Understanding the difference between coverage limit and deductible is crucial for choosing the right pet warranty. Coverage limit refers to the maximum amount the warranty will pay for eligible veterinary expenses, while the deductible is the fixed amount pet owners must pay out-of-pocket before the warranty coverage begins. Opting for a higher deductible can lower monthly premiums, but pet owners should carefully compare coverage limits to ensure adequate financial protection for unexpected vet bills.

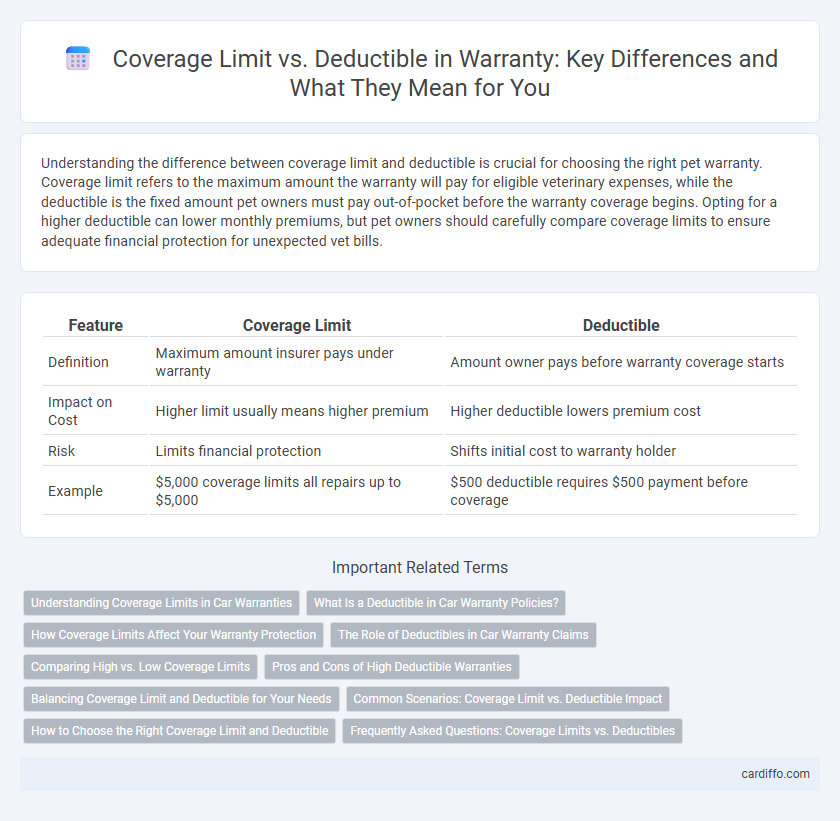

Table of Comparison

| Feature | Coverage Limit | Deductible |

|---|---|---|

| Definition | Maximum amount insurer pays under warranty | Amount owner pays before warranty coverage starts |

| Impact on Cost | Higher limit usually means higher premium | Higher deductible lowers premium cost |

| Risk | Limits financial protection | Shifts initial cost to warranty holder |

| Example | $5,000 coverage limits all repairs up to $5,000 | $500 deductible requires $500 payment before coverage |

Understanding Coverage Limits in Car Warranties

Coverage limits in car warranties define the maximum amount the warranty provider will pay for repairs or replacements under the policy, protecting both the vehicle owner and the company from excessive costs. These limits vary by warranty type, such as bumper-to-bumper or powertrain warranties, and often exclude wear-and-tear items. Understanding coverage limits is crucial to avoid unexpected expenses, especially when repair costs exceed the deductible but remain within the maximum payout.

What Is a Deductible in Car Warranty Policies?

A deductible in car warranty policies is the fixed amount a vehicle owner must pay out-of-pocket before the warranty coverage takes effect. It directly impacts the overall cost of repairs, as a higher deductible typically results in lower warranty premiums but increased upfront expenses. Understanding the deductible versus coverage limit helps owners balance immediate repair costs with potential long-term benefits within their warranty terms.

How Coverage Limits Affect Your Warranty Protection

Coverage limits define the maximum amount your warranty will pay for repairs or replacements, directly impacting the extent of your protection. When the cost of a repair exceeds this limit, you are responsible for the remaining expenses, which can lead to significant out-of-pocket costs. Understanding coverage limits is crucial to ensure your warranty provides adequate financial protection against potential damages or malfunctions.

The Role of Deductibles in Car Warranty Claims

Deductibles in car warranty claims represent the fixed amount a vehicle owner must pay out-of-pocket before the warranty coverage applies, directly influencing claim costs and repair accessibility. A higher deductible often results in lower premium costs but increases immediate expenses during repairs, impacting overall financial planning for vehicle maintenance. Understanding the balance between coverage limits and deductibles is crucial for optimizing warranty protection and managing unexpected automotive repair expenses effectively.

Comparing High vs. Low Coverage Limits

High coverage limits in warranties provide extensive protection, reducing out-of-pocket expenses for repairs or replacements, but often come with higher premium costs. Low coverage limits may keep initial costs manageable, yet they increase financial risk by capping the amount reimbursed, which can lead to substantial expenses beyond the deductible. Balancing deductible amounts with coverage limits is essential to optimize warranty value, ensuring adequate protection without excessive upfront payments.

Pros and Cons of High Deductible Warranties

High deductible warranties lower monthly premiums by requiring larger out-of-pocket payments during repairs or replacements, making them cost-effective for owners who rarely need service. However, the increased upfront expense can deter claims for minor issues, potentially leading to higher long-term costs if significant problems arise. Choosing a high deductible warranty balances immediate savings against the risk of substantial expenses when coverage is utilized.

Balancing Coverage Limit and Deductible for Your Needs

Balancing coverage limit and deductible is essential for tailoring warranty protection to your financial situation and risk tolerance. Selecting a higher coverage limit provides more extensive protection but usually comes with increased premiums, whereas a higher deductible lowers costs upfront but requires more out-of-pocket expenses when claims occur. Analyzing product value, usage frequency, and potential repair costs helps determine the optimal combination that maximizes security while minimizing unexpected expenses.

Common Scenarios: Coverage Limit vs. Deductible Impact

In common warranty scenarios, the coverage limit determines the maximum amount the warranty will pay for repairs or replacements, while the deductible is the out-of-pocket cost the owner must pay before coverage applies. High coverage limits protect against extensive or multiple repairs, whereas high deductibles can reduce the initial warranty cost but increase immediate expenses during claims. Understanding the balance between coverage limits and deductibles is crucial for choosing a warranty that aligns with potential repair costs and financial risk tolerance.

How to Choose the Right Coverage Limit and Deductible

Choosing the right coverage limit involves assessing the maximum amount you are willing to pay for repairs or replacements, ensuring it aligns with the value and importance of your covered item. Select a deductible that balances affordability and risk tolerance, as a higher deductible lowers your premium but increases out-of-pocket expenses during claims. Evaluating your financial capacity and the likelihood of claims helps determine the optimal combination for effective and economical warranty protection.

Frequently Asked Questions: Coverage Limits vs. Deductibles

Coverage limits define the maximum amount an insurance policy will pay for a covered claim, while deductibles represent the out-of-pocket expense the policyholder must pay before the insurer covers the remaining costs. Common questions often address how choosing higher deductibles can lower premiums but increase upfront costs during a claim, and how coverage limits impact the total financial protection offered by the warranty. Policyholders should evaluate both factors to balance monthly costs with potential expenses in the event of damage or repair.

Coverage Limit vs Deductible Infographic

cardiffo.com

cardiffo.com