Premium insurance for rental pets offers extensive coverage including illness, accidental injury, and liability protection, ensuring peace of mind for pet owners and property managers alike. Basic insurance typically covers only the most fundamental risks, such as accidental injury, leaving gaps in protection that could result in significant out-of-pocket expenses. Choosing premium insurance delivers comprehensive financial security, reducing risks associated with vet bills and property damage during the rental period.

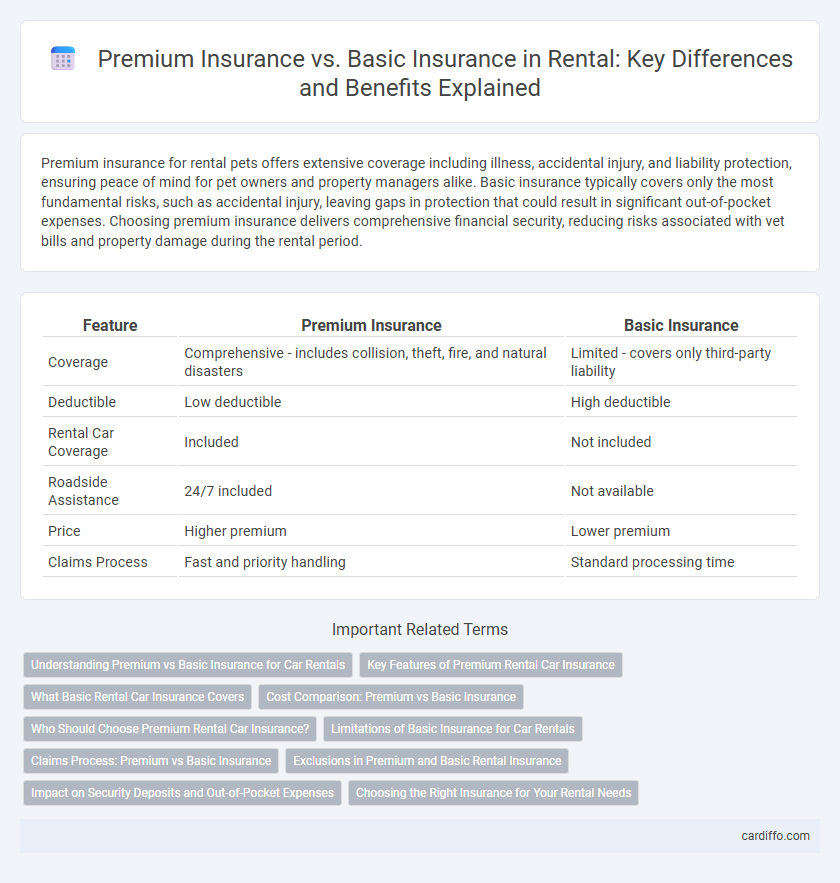

Table of Comparison

| Feature | Premium Insurance | Basic Insurance |

|---|---|---|

| Coverage | Comprehensive - includes collision, theft, fire, and natural disasters | Limited - covers only third-party liability |

| Deductible | Low deductible | High deductible |

| Rental Car Coverage | Included | Not included |

| Roadside Assistance | 24/7 included | Not available |

| Price | Higher premium | Lower premium |

| Claims Process | Fast and priority handling | Standard processing time |

Understanding Premium vs Basic Insurance for Car Rentals

Premium car rental insurance offers comprehensive coverage including collision, theft, and liability protection, often with lower deductibles and additional perks like roadside assistance. Basic insurance typically covers only third-party liability, leaving renters responsible for damages to the rental vehicle and potential out-of-pocket expenses. Choosing premium insurance ensures broader protection and peace of mind during the rental period, especially in high-risk situations or unfamiliar locations.

Key Features of Premium Rental Car Insurance

Premium rental car insurance offers comprehensive coverage including collision, theft protection, and liability coverage with higher limits compared to basic insurance. It often includes benefits such as roadside assistance, zero deductible options, and coverage for personal belongings inside the vehicle. These key features provide enhanced financial security and peace of mind during rental periods.

What Basic Rental Car Insurance Covers

Basic rental car insurance typically covers liability protection, which pays for injuries or property damage caused to others during an accident. It may also include limited coverage for collision damage, theft, and vandalism, though the extent varies by provider and location. This insurance provides essential financial protection but often excludes personal injury, roadside assistance, and high-value damage claims that premium insurance policies cover.

Cost Comparison: Premium vs Basic Insurance

Premium insurance often entails higher upfront costs compared to basic insurance but provides broader coverage, reducing out-of-pocket expenses during claims. Basic insurance usually features lower monthly premiums but may leave renters responsible for deductibles, exclusions, and additional fees not covered under the plan. Evaluating total cost of ownership, including premiums, deductibles, and potential claim payouts, is essential for cost-effective rental insurance decisions.

Who Should Choose Premium Rental Car Insurance?

Premium rental car insurance suits drivers seeking extensive coverage for high-value vehicles or those traveling in unfamiliar areas with greater risk of accidents or theft. Customers prioritizing comprehensive protection, including collision, liability, and personal injury coverage, benefit from premium plans. Business travelers and frequent renters also prefer premium insurance to minimize financial exposure and downtime during trips.

Limitations of Basic Insurance for Car Rentals

Basic insurance for car rentals often includes minimal coverage, leaving renters exposed to significant risks such as limited liability protection and high deductibles. It typically excludes coverage for personal belongings, roadside assistance, and damage to rental vehicles beyond collision or theft. Choosing premium insurance enhances protection by offering broader coverage, lower deductibles, and additional services, reducing financial vulnerability during rental periods.

Claims Process: Premium vs Basic Insurance

Premium insurance offers a streamlined claims process with faster approvals, dedicated claim managers, and comprehensive coverage that reduces out-of-pocket expenses. Basic insurance features a more standardized, slower claims procedure, often requiring additional documentation and longer wait times for reimbursements. Choosing premium insurance enhances claim efficiency and customer support, minimizing delays and complexities during the rental experience.

Exclusions in Premium and Basic Rental Insurance

Premium rental insurance typically offers broader coverage but includes exclusions such as intentional damage, wear and tear, and pre-existing damages to the rental property. Basic rental insurance covers fewer risks and generally excludes high-value items, water damage, and liability for guest injuries on the premises. Understanding these exclusions helps renters decide which policy best suits their protection needs and budget constraints.

Impact on Security Deposits and Out-of-Pocket Expenses

Premium insurance for rentals significantly reduces security deposits by offering broader coverage and lower risk to landlords, while basic insurance often requires higher deposits due to limited protection. Tenants with premium insurance experience fewer out-of-pocket expenses for damages or claims, whereas those with basic insurance may face substantial costs not covered by their policy. Choosing premium insurance enhances financial security by minimizing upfront deposits and reducing potential unexpected expenses during the rental period.

Choosing the Right Insurance for Your Rental Needs

Premium insurance offers comprehensive coverage, including extensive liability protection, collision, theft, and personal injury benefits, making it ideal for high-value rentals or frequent travelers. Basic insurance covers fundamental risks such as third-party liability and limited property damage, suitable for short-term or budget-conscious renters. Evaluating factors like rental duration, vehicle type, and personal risk tolerance ensures selecting the most cost-effective and adequate insurance plan for your rental needs.

Premium insurance vs Basic insurance Infographic

cardiffo.com

cardiffo.com