Proof of insurance verifies that your pet is covered against medical emergencies and liabilities, ensuring their safety and compliance with local regulations. Proof of residency establishes your address within the jurisdiction where the pet registration is required, confirming eligibility to register your pet locally. Both documents are essential for a smooth and valid pet registration process, preventing delays or rejections.

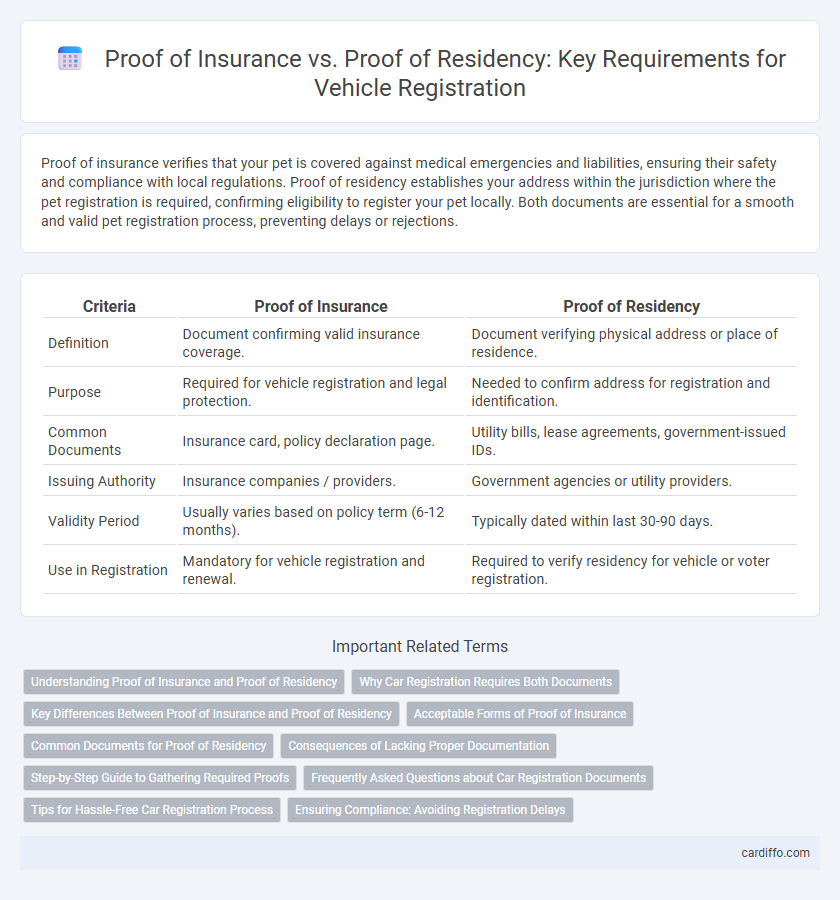

Table of Comparison

| Criteria | Proof of Insurance | Proof of Residency |

|---|---|---|

| Definition | Document confirming valid insurance coverage. | Document verifying physical address or place of residence. |

| Purpose | Required for vehicle registration and legal protection. | Needed to confirm address for registration and identification. |

| Common Documents | Insurance card, policy declaration page. | Utility bills, lease agreements, government-issued IDs. |

| Issuing Authority | Insurance companies / providers. | Government agencies or utility providers. |

| Validity Period | Usually varies based on policy term (6-12 months). | Typically dated within last 30-90 days. |

| Use in Registration | Mandatory for vehicle registration and renewal. | Required to verify residency for vehicle or voter registration. |

Understanding Proof of Insurance and Proof of Residency

Proof of insurance verifies that an individual has active coverage from an authorized insurance provider, essential for vehicle registration and compliance with legal requirements. Proof of residency confirms a person's residence within a specific jurisdiction, typically established through documents like utility bills, lease agreements, or official government correspondence. Both documents serve distinct purposes during registration: insurance ensures financial responsibility for potential damages, while residency validates eligibility for local registration services.

Why Car Registration Requires Both Documents

Car registration requires both proof of insurance and proof of residency to ensure legal compliance and verify ownership credibility. Proof of insurance confirms the vehicle is covered against liability and damages, meeting state-mandated financial responsibility laws. Proof of residency establishes the registrant's legal address within the state, enabling accurate taxation, jurisdiction, and law enforcement accountability.

Key Differences Between Proof of Insurance and Proof of Residency

Proof of insurance verifies active coverage by an insurance company, typically showcasing a policy number, provider details, and coverage dates, essential for vehicle registration or medical services. Proof of residency confirms a person's physical address within a jurisdiction using documents like utility bills, lease agreements, or government correspondence, necessary for voter registration or school enrollment. Unlike proof of residency, proof of insurance validates financial responsibility and risk mitigation rather than establishing location or domicile.

Acceptable Forms of Proof of Insurance

Acceptable forms of proof of insurance for registration typically include an insurance card, a digital insurance ID accessible via an app, or an official insurance policy declaration page. The document must clearly display the policyholder's name, the vehicle identification number (VIN), and the effective coverage dates to validate active insurance. Proof of residency, such as utility bills or lease agreements, does not substitute for insurance verification when registering a vehicle.

Common Documents for Proof of Residency

Common documents for proof of residency include utility bills, bank statements, rental or lease agreements, and government-issued correspondence, all dated within the past three months. These documents verify the applicant's physical address and are essential during registration processes to establish residency status. Proof of insurance differs as it confirms coverage but does not serve to validate the applicant's residential address.

Consequences of Lacking Proper Documentation

Lacking proper proof of insurance during vehicle registration can result in fines, denied registration, and potential legal penalties for driving uninsured. Failure to provide valid proof of residency often leads to rejection of the registration application, delays in processing, or inability to register the vehicle in the desired jurisdiction. Both documentation types are essential to ensure compliance with state regulations and avoid administrative or legal complications.

Step-by-Step Guide to Gathering Required Proofs

Gathering the required proofs for registration involves first obtaining a valid proof of insurance, such as an insurance card or certificate that clearly displays your policy number and coverage dates. Next, secure proof of residency by collecting documents like utility bills, lease agreements, or government-issued IDs that confirm your address within the registration jurisdiction. Ensure all documents are current, legible, and meet the specific criteria outlined by the registration authority to avoid delays or rejections.

Frequently Asked Questions about Car Registration Documents

Proof of insurance verifies that a vehicle is covered by a valid insurance policy, which is mandatory for car registration to ensure financial responsibility in case of accidents. Proof of residency confirms the registrant's address within the jurisdiction, required to establish local legal eligibility and applicable tax rates. Frequently asked questions clarify differences, required formats, and acceptable documents, such as insurance cards versus utility bills, and address timelines for submission during the car registration process.

Tips for Hassle-Free Car Registration Process

For a hassle-free car registration process, ensure you present both proof of insurance and proof of residency, as many DMV offices require these to verify your eligibility. Proof of insurance confirms that your vehicle is legally covered against accidents, while proof of residency establishes your address within the registration jurisdiction. Keep documents such as an insurance card, utility bills, or lease agreements ready and up-to-date to avoid delays or rejection during registration.

Ensuring Compliance: Avoiding Registration Delays

Providing accurate proof of insurance is essential to confirm coverage compliance and prevent registration delays, while valid proof of residency verifies eligibility within the registration jurisdiction. Failure to present updated insurance certificates or acceptable residency documents can result in registration refusals or prolonged processing times. Ensuring both proofs meet local regulatory requirements streamlines registration, maintaining legal adherence and operational efficiency.

Proof of insurance vs Proof of residency Infographic

cardiffo.com

cardiffo.com