Insurance inspections prioritize assessing vehicle condition to determine coverage eligibility and risk factors, often emphasizing safety and damage evaluation. Dealer inspections focus on verifying the vehicle's mechanical functionality and cosmetic condition for resale value and customer satisfaction. Both inspections ensure transparency, but their objectives and criteria differ significantly, with insurance inspections geared towards risk assessment and dealer inspections toward sales readiness.

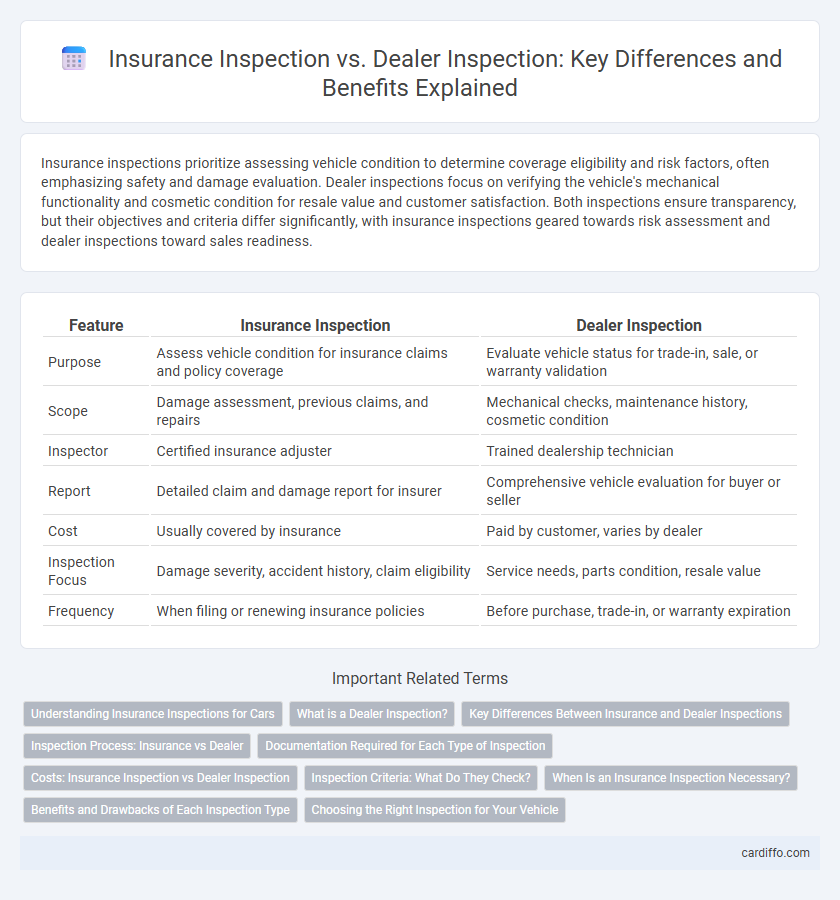

Table of Comparison

| Feature | Insurance Inspection | Dealer Inspection |

|---|---|---|

| Purpose | Assess vehicle condition for insurance claims and policy coverage | Evaluate vehicle status for trade-in, sale, or warranty validation |

| Scope | Damage assessment, previous claims, and repairs | Mechanical checks, maintenance history, cosmetic condition |

| Inspector | Certified insurance adjuster | Trained dealership technician |

| Report | Detailed claim and damage report for insurer | Comprehensive vehicle evaluation for buyer or seller |

| Cost | Usually covered by insurance | Paid by customer, varies by dealer |

| Inspection Focus | Damage severity, accident history, claim eligibility | Service needs, parts condition, resale value |

| Frequency | When filing or renewing insurance policies | Before purchase, trade-in, or warranty expiration |

Understanding Insurance Inspections for Cars

Insurance inspections for cars primarily assess vehicle condition and ownership to verify claims and determine risk accurately. These inspections often include checking for pre-existing damages, verifying VIN numbers, and ensuring compliance with policy terms, unlike dealer inspections which focus more on vehicle quality and maintenance for resale. Understanding the detailed requirements and procedures of insurance inspections helps policyholders streamline claim approvals and avoid potential disputes.

What is a Dealer Inspection?

A dealer inspection is a comprehensive evaluation conducted by a licensed automobile dealer to assess the condition and functionality of a vehicle before sale or trade-in. This inspection typically includes checks on the engine, transmission, brakes, suspension, and safety features to ensure the vehicle meets manufacturer standards and regulatory requirements. Unlike insurance inspections that focus on damage assessment for claims, dealer inspections aim to verify vehicle quality and performance for potential buyers.

Key Differences Between Insurance and Dealer Inspections

Insurance inspections primarily assess vehicle condition to determine claim validity and repair costs, ensuring coverage compliance and fraud prevention. Dealer inspections focus on evaluating vehicle quality, functionality, and market readiness to guarantee customer satisfaction and resale value. Key differences include the inspection purpose, criteria standards, and the scope of evaluation, with insurance inspections emphasizing damage assessment and dealer inspections emphasizing overall vehicle performance and aesthetics.

Inspection Process: Insurance vs Dealer

Insurance inspections prioritize risk assessment by thoroughly examining vehicle condition, verifying ownership, and identifying potential damages to determine policy eligibility and premium adjustments. Dealer inspections focus on ensuring the vehicle meets manufacturer standards, assessing mechanical systems, and preparing the car for sale or trade-in, often emphasizing cosmetic and functional aspects. Both processes involve detailed checklists, but insurance inspections target liability and coverage factors, while dealer inspections aim to confirm vehicle quality and market readiness.

Documentation Required for Each Type of Inspection

Insurance inspections require comprehensive documentation, including the vehicle's registration, proof of insurance, a valid driver's license, and detailed photos of the vehicle's condition to assess risk and verify coverage eligibility. Dealer inspections focus primarily on the vehicle's maintenance records, warranty documents, title, and a thorough checklist of mechanical and cosmetic conditions to ensure compliance with sales standards. Proper preparation and submission of these specific documents streamline the inspection process and enhance accuracy in both insurance and dealer evaluations.

Costs: Insurance Inspection vs Dealer Inspection

Insurance inspections typically focus on verifying vehicle condition for policy underwriting and claims, often costing between $50 to $150 depending on the provider and region. Dealer inspections are more comprehensive, aimed at confirming vehicle status before a sale or trade-in, with costs ranging from $100 to $300 due to detailed diagnostics and service checks. Understanding these cost differences helps vehicle owners choose the appropriate inspection type for their needs and budget.

Inspection Criteria: What Do They Check?

Insurance inspections primarily focus on verifying the vehicle's condition, mileage, and identifying any pre-existing damage to assess risk and determine premiums. Dealer inspections emphasize mechanical functionality, including engine performance, brakes, and electrical systems, to ensure the car meets resale standards. Both inspections include checking vehicle identification numbers (VIN), tires, and overall safety features, but dealer inspections tend to be more comprehensive in evaluating operational quality.

When Is an Insurance Inspection Necessary?

An insurance inspection is necessary when verifying vehicle condition for underwriting, claims processing, or risk assessment, often required after significant accidents or before issuing a policy. Dealer inspections occur primarily during trade-in or pre-sale evaluations to assess the vehicle's market value and mechanical condition. Insurance inspections prioritize damage assessment and safety compliance, while dealer inspections focus on resale readiness and cosmetic condition.

Benefits and Drawbacks of Each Inspection Type

Insurance inspection provides a thorough assessment to verify vehicle condition for accurate policy underwriting and claim processing, offering financial protection but often involving strict scrutiny that may delay approval. Dealer inspection focuses on evaluating a vehicle's market readiness and quality for sale, which enhances buyer confidence and resale value but may overlook issues relevant to insurance claims. Choosing between insurance and dealer inspection depends on whether financial risk mitigation or market-oriented validation is the primary concern.

Choosing the Right Inspection for Your Vehicle

Insurance inspections focus on verifying vehicle condition for policy underwriting and claim accuracy, ensuring coverage matches the car's true state. Dealer inspections prioritize assessing vehicle value, identifying needed repairs, and confirming condition to support sales or trade-ins. Selecting the right inspection depends on your goal: insurance protection requires detailed condition reports, while dealer inspections emphasize market readiness and repair status.

Insurance Inspection vs Dealer Inspection Infographic

cardiffo.com

cardiffo.com