Insurance-included pet rental options provide peace of mind by covering unexpected veterinary expenses, reducing financial risks during the rental period. Self-insured rentals may offer lower upfront costs but require renters to manage potential medical bills independently, increasing overall liability. Choosing insurance-included rentals ensures comprehensive protection and simplifies the rental experience for pet owners.

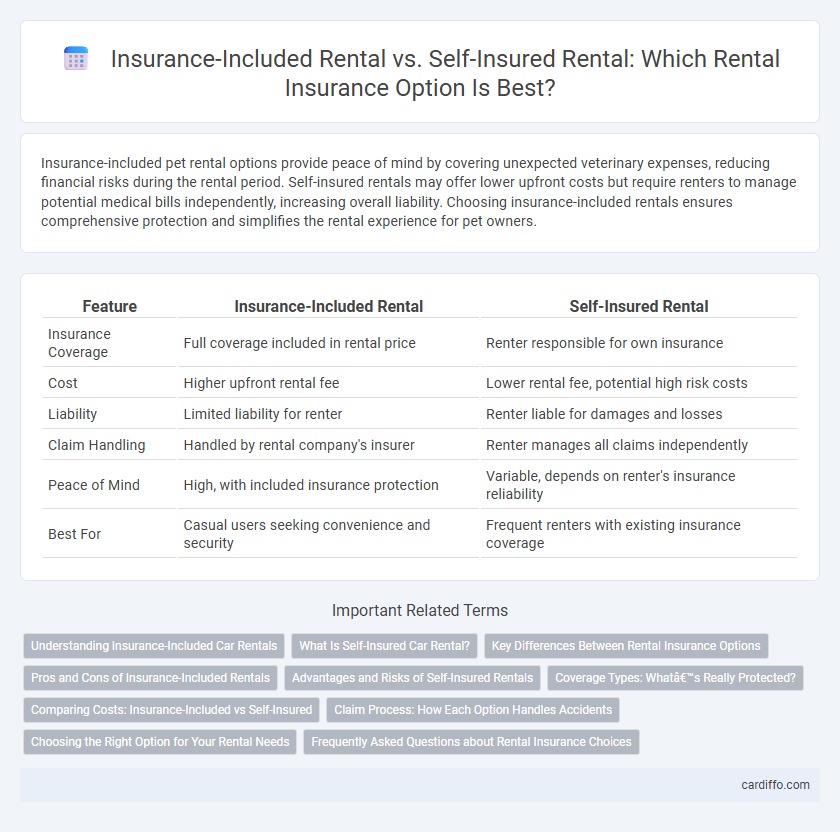

Table of Comparison

| Feature | Insurance-Included Rental | Self-Insured Rental |

|---|---|---|

| Insurance Coverage | Full coverage included in rental price | Renter responsible for own insurance |

| Cost | Higher upfront rental fee | Lower rental fee, potential high risk costs |

| Liability | Limited liability for renter | Renter liable for damages and losses |

| Claim Handling | Handled by rental company's insurer | Renter manages all claims independently |

| Peace of Mind | High, with included insurance protection | Variable, depends on renter's insurance reliability |

| Best For | Casual users seeking convenience and security | Frequent renters with existing insurance coverage |

Understanding Insurance-Included Car Rentals

Insurance-included car rentals provide comprehensive coverage that simplifies the rental process by protecting against damage, theft, and liability without requiring separate insurance purchases. This option eliminates the risk of unexpected out-of-pocket expenses and reduces the complexity of dealing with multiple insurance policies. Choosing insurance-included rentals ensures peace of mind and seamless claims handling during the rental period.

What Is Self-Insured Car Rental?

Self-insured car rental refers to a rental arrangement where the renter assumes financial responsibility for any damages or losses instead of relying on insurance coverage provided by the rental company. This option often requires renters to have their own comprehensive auto insurance or credit card coverage that includes rental vehicles, reducing the need for purchasing additional insurance from the rental agency. Self-insured rentals can lower upfront costs but increase risk, making it essential for renters to verify their existing insurance policies before opting out of rental insurance.

Key Differences Between Rental Insurance Options

Rental insurance-included options provide comprehensive coverage that protects against theft, damage, and liability, minimizing out-of-pocket expenses during the rental period. Self-insured rentals require renters to rely on their personal insurance policies or accept financial responsibility for potential losses, often leading to higher risk exposure. The primary differences lie in coverage scope, cost predictability, and risk management, influencing the renter's overall security and peace of mind.

Pros and Cons of Insurance-Included Rentals

Insurance-included rentals offer seamless protection with coverage for damages, theft, and liability, reducing the renter's financial risk and simplifying the rental process by bundling insurance costs into one payment. They provide peace of mind and ease of claim handling but often come with higher upfront rental fees and less flexibility in choosing coverage options compared to self-insured rentals. Renters should weigh the convenience and comprehensive protection against increased costs and potential overlap with personal insurance policies.

Advantages and Risks of Self-Insured Rentals

Self-insured rentals offer lower upfront costs and greater control over claims management, reducing dependency on third-party insurers while allowing customized coverage tailored to specific rental operations. However, the risks include potential financial exposure to significant damages, administrative burdens of claim handling, and the need for sufficient capital reserves to cover unexpected losses. Effective risk assessment and strong financial backing are essential to mitigate these challenges and ensure sustainable self-insured rental practices.

Coverage Types: What’s Really Protected?

Insurance-included rentals typically offer comprehensive coverage including collision, liability, and theft protection, minimizing out-of-pocket expenses during accidents or damages. Self-insured rentals rely on the renter's personal insurance policy, which may have gaps in coverage such as limited liability or no protection for loss of use and administrative fees. Understanding the specific coverage types and exclusions in each option is essential to avoid unexpected financial burdens during the rental period.

Comparing Costs: Insurance-Included vs Self-Insured

Insurance-included rentals generally incur higher upfront costs due to included comprehensive coverage, reducing out-of-pocket expenses during claims. Self-insured rentals often present lower initial fees but expose renters to significant financial risk if damages or losses occur, potentially resulting in expensive repairs or liability payments. Evaluating total cost of ownership by considering insurance premiums, deductibles, and risk tolerance is essential for optimizing budget efficiency in rental agreements.

Claim Process: How Each Option Handles Accidents

Insurance-included rentals simplify the claim process by providing direct support and coverage through the rental company's insurance provider, minimizing out-of-pocket expenses and administrative hassle for the renter. Self-insured rentals require renters to manage claims independently, often involving personal insurance policies, which can lead to longer resolution times and potential coverage gaps. Understanding the claim handling differences is crucial for renters seeking seamless accident support and financial protection.

Choosing the Right Option for Your Rental Needs

Selecting between insurance-included rental and self-insured rental depends on the level of risk tolerance and budget constraints. Insurance-included rentals offer comprehensive coverage, simplifying claims and minimizing out-of-pocket expenses in case of damage or theft. Self-insured rentals may reduce upfront costs but require renters to assume full financial responsibility for potential losses, making them suitable for those with sufficient reserve funds and risk management strategies.

Frequently Asked Questions about Rental Insurance Choices

Choosing between insurance-included rental and self-insured rental depends on coverage needs, cost efficiency, and liability protection. Insurance-included rentals offer convenience with pre-packaged coverage, eliminating the need to manage separate policies, while self-insured rentals require the renter to maintain personal insurance, potentially reducing upfront rental costs but increasing risk exposure. Common FAQs address coverage limits, claim procedures, and how damage or theft is handled under each option.

Insurance-included rental vs self-insured rental Infographic

cardiffo.com

cardiffo.com