of usage. Drivers benefit from transparent pricing and customizable coverage, making pay-as-you-go insurance ideal for occasional renters seeking financial efficiency.

Key Differences Between Inclusive and Pay-as-you-go Insurance

Inclusive insurance in rental agreements covers the vehicle for the entire duration of the lease, providing comprehensive protection and fixed costs, while pay-as-you-go insurance charges based on actual usage or rental days, offering flexibility and potential cost savings for short-term rentals. Inclusive insurance typically includes liability, collision, theft, and sometimes roadside assistance, whereas pay-as-you-go plans allow renters to add coverage as needed, tailoring expenses to their specific rental period. The choice between these insurance types impacts overall rental cost predictability, coverage comprehensiveness, and risk management strategies.

Cost Comparison: Inclusive vs Pay-as-you-go Coverage

Inclusive insurance offers a fixed, often higher upfront cost that covers a wide range of risks, providing predictable monthly expenses for renters. Pay-as-you-go insurance typically features lower base rates with variable charges based on actual usage or risk factors, resulting in potentially lower costs but less certainty in monthly budgeting. Renters prioritizing cost control may choose pay-as-you-go options, while those seeking comprehensive, hassle-free coverage lean towards inclusive insurance despite the higher price.

Pros and Cons of Inclusive Car Rental Insurance

Inclusive car rental insurance offers comprehensive coverage that eliminates the need for separate purchases, simplifying the rental process and providing peace of mind against theft, accidents, and damage. It typically costs more upfront, potentially inflating the total rental price compared to pay-as-you-go insurance options that charge based on actual usage or risk factors. However, inclusive insurance reduces the risk of unexpected expenses and streamlines claims handling, making it ideal for renters who prioritize convenience and financial predictability.

Advantages and Disadvantages of Pay-as-you-go Insurance

Pay-as-you-go insurance offers flexibility by charging premiums based on actual usage, making it cost-effective for infrequent renters or short-term vehicle users. This model can reduce upfront costs but may result in higher expenses during periods of heavy usage or unpredictable driving habits. Limited coverage options and potential variability in premiums are notable disadvantages compared to the fixed rates of inclusive insurance plans.

How Coverage Affects Your Rental Experience

Inclusive insurance offers comprehensive coverage built into your rental price, ensuring protection against accidents, theft, or damage without unexpected costs, which enhances peace of mind during your rental period. Pay-as-you-go insurance allows renters to pay only for the coverage they use, potentially lowering upfront costs but risking higher out-of-pocket expenses if incidents occur. Understanding how coverage levels impact liability, deductibles, and claims processing is crucial to choosing the best insurance option that aligns with your risk tolerance and budget while maximizing rental convenience.

Which Insurance Option Offers Better Flexibility?

Inclusive insurance offers fixed coverage as part of the rental cost, providing consistent protection without additional actions from the customer. Pay-as-you-go insurance allows renters to activate coverage only when needed, offering greater flexibility and potential cost savings for infrequent users. For renters seeking adaptability and control over insurance expenses, pay-as-you-go options typically deliver better flexibility compared to inclusive plans.

Factors to Consider When Choosing Rental Car Insurance

When choosing rental car insurance, factors to consider include coverage scope, cost, and flexibility. Inclusive insurance typically offers comprehensive protection bundled with the rental price, making it convenient but potentially more expensive. Pay-as-you-go insurance provides customizable coverage based on actual usage, ideal for short-term rentals or infrequent drivers seeking cost efficiency.

Making the Right Choice: Inclusive or Pay-as-you-go for Your Needs

Inclusive insurance offers guaranteed coverage with a fixed cost, providing peace of mind for renters who prefer predictable expenses and broad protection during their rental period. Pay-as-you-go insurance allows users to pay based on actual usage or rental duration, making it ideal for those with occasional or short-term rental needs seeking cost efficiency. Evaluating rental frequency, duration, and budget considerations helps determine whether the stability of inclusive insurance or the flexibility of pay-as-you-go aligns best with individual insurance requirements.

Inclusive insurance vs Pay-as-you-go insurance Infographic

cardiffo.com

cardiffo.com