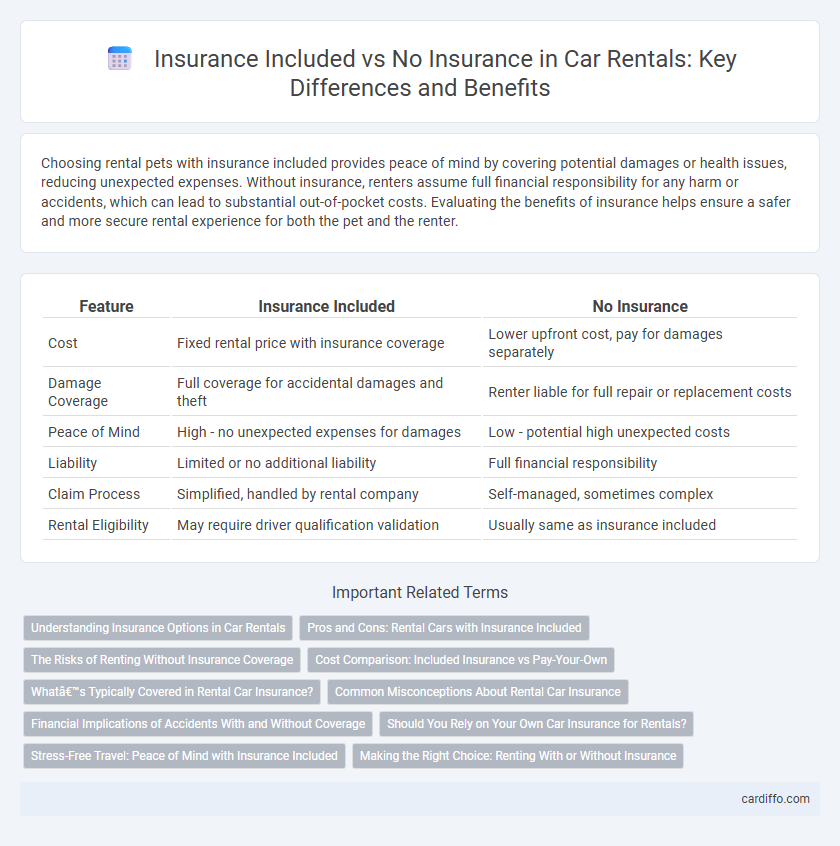

Choosing rental pets with insurance included provides peace of mind by covering potential damages or health issues, reducing unexpected expenses. Without insurance, renters assume full financial responsibility for any harm or accidents, which can lead to substantial out-of-pocket costs. Evaluating the benefits of insurance helps ensure a safer and more secure rental experience for both the pet and the renter.

Table of Comparison

| Feature | Insurance Included | No Insurance |

|---|---|---|

| Cost | Fixed rental price with insurance coverage | Lower upfront cost, pay for damages separately |

| Damage Coverage | Full coverage for accidental damages and theft | Renter liable for full repair or replacement costs |

| Peace of Mind | High - no unexpected expenses for damages | Low - potential high unexpected costs |

| Liability | Limited or no additional liability | Full financial responsibility |

| Claim Process | Simplified, handled by rental company | Self-managed, sometimes complex |

| Rental Eligibility | May require driver qualification validation | Usually same as insurance included |

Understanding Insurance Options in Car Rentals

Choosing a car rental with insurance included offers peace of mind by covering collision, theft, and liability, reducing out-of-pocket risks during the rental period. Without insurance, renters must rely on personal auto policies or credit card benefits, which may have coverage gaps or limits. Understanding specific policy details, such as collision damage waiver (CDW) and liability protection, is crucial for optimizing coverage and minimizing financial exposure.

Pros and Cons: Rental Cars with Insurance Included

Rental cars with insurance included offer peace of mind by covering damages, theft, and liability, reducing out-of-pocket expenses during the rental period. However, these policies often come with higher daily rental rates and may include coverage limitations or exclusions that require careful review. Renting without insurance might lower upfront costs but exposes renters to financial risks and potential high expenses in case of accidents or damage.

The Risks of Renting Without Insurance Coverage

Renting without insurance coverage exposes renters to significant financial risks, including liability for accidental damages to the property or injuries sustained on-site. Without insurance, renters must pay out-of-pocket for repairs, medical bills, and potential legal fees arising from unforeseen incidents. This lack of protection can lead to substantial monetary loss and legal complications, emphasizing the importance of securing rental insurance.

Cost Comparison: Included Insurance vs Pay-Your-Own

Rental agreements with insurance included typically result in higher upfront costs but provide comprehensive coverage, reducing potential out-of-pocket expenses during damages or accidents. Opting for a pay-your-own insurance approach lowers initial rental fees but increases financial risk, as renters must cover repair costs without reimbursement if uninsured. Comparing total expenses reveals that included insurance can offer better cost predictability and protection, while pay-your-own may save money only if no incidents occur.

What’s Typically Covered in Rental Car Insurance?

Rental car insurance typically covers liability protection, collision damage waiver (CDW), theft protection, and personal accident insurance. Liability protection covers bodily injury and property damage to others, while CDW handles repair costs if the rental car is damaged. Theft protection safeguards against loss from vehicle theft, and personal accident insurance provides medical coverage for the driver and passengers.

Common Misconceptions About Rental Car Insurance

Many renters mistakenly believe that personal auto insurance or credit card coverage will fully protect them when renting a car, but these policies often have significant limitations and exclusions. Rental companies frequently offer insurance packages that cover liability, collision, and theft, which personal policies may not include. Understanding the specific coverage details and potential gaps can prevent unexpected out-of-pocket expenses during the rental period.

Financial Implications of Accidents With and Without Coverage

Renters with insurance coverage benefit from reduced out-of-pocket expenses following accidents, as policy terms typically cover damage repair costs and liability claims. Without insurance, individuals face potentially significant financial burdens, including full responsibility for vehicle repairs, medical bills, and legal fees arising from accidents. Choosing rental insurance minimizes economic risks, protecting renters from unexpected liabilities and ensuring more predictable financial outcomes.

Should You Rely on Your Own Car Insurance for Rentals?

Relying solely on your personal car insurance for rental vehicles can expose you to coverage gaps, especially regarding liability and physical damage protections that vary widely by policy and rental location. Rental companies often offer supplemental insurance that fills these gaps, providing peace of mind and potentially lowering out-of-pocket costs in case of an accident. Carefully reviewing your existing policy's rental coverage limits ensures you avoid unexpected expenses while driving a rented car.

Stress-Free Travel: Peace of Mind with Insurance Included

Choosing a rental with insurance included eliminates unexpected costs and reduces financial risk, ensuring stress-free travel. Coverage protects against damages, theft, and liability, allowing renters to focus on their trip without worry. Peace of mind from comprehensive insurance enhances overall travel experience and confidence.

Making the Right Choice: Renting With or Without Insurance

Choosing to rent with insurance provides financial protection against potential damages, theft, or liability, reducing unexpected expenses during the rental period. Renting without insurance may lower upfront costs but increases the renter's risk of covering costly repairs or legal claims out of pocket. Evaluating the specific rental agreement, vehicle type, and personal risk tolerance helps determine whether insurance inclusion aligns with one's budget and peace of mind.

Insurance included vs No insurance Infographic

cardiffo.com

cardiffo.com