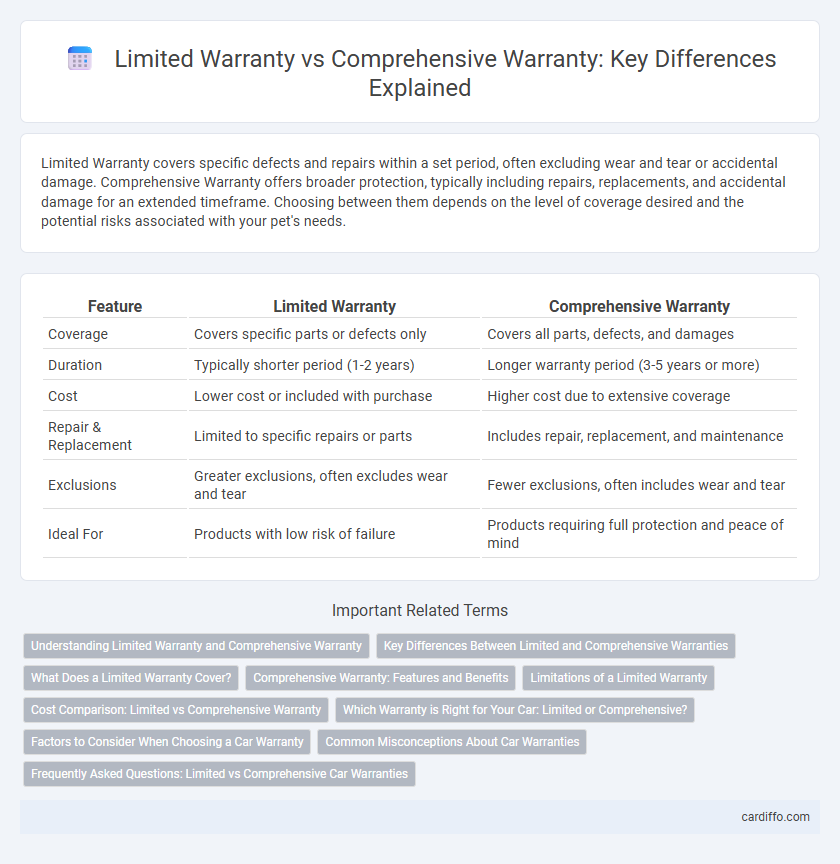

Limited Warranty covers specific defects and repairs within a set period, often excluding wear and tear or accidental damage. Comprehensive Warranty offers broader protection, typically including repairs, replacements, and accidental damage for an extended timeframe. Choosing between them depends on the level of coverage desired and the potential risks associated with your pet's needs.

Table of Comparison

| Feature | Limited Warranty | Comprehensive Warranty |

|---|---|---|

| Coverage | Covers specific parts or defects only | Covers all parts, defects, and damages |

| Duration | Typically shorter period (1-2 years) | Longer warranty period (3-5 years or more) |

| Cost | Lower cost or included with purchase | Higher cost due to extensive coverage |

| Repair & Replacement | Limited to specific repairs or parts | Includes repair, replacement, and maintenance |

| Exclusions | Greater exclusions, often excludes wear and tear | Fewer exclusions, often includes wear and tear |

| Ideal For | Products with low risk of failure | Products requiring full protection and peace of mind |

Understanding Limited Warranty and Comprehensive Warranty

Limited Warranty covers specific parts or defects for a defined period, often excluding accidental damage or wear and tear. Comprehensive Warranty offers broader protection, including repairs or replacements for a wider range of issues such as mechanical failures and accidental damage. Understanding the scope, duration, and exclusions of each warranty type ensures informed decisions on product protection.

Key Differences Between Limited and Comprehensive Warranties

Limited warranties typically cover specific parts or defects for a set period, often excluding wear and tear or accidental damage, while comprehensive warranties provide broader protection that includes multiple components and potential repairs. Comprehensive warranties often extend coverage beyond the standard time frame and may include services such as labor costs, maintenance, and full replacements. Understanding these distinctions helps consumers choose the appropriate warranty based on the level of protection and potential repair needs.

What Does a Limited Warranty Cover?

A Limited Warranty typically covers specific parts or defects in materials and workmanship for a defined period, excluding incidental or consequential damages. It often requires the consumer to meet certain conditions such as proper maintenance and use to remain valid. Compared to Comprehensive Warranties, it offers narrower protection, focusing on essential components rather than all-encompassing repairs or replacements.

Comprehensive Warranty: Features and Benefits

Comprehensive Warranty provides extensive coverage for a wide range of repairs and replacements, including parts, labor, and accidental damage. It offers peace of mind by covering unexpected issues beyond standard manufacturer defects, often with longer duration and fewer exclusions compared to Limited Warranty. Consumers benefit from reduced out-of-pocket expenses and enhanced product protection, making Comprehensive Warranty a valuable investment for high-value or frequently used items.

Limitations of a Limited Warranty

A Limited Warranty restricts coverage to specific components, defects, or repair types, often excluding wear and tear or accidental damage. It usually requires the owner to cover certain costs such as labor or shipping fees, which can increase out-of-pocket expenses. Unlike a Comprehensive Warranty that provides broader protection, the limitations in a Limited Warranty can result in less financial security and more stringent claim conditions.

Cost Comparison: Limited vs Comprehensive Warranty

Limited warranties generally incur lower upfront costs but may result in higher out-of-pocket expenses for repairs not covered, while comprehensive warranties typically have higher premiums yet offer broader protection, reducing unexpected repair costs. Consumers prioritizing budget-friendly options often choose limited warranty for essential coverage, whereas comprehensive warranty appeals to those seeking extensive coverage and predictable expenses. Cost efficiency depends on usage patterns, product type, and risk tolerance for potential repair costs outside limited warranty terms.

Which Warranty is Right for Your Car: Limited or Comprehensive?

Choosing the right warranty for your car depends on coverage needs and budget. A limited warranty typically covers specific components like the powertrain for a set period, offering basic protection against major repairs. Comprehensive warranty, however, provides broader coverage including electrical systems, air conditioning, and even small parts, ideal for drivers seeking extensive protection and peace of mind.

Factors to Consider When Choosing a Car Warranty

When choosing a car warranty, consider coverage scope, as limited warranties typically cover only specific components like the powertrain, while comprehensive warranties extend to most parts and repairs. Evaluate the warranty duration and mileage limits, since longer terms with higher mileage allowances offer prolonged protection but may cost more upfront. Assess deductibles and claim process ease to balance affordability with convenience and ensure the warranty aligns with your driving habits, vehicle age, and budget.

Common Misconceptions About Car Warranties

Many car buyers mistakenly believe a limited warranty covers all repair costs, but it typically only includes specific parts and labor for a set duration. Comprehensive warranties offer broader protection, covering a wider range of components and potential issues. Understanding the scope and exclusions of each warranty type is crucial for accurate expectations and long-term vehicle maintenance planning.

Frequently Asked Questions: Limited vs Comprehensive Car Warranties

Limited warranties cover specific parts and repairs for a set period or mileage, often excluding wear-and-tear or accidental damage, while comprehensive warranties provide broader protection, including most components and repair types. Consumers frequently ask whether comprehensive coverage justifies the higher cost compared to limited warranties and what expenses they might still incur under each plan. Understanding the exact terms, coverage limits, and claim processes helps buyers choose the warranty that best suits their vehicle usage and risk tolerance.

Limited Warranty vs Comprehensive Warranty Infographic

cardiffo.com

cardiffo.com