Lienholder registration involves listing a financial institution or lender as a legal claimholder on the pet's registration, ensuring that ownership rights are protected during loan repayment. Clear title registration confirms sole ownership without any liens, providing full legal control and transferability of the pet. Choosing between lienholder and clear title registration depends on whether the pet is financed or fully owned outright.

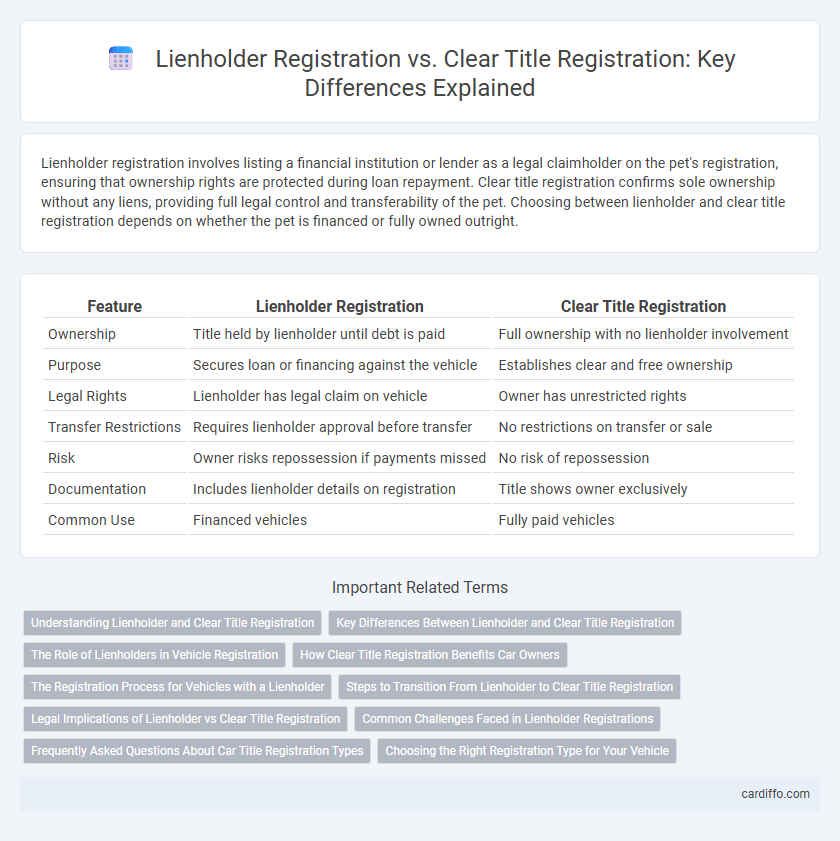

Table of Comparison

| Feature | Lienholder Registration | Clear Title Registration |

|---|---|---|

| Ownership | Title held by lienholder until debt is paid | Full ownership with no lienholder involvement |

| Purpose | Secures loan or financing against the vehicle | Establishes clear and free ownership |

| Legal Rights | Lienholder has legal claim on vehicle | Owner has unrestricted rights |

| Transfer Restrictions | Requires lienholder approval before transfer | No restrictions on transfer or sale |

| Risk | Owner risks repossession if payments missed | No risk of repossession |

| Documentation | Includes lienholder details on registration | Title shows owner exclusively |

| Common Use | Financed vehicles | Fully paid vehicles |

Understanding Lienholder and Clear Title Registration

Lienholder registration occurs when a vehicle's title lists a financial institution or lender as the lienholder, indicating that the loan has not been fully paid off and the lender retains a legal interest in the vehicle. Clear title registration signifies that the owner holds full ownership rights free of any liens or encumbrances, allowing for unrestricted transfer or sale of the vehicle. Understanding the distinction between lienholder and clear title registration is crucial for verifying ownership status and ensuring proper legal documentation during vehicle transactions.

Key Differences Between Lienholder and Clear Title Registration

Lienholder registration involves recording a financial institution's interest in a vehicle when a loan is secured, ensuring the lender holds a legal claim until the debt is paid, while clear title registration indicates the vehicle is fully owned without any outstanding liens. The key differences include the presence of a lienholder's name on the vehicle title in lienholder registration, which restricts the owner's ability to sell or transfer the vehicle without lender approval, whereas clear title registration grants full ownership rights and unrestricted transferability. Lienholder registration requires additional documentation and coordination with the lender during the registration process, unlike clear title registration, which typically involves straightforward ownership proof and fee payment.

The Role of Lienholders in Vehicle Registration

Lienholder registration records the financial institution or individual holding the lien on the vehicle, ensuring legal ownership rights until the debt is satisfied. Clear title registration indicates the vehicle is free of liens, allowing full ownership transfer without encumbrances. The role of lienholders in vehicle registration is crucial for protecting lenders' interests and maintaining accurate ownership records in state databases.

How Clear Title Registration Benefits Car Owners

Clear Title Registration benefits car owners by ensuring full ownership rights without any lien claims, allowing immediate freedom to sell, transfer, or modify the vehicle. It simplifies the registration process as the title status is undisputed, reducing legal complexities and potential delays. Clear title registration also enhances vehicle value and trustworthiness in resale transactions, providing assurance to buyers and lenders.

The Registration Process for Vehicles with a Lienholder

When registering a vehicle with a lienholder, the title will indicate the lienholder's interest, ensuring legal recognition of their financial stake. The registration process requires submitting the lienholder's information along with the owner's details to the Department of Motor Vehicles (DMV), where the vehicle's title is held until the loan is paid off. Once the lien is satisfied, the owner can request a clear title registration, which removes the lienholder's name and fully transfers ownership.

Steps to Transition From Lienholder to Clear Title Registration

Transitioning from lienholder registration to clear title registration involves first ensuring the lien has been fully satisfied and obtaining a lien release document from the lender. Next, submit the lien release along with a clear title application to the relevant motor vehicle department, following their specific procedures for title transfer. Finally, pay any required fees and receive the updated title reflecting clear ownership without any lienholder claims.

Legal Implications of Lienholder vs Clear Title Registration

Lienholder registration legally binds the vehicle title to a financial institution or creditor, ensuring they maintain a secured interest until the loan is fully paid, which can limit the owner's ability to sell or transfer the vehicle without lienholder approval. Clear title registration signifies that the owner holds full legal ownership free of any liens, granting unrestricted rights to sell, transfer, or modify the vehicle. Failure to comply with lienholder registration requirements can result in legal disputes, repossession rights, or credit complications, whereas clear title registration confirms clear ownership and simplifies legal processes.

Common Challenges Faced in Lienholder Registrations

Lienholder registration often encounters challenges such as accurately verifying and recording the lienholder's details to prevent ownership disputes. Delays in processing lienholder paperwork can lead to complications in vehicle transfers or sales, affecting both lenders and owners. Ensuring all lien information complies with state regulations is critical to maintain clear ownership records and avoid legal issues.

Frequently Asked Questions About Car Title Registration Types

Lienholder registration involves listing a financial institution or lender as the lienholder on the vehicle title, indicating outstanding loans or security interests, whereas clear title registration shows no liens, signifying full ownership. Common FAQs about car title registrations address how lienholder information affects transfer processes, the impact on selling or refinancing, and steps to obtain a clear title once loans are paid off. Understanding these distinctions helps vehicle owners navigate legal responsibilities and ownership rights during registration.

Choosing the Right Registration Type for Your Vehicle

Selecting the appropriate registration type depends on your vehicle's ownership status and financial obligations. Lienholder registration includes the lender's information, ensuring the lien remains recorded until the loan is paid off, while clear title registration indicates full ownership without any outstanding liens. Understanding these distinctions helps vehicle owners comply with legal requirements and protect their financial interests.

Lienholder Registration vs Clear Title Registration Infographic

cardiffo.com

cardiffo.com