Choosing an insured rental pet provides peace of mind by covering potential damages or injuries, ensuring financial protection during the rental period. Non-insured rentals may seem cost-effective initially but carry significant risks, including unexpected expenses for veterinary care or property damage. Prioritizing insured options safeguards both the renter and the pet owner from unforeseen liabilities.

Table of Comparison

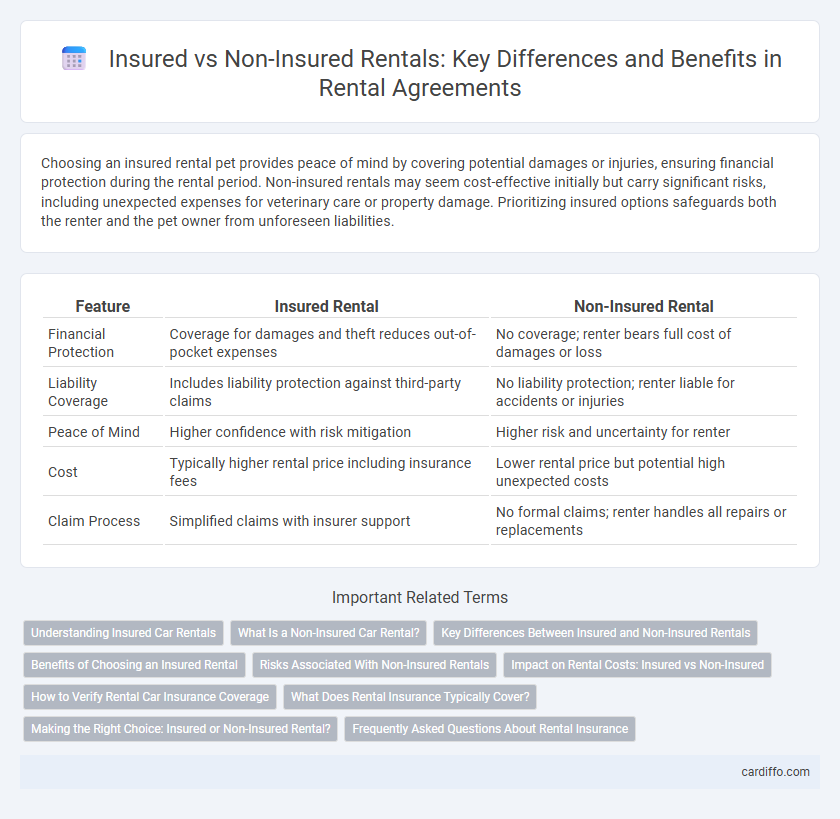

| Feature | Insured Rental | Non-Insured Rental |

|---|---|---|

| Financial Protection | Coverage for damages and theft reduces out-of-pocket expenses | No coverage; renter bears full cost of damages or loss |

| Liability Coverage | Includes liability protection against third-party claims | No liability protection; renter liable for accidents or injuries |

| Peace of Mind | Higher confidence with risk mitigation | Higher risk and uncertainty for renter |

| Cost | Typically higher rental price including insurance fees | Lower rental price but potential high unexpected costs |

| Claim Process | Simplified claims with insurer support | No formal claims; renter handles all repairs or replacements |

Understanding Insured Car Rentals

Insured car rentals provide essential protection against financial liability from accidents or damages, significantly reducing renter risk compared to non-insured rentals. Most insured rentals include comprehensive coverage such as collision damage waiver (CDW), liability insurance, and theft protection, offering peace of mind for drivers. Understanding policy details and coverage limits helps renters avoid unexpected expenses and ensures compliance with rental agreements.

What Is a Non-Insured Car Rental?

A non-insured car rental refers to renting a vehicle without purchasing additional insurance coverage from the rental company or relying solely on the driver's personal insurance policy, which may not fully cover potential damages or liabilities. Renters without insurance protection face increased financial risks if accidents, theft, or damages occur during the rental period. Understanding the limitations and potential out-of-pocket expenses associated with non-insured car rentals is essential for making informed decisions when renting a vehicle.

Key Differences Between Insured and Non-Insured Rentals

Insured rentals provide financial protection against damages, theft, and liability claims, reducing the renter's risk exposure, while non-insured rentals leave the renter fully responsible for any losses or damage incurred. Insured rentals often require proof of insurance or include coverage in the rental agreement, offering peace of mind and potential cost savings on out-of-pocket expenses. Non-insured rentals may offer lower upfront costs but pose a higher financial risk if accidents or damages occur during the rental period.

Benefits of Choosing an Insured Rental

Choosing an insured rental provides protection against unforeseen damages and liabilities, reducing financial risk for renters and owners alike. Insured rentals often include coverage for property damage, theft, and personal injury, ensuring peace of mind throughout the rental period. This added security enhances trust and reliability, making insured rentals a safer and more responsible choice.

Risks Associated With Non-Insured Rentals

Non-insured rentals expose renters and property owners to significant financial risks, including liability for damages, theft, or accidents occurring during the rental period. Without insurance coverage, renters may face unexpected out-of-pocket expenses, while property owners risk costly repairs and potential legal claims. Insured rentals mitigate these risks by providing financial protection and ensuring compliance with liability requirements.

Impact on Rental Costs: Insured vs Non-Insured

Insured rentals typically incur higher upfront costs due to insurance premiums, but these expenses provide financial protection against damages or liabilities, potentially saving renters from significant out-of-pocket expenses. Non-insured rentals might offer lower initial prices, but renters assume full responsibility for any damages, leading to unpredictable and possibly substantial costs. Factoring insurance into rental agreements often results in more stable and predictable overall rental expenses.

How to Verify Rental Car Insurance Coverage

To verify rental car insurance coverage, review the policy details provided by your personal auto insurer or credit card company, confirming if it extends to rental vehicles. Contact the rental agency to request proof of insurance and check for coverage limitations, such as vehicle type or geographic restrictions. Always compare these details against your own insurance documentation to ensure comprehensive protection before finalizing the rental agreement.

What Does Rental Insurance Typically Cover?

Rental insurance typically covers personal property protection against theft, fire, and water damage, ensuring tenants' belongings are financially safeguarded. It also provides liability coverage for accidents or injuries occurring within the rental property, protecting renters from potential lawsuits. Some policies include additional living expenses coverage if the rental becomes uninhabitable due to a covered peril, facilitating temporary housing costs.

Making the Right Choice: Insured or Non-Insured Rental?

Choosing between insured and non-insured rental options significantly impacts financial risk and liability coverage during the rental period. Insured rentals provide protection against damages, theft, and accidents, often reducing out-of-pocket expenses and ensuring peace of mind, while non-insured rentals place full responsibility for damages or losses on the renter. Evaluating factors like rental cost, duration, asset value, and personal risk tolerance helps determine the most cost-effective and secure choice for your specific rental needs.

Frequently Asked Questions About Rental Insurance

Rental insurance protects tenants from financial loss due to property damage, theft, or liability claims during the rental period, offering peace of mind that non-insured rentals cannot provide. FAQs often address coverage limits, the cost of premiums, and what types of damages or incidents are excluded, clarifying common concerns about policy effectiveness and necessity. Insured rentals typically require proof of insurance upon lease signing, emphasizing the importance of understanding rental insurance benefits and requirements before committing to a lease.

Insured rental vs non-insured rental Infographic

cardiffo.com

cardiffo.com