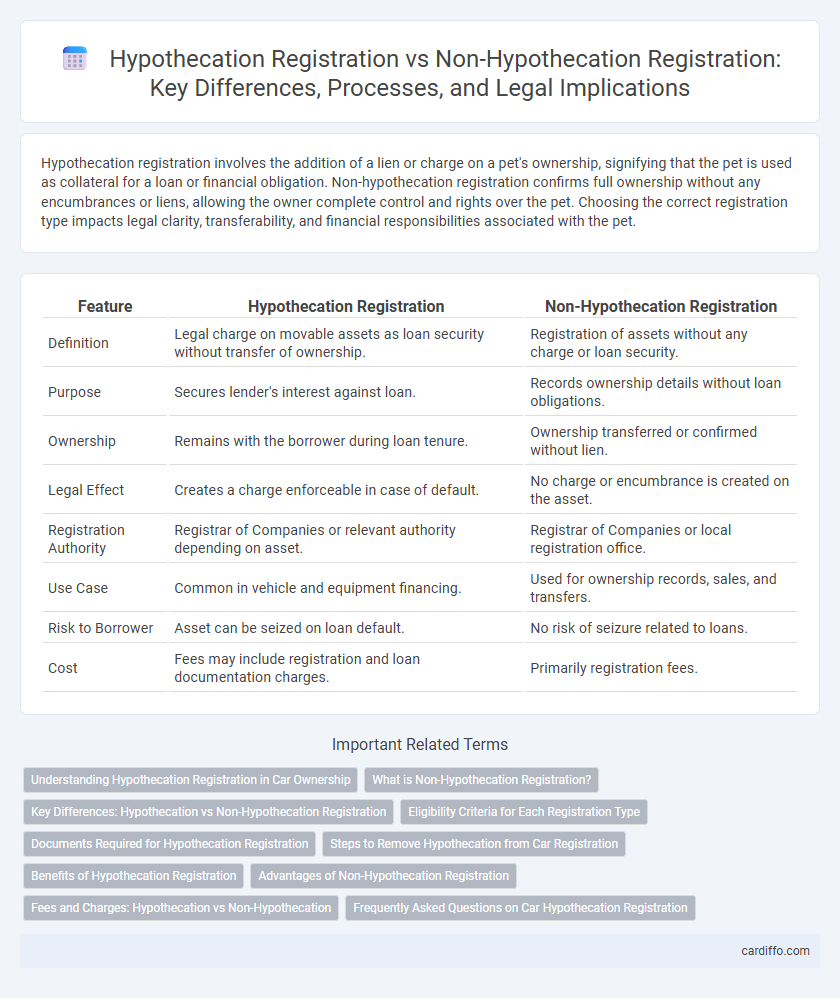

Hypothecation registration involves the addition of a lien or charge on a pet's ownership, signifying that the pet is used as collateral for a loan or financial obligation. Non-hypothecation registration confirms full ownership without any encumbrances or liens, allowing the owner complete control and rights over the pet. Choosing the correct registration type impacts legal clarity, transferability, and financial responsibilities associated with the pet.

Table of Comparison

| Feature | Hypothecation Registration | Non-Hypothecation Registration |

|---|---|---|

| Definition | Legal charge on movable assets as loan security without transfer of ownership. | Registration of assets without any charge or loan security. |

| Purpose | Secures lender's interest against loan. | Records ownership details without loan obligations. |

| Ownership | Remains with the borrower during loan tenure. | Ownership transferred or confirmed without lien. |

| Legal Effect | Creates a charge enforceable in case of default. | No charge or encumbrance is created on the asset. |

| Registration Authority | Registrar of Companies or relevant authority depending on asset. | Registrar of Companies or local registration office. |

| Use Case | Common in vehicle and equipment financing. | Used for ownership records, sales, and transfers. |

| Risk to Borrower | Asset can be seized on loan default. | No risk of seizure related to loans. |

| Cost | Fees may include registration and loan documentation charges. | Primarily registration fees. |

Understanding Hypothecation Registration in Car Ownership

Hypothecation registration in car ownership secures the lender's interest by legally recording a loan agreement against the vehicle, making it collateral for the loan amount. Unlike non-hypothecation registration, where full ownership is transferred without any encumbrance, hypothecation ensures the vehicle cannot be sold or transferred until the loan is fully repaid. This system protects financial institutions while allowing the borrower to use the vehicle during the loan tenure.

What is Non-Hypothecation Registration?

Non-Hypothecation Registration refers to the process of registering a vehicle without creating a loan or financial lien on it, indicating the owner has full ownership rights free from any creditor claims. This type of registration is essential for individuals who purchase a vehicle with complete payment, ensuring clear title transfer and hassle-free resale. Non-Hypothecation status simplifies ownership verification and is recorded in the vehicle's registration documents by transport authorities.

Key Differences: Hypothecation vs Non-Hypothecation Registration

Hypothecation registration involves the creation of a security interest where the borrower pledges an asset as collateral without transferring ownership, enabling the lender to claim the asset in case of default. Non-hypothecation registration signifies ownership without any encumbrance, meaning the asset is free from any security interest or lien. The key difference lies in the legal right granted to the lender under hypothecation, which does not exist in non-hypothecation scenarios.

Eligibility Criteria for Each Registration Type

Hypothecation registration requires the applicant to be the owner of a movable asset, such as a vehicle, and the registration process mandates a legal agreement with a lender that holds interest until the loan is repaid. Non-hypothecation registration is eligible for individuals who fully own the asset without any encumbrances or financial liabilities, allowing registration free of any security interests. Each registration type demands proof of ownership documents, identity verification, and compliance with regulatory norms specific to hypothecation agreements or outright asset ownership.

Documents Required for Hypothecation Registration

Hypothecation registration requires specific documents including a valid registration application, proof of ownership (such as the RC book), a copy of the loan agreement between the hypothecator and the lender, valid identification proof, and a No Objection Certificate (NOC) from the financer if applicable. These documents ensure legal acknowledgment of the vehicle as collateral for the loan without transferring ownership. In contrast, non-hypothecation registration typically only requires ownership proof and identification, as no lien or security interest is involved.

Steps to Remove Hypothecation from Car Registration

To remove hypothecation from car registration, the borrower must first clear the outstanding loan amount with the financing institution. After receiving a No Objection Certificate (NOC) from the lender, the vehicle owner needs to submit Form 35 along with the NOC, original Registration Certificate (RC), and identification proof to the Regional Transport Office (RTO). The RTO then updates the registration record by deleting the financier's name, completing the removal of hypothecation from the car's RC.

Benefits of Hypothecation Registration

Hypothecation registration provides legal proof of a secured loan where the asset, typically a vehicle or equipment, remains with the borrower but acts as collateral, ensuring the lender's interest is protected. This registration facilitates easier loan approval, potentially lower interest rates, and enhances the borrower's credibility with financial institutions. Unlike non-hypothecation registration, where no security interest is recorded, hypothecation registration offers a safeguard against asset seizure without due process, minimizing risks for both parties involved.

Advantages of Non-Hypothecation Registration

Non-Hypothecation Registration offers clear ownership rights without encumbrances, enhancing asset liquidity and ease of transfer. It eliminates the risk of creditors claiming the asset during loan defaults, providing greater security for the registered party. This type of registration simplifies legal proceedings in disputes, ensuring faster resolution and reduced administrative burdens.

Fees and Charges: Hypothecation vs Non-Hypothecation

Hypothecation registration typically involves higher fees due to the involvement of lenders securing a loan against an asset, including charges for documentation and verification. Non-hypothecation registration generally has lower fees since it involves straightforward ownership transfer without collateral obligations. Comparing the two, hypothecation registration incurs additional legal and processing costs reflecting the complexity of the secured interest.

Frequently Asked Questions on Car Hypothecation Registration

Car hypothecation registration involves legally pledging a vehicle as collateral for a loan, allowing ownership to remain with the borrower while the lender holds an interest. Non-hypothecation registration means the vehicle is fully owned by the buyer without any liens, providing complete ownership rights and no loan obligations. Common FAQs address how hypothecation affects car resale, the process for removing hypothecation after loan repayment, and differences in registration documentation for both types.

Hypothecation Registration vs Non-Hypothecation Registration Infographic

cardiffo.com

cardiffo.com