Rent-to-own pet programs offer an alternative to traditional rentals by allowing tenants to gradually build ownership of the pet through monthly payments. Unlike traditional rentals, which require full upfront payments and return of the pet at the end of the lease, rent-to-own provides flexibility and the potential for permanent pet ownership. This model benefits renters seeking a long-term commitment without immediate financial burden.

Table of Comparison

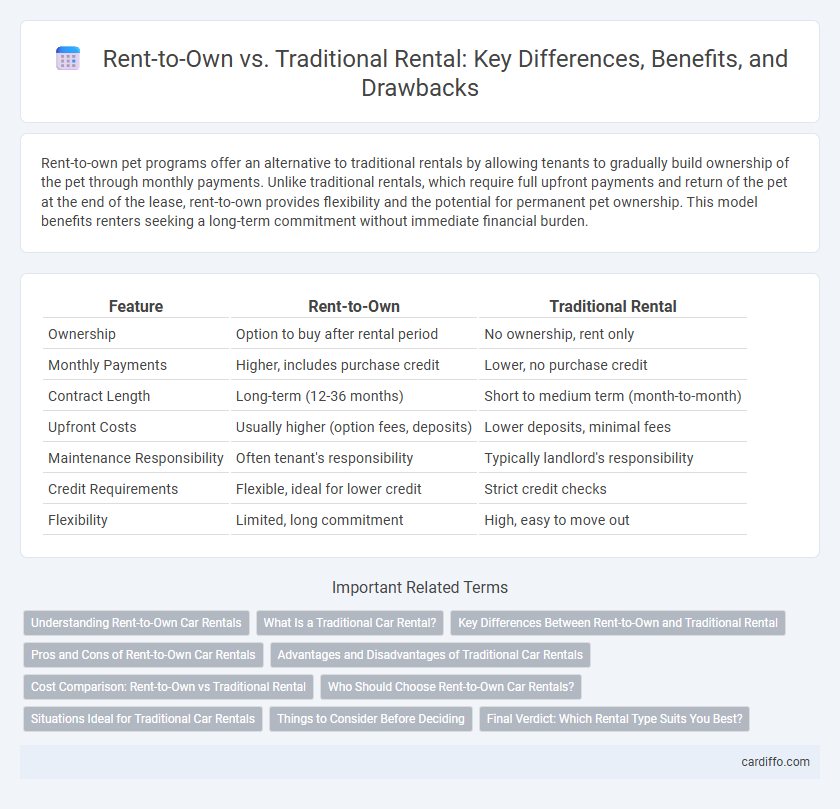

| Feature | Rent-to-Own | Traditional Rental |

|---|---|---|

| Ownership | Option to buy after rental period | No ownership, rent only |

| Monthly Payments | Higher, includes purchase credit | Lower, no purchase credit |

| Contract Length | Long-term (12-36 months) | Short to medium term (month-to-month) |

| Upfront Costs | Usually higher (option fees, deposits) | Lower deposits, minimal fees |

| Maintenance Responsibility | Often tenant's responsibility | Typically landlord's responsibility |

| Credit Requirements | Flexible, ideal for lower credit | Strict credit checks |

| Flexibility | Limited, long commitment | High, easy to move out |

Understanding Rent-to-Own Car Rentals

Rent-to-own car rentals allow customers to gradually build equity in the vehicle by applying rental payments towards eventual ownership, contrasting with traditional rentals where payments solely cover temporary use with no ownership benefits. This model provides flexibility for individuals with limited credit or budget constraints, combining short-term rental convenience with long-term vehicle acquisition goals. Understanding the contractual terms and total cost of rent-to-own agreements is essential to evaluate financial advantages over conventional rental options.

What Is a Traditional Car Rental?

Traditional car rental involves paying a fixed daily or weekly fee to use a vehicle for a short-term period, typically without ownership options. Customers select from a range of models and return the car at the end of the rental term, incurring any additional charges for mileage or damages. Rental companies such as Hertz, Enterprise, and Avis dominate this market, emphasizing convenience and flexibility without long-term commitments.

Key Differences Between Rent-to-Own and Traditional Rental

Rent-to-own agreements allow tenants to apply a portion of their monthly payments toward homeownership, unlike traditional rentals where payments only cover temporary occupancy. Rent-to-own contracts typically span several years and include an option to purchase the property, whereas traditional rentals have fixed lease terms with no purchase option. This model benefits those aiming for eventual ownership with flexible initial financial commitments, while traditional rentals favor short-term living without equity accumulation.

Pros and Cons of Rent-to-Own Car Rentals

Rent-to-own car rentals offer flexibility with the option to purchase the vehicle after a rental period, appealing to customers seeking eventual ownership without immediate financing. Pros include building equity and avoiding long-term commitments typical of traditional leasing, while cons involve higher overall costs and potential vehicle condition concerns due to prior use. Traditional car rentals provide short-term usage without ownership benefits, generally featuring lower rates but no opportunity to accumulate value from the payments.

Advantages and Disadvantages of Traditional Car Rentals

Traditional car rentals offer flexibility with no long-term commitment, making them ideal for short trips or occasional use. However, they often come with higher daily rates, mileage limits, and potential extra fees for insurance and fuel. Unlike rent-to-own agreements, traditional rentals do not build equity or ownership over time, which can be a disadvantage for long-term drivers.

Cost Comparison: Rent-to-Own vs Traditional Rental

Rent-to-own agreements often involve higher monthly payments compared to traditional rentals, as a portion of each payment builds equity toward eventual ownership. Traditional rentals typically require lower upfront and monthly costs but do not contribute to property ownership, making them more cost-effective in the short term. Over time, rent-to-own can be more expensive due to accumulated premiums and fees, whereas traditional rentals offer predictable expenses without property investment benefits.

Who Should Choose Rent-to-Own Car Rentals?

Rent-to-own car rentals suit individuals seeking vehicle ownership without immediate full payment, ideal for those with limited credit or fluctuating income. This option benefits renters aiming to build credit history or save gradually while driving the car they intend to own. Traditional rental remains preferable for short-term needs or those avoiding long-term financial commitments.

Situations Ideal for Traditional Car Rentals

Traditional car rentals are ideal for short-term needs such as vacations, business trips, or temporary transportation during vehicle repairs. They offer flexibility without long-term commitments, allowing renters to choose different vehicles for each rental period. This option suits individuals who do not plan to own a car or require temporary transportation solutions.

Things to Consider Before Deciding

Evaluating rent-to-own versus traditional rental requires careful consideration of financial commitments, such as upfront costs, monthly payments, and long-term equity potential. Rent-to-own agreements often involve higher overall expenses but can lead to property ownership, while traditional rentals provide flexibility without equity accumulation. Understanding contract terms, maintenance responsibilities, and future market conditions is essential to making an informed decision.

Final Verdict: Which Rental Type Suits You Best?

Rent-to-own offers a pathway to homeownership by applying rental payments toward purchase, making it ideal for tenants aiming to build equity over time. Traditional rental provides flexibility with lower upfront costs, suitable for those prioritizing short-term living without long-term commitment. Choosing between rent-to-own and traditional rental depends on your financial goals and housing stability preferences.

Rent-to-own vs traditional rental Infographic

cardiffo.com

cardiffo.com