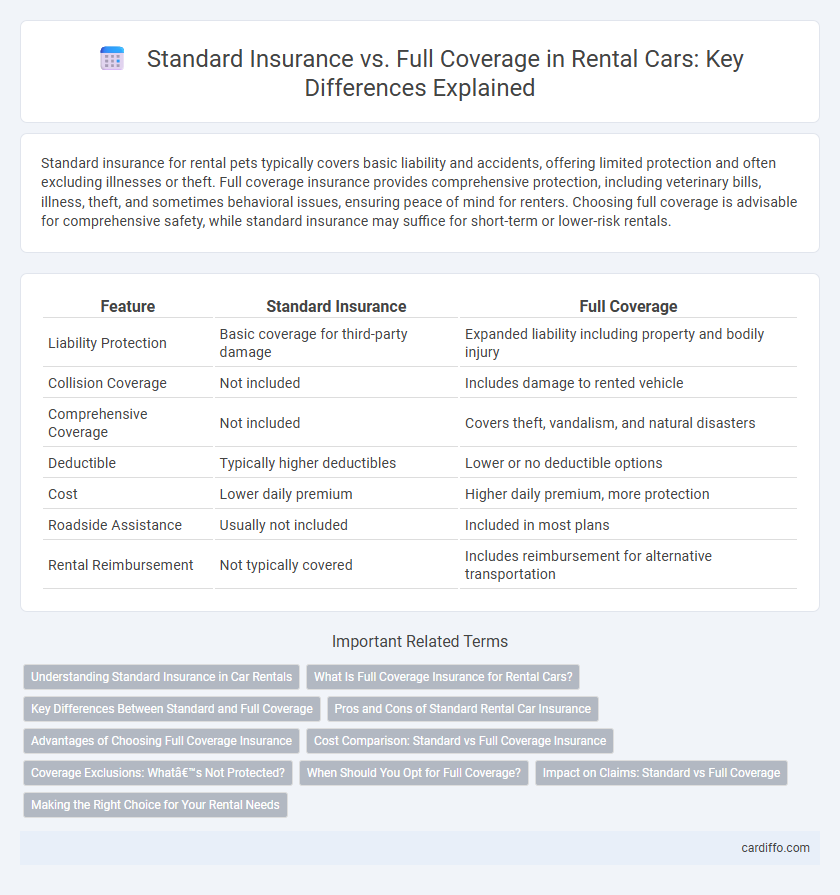

Standard insurance for rental pets typically covers basic liability and accidents, offering limited protection and often excluding illnesses or theft. Full coverage insurance provides comprehensive protection, including veterinary bills, illness, theft, and sometimes behavioral issues, ensuring peace of mind for renters. Choosing full coverage is advisable for comprehensive safety, while standard insurance may suffice for short-term or lower-risk rentals.

Table of Comparison

| Feature | Standard Insurance | Full Coverage |

|---|---|---|

| Liability Protection | Basic coverage for third-party damage | Expanded liability including property and bodily injury |

| Collision Coverage | Not included | Includes damage to rented vehicle |

| Comprehensive Coverage | Not included | Covers theft, vandalism, and natural disasters |

| Deductible | Typically higher deductibles | Lower or no deductible options |

| Cost | Lower daily premium | Higher daily premium, more protection |

| Roadside Assistance | Usually not included | Included in most plans |

| Rental Reimbursement | Not typically covered | Includes reimbursement for alternative transportation |

Understanding Standard Insurance in Car Rentals

Standard insurance in car rentals typically includes basic liability coverage that protects the renter against third-party bodily injury and property damage. This coverage often meets the minimum legal requirements but excludes protection for the rental vehicle itself, leaving renters responsible for repair or replacement costs. Understanding the limitations of standard insurance is crucial for renters to assess whether purchasing additional full coverage or collision damage waiver is necessary for comprehensive protection.

What Is Full Coverage Insurance for Rental Cars?

Full coverage insurance for rental cars typically combines liability, collision, and comprehensive protection, ensuring renters are shielded from costs related to accidents, theft, or damage. Standard insurance often includes only basic liability coverage, which may leave renters financially responsible for repair expenses or loss of the vehicle. Opting for full coverage provides peace of mind by covering a wider range of potential risks during the rental period.

Key Differences Between Standard and Full Coverage

Standard insurance typically includes liability coverage, protecting against damages or injuries you cause to others during a rental period, while full coverage extends protection by also covering collision, comprehensive, and sometimes personal injury. Key differences lie in the extent of risk mitigation--standard insurance covers basic incidents, whereas full coverage guards against a broader range of potential damages, including theft and vehicle damage. Renters opting for full coverage benefit from greater financial security and peace of mind, especially in high-risk environments.

Pros and Cons of Standard Rental Car Insurance

Standard rental car insurance typically covers basic liability and collision damage protection, offering essential financial security with lower daily premiums. However, its limitations may expose renters to out-of-pocket costs for theft, personal injuries, or damage beyond policy limits, reducing overall coverage confidence. Choosing standard insurance suits budget-conscious renters willing to accept moderate risk in exchange for cost savings during short-term vehicle rentals.

Advantages of Choosing Full Coverage Insurance

Full coverage insurance offers comprehensive protection by covering both liability and physical damage, significantly reducing out-of-pocket expenses after an accident. It provides peace of mind with benefits such as collision, comprehensive, and uninsured motorist coverage, which are not included in standard insurance policies. Choosing full coverage rental insurance ensures maximum financial security and faster claim processing in case of damages or theft.

Cost Comparison: Standard vs Full Coverage Insurance

Standard insurance for rental properties typically covers basic protection such as fire, theft, and certain liabilities, resulting in lower monthly premiums ranging from $15 to $30. Full coverage insurance includes comprehensive protection like natural disasters, vandalism, and loss of rental income, with premiums often doubling or tripling the cost of standard plans, averaging $40 to $90 per month. Landlords must balance the higher expense of full coverage against the potential risk exposure and financial impact of unforeseen damages or tenant claims.

Coverage Exclusions: What’s Not Protected?

Standard rental insurance typically excludes coverage for vehicle damage caused by reckless driving, off-road use, or unauthorized drivers, leaving renters financially vulnerable in these scenarios. Full coverage rental insurance extends protection by including collisions, comprehensive damages, theft, and liability, but still excludes intentional damage and use in prohibited activities. Renters should carefully review policy exclusions to avoid unexpected out-of-pocket expenses during the rental period.

When Should You Opt for Full Coverage?

Opt for full coverage insurance on rental vehicles when driving in high-risk areas or for extended periods to ensure protection against theft, damage, and liability. Full coverage is essential for renters who do not have personal auto insurance or whose existing policy offers limited rental protection. Choosing full coverage minimizes out-of-pocket expenses in case of accidents, providing comprehensive financial security during the rental period.

Impact on Claims: Standard vs Full Coverage

Standard insurance typically covers basic liabilities such as property damage and bodily injury, limiting the scope and amount of claims that can be filed. Full coverage extends protection to include collision, comprehensive damage, and often uninsured motorist claims, significantly increasing the potential claim payout. Renters with full coverage experience fewer out-of-pocket expenses when filing claims, reducing financial risk compared to those with only standard insurance.

Making the Right Choice for Your Rental Needs

Choosing between standard insurance and full coverage for your rental depends on the level of protection needed and budget considerations. Standard insurance typically covers basic liabilities and damages, while full coverage offers comprehensive protection, including collision, theft, and personal injury. Evaluating your rental duration, destination risks, and financial exposure is crucial to making the right insurance choice for your specific rental needs.

Standard insurance vs full coverage Infographic

cardiffo.com

cardiffo.com