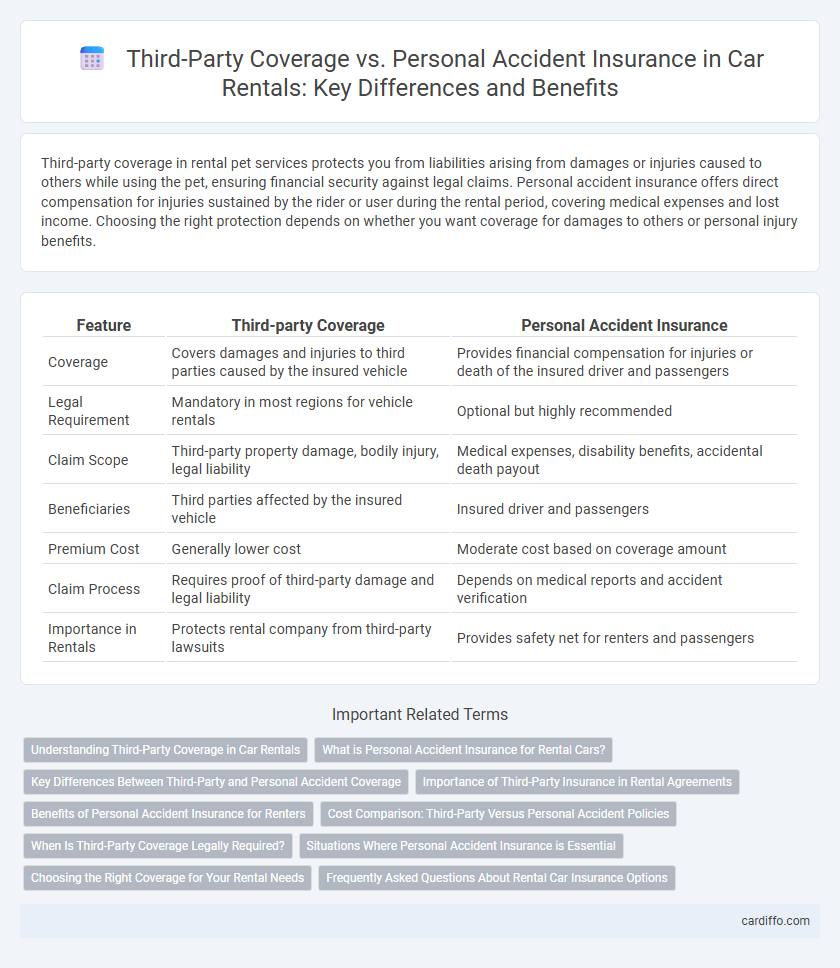

Third-party coverage in rental pet services protects you from liabilities arising from damages or injuries caused to others while using the pet, ensuring financial security against legal claims. Personal accident insurance offers direct compensation for injuries sustained by the rider or user during the rental period, covering medical expenses and lost income. Choosing the right protection depends on whether you want coverage for damages to others or personal injury benefits.

Table of Comparison

| Feature | Third-party Coverage | Personal Accident Insurance |

|---|---|---|

| Coverage | Covers damages and injuries to third parties caused by the insured vehicle | Provides financial compensation for injuries or death of the insured driver and passengers |

| Legal Requirement | Mandatory in most regions for vehicle rentals | Optional but highly recommended |

| Claim Scope | Third-party property damage, bodily injury, legal liability | Medical expenses, disability benefits, accidental death payout |

| Beneficiaries | Third parties affected by the insured vehicle | Insured driver and passengers |

| Premium Cost | Generally lower cost | Moderate cost based on coverage amount |

| Claim Process | Requires proof of third-party damage and legal liability | Depends on medical reports and accident verification |

| Importance in Rentals | Protects rental company from third-party lawsuits | Provides safety net for renters and passengers |

Understanding Third-Party Coverage in Car Rentals

Third-party coverage in car rentals protects renters against liabilities arising from bodily injury or property damage caused to others during the rental period. It covers costs such as medical expenses, legal fees, and property repair, ensuring financial protection if the renter is at fault in an accident. This coverage differs from personal accident insurance, which specifically addresses the renter's own medical expenses and accidental death benefits.

What is Personal Accident Insurance for Rental Cars?

Personal Accident Insurance for rental cars provides financial protection covering medical expenses and accidental death or injury to the driver and passengers during the rental period. It supplements third-party coverage, which only covers damages or injuries caused to others, by focusing on the insured vehicle occupants' health and safety. This insurance ensures peace of mind by mitigating personal financial risks associated with accidents while driving a rental car.

Key Differences Between Third-Party and Personal Accident Coverage

Third-party coverage in rental insurance protects against damages or injuries caused to others and their property, while personal accident insurance provides medical and financial benefits to the insured party in case of injury or death during the rental period. Third-party coverage is legally required in many regions to cover liability claims, whereas personal accident insurance is optional, focusing on the renter's own safety. Understanding these key differences helps renters choose appropriate protection based on liability risks and personal health concerns.

Importance of Third-Party Insurance in Rental Agreements

Third-party coverage is essential in rental agreements as it protects against financial liability arising from damages or injuries caused to others, ensuring compliance with legal requirements and minimizing risk. Personal accident insurance, while beneficial for covering the renter's medical expenses, does not address damage to third parties, making third-party insurance crucial for comprehensive protection. Rental companies prioritize third-party insurance to safeguard both their assets and customers from potential costly claims.

Benefits of Personal Accident Insurance for Renters

Personal Accident Insurance for renters offers crucial financial protection against unexpected injuries during the rental period, covering medical expenses and compensation for disability or death. Unlike third-party coverage, which primarily protects against damages to others or their property, personal accident insurance safeguards the renter's own health and well-being. This insurance ensures peace of mind and reduces out-of-pocket costs if accidents occur while occupying a rental property.

Cost Comparison: Third-Party Versus Personal Accident Policies

Third-party coverage typically offers lower premiums compared to personal accident insurance due to its limited scope, covering only damages to others. Personal accident insurance includes higher costs as it provides financial protection for bodily injuries sustained by the policyholder during a rental period. Evaluating the cost difference helps renters balance budget constraints with the level of personal risk protection desired.

When Is Third-Party Coverage Legally Required?

Third-party coverage is legally required in most jurisdictions to protect against liabilities arising from injuries or damages caused to other parties during rental vehicle use. Personal accident insurance, while optional, provides financial protection for the renter's own injuries but does not fulfill legal liability requirements. Compliance with mandatory third-party coverage ensures adherence to rental laws and safeguards renters from legal penalties.

Situations Where Personal Accident Insurance is Essential

Personal Accident Insurance becomes essential in rental vehicle situations involving physical injury to the driver or passengers, where third-party coverage does not provide medical benefits. This insurance covers hospital bills, disability, or death resulting from an accident during the rental period, ensuring financial protection beyond liability to others. Renters in high-risk environments or using vehicles for extended periods benefit significantly from personal accident coverage to mitigate personal health-related costs.

Choosing the Right Coverage for Your Rental Needs

When selecting rental insurance, third-party coverage protects against damages or injuries caused to others, ensuring financial liability is managed effectively, while personal accident insurance focuses on safeguarding the renter's own health by covering medical expenses resulting from accidents. Evaluating your rental duration, destination risks, and personal health considerations helps determine the optimal balance between liability protection and personal injury coverage. Prioritizing comprehensive protection tailored to your rental activities maximizes safety and minimizes unexpected out-of-pocket costs.

Frequently Asked Questions About Rental Car Insurance Options

Third-party coverage in rental car insurance protects against damages and injuries you cause to others, while personal accident insurance covers medical expenses for you and your passengers after an accident. Rental companies often require third-party coverage as a legal minimum, but personal accident insurance is optional and provides extra peace of mind. Questions frequently arise about the necessity, scope, and cost differences between these two types of insurance when renting vehicles.

Third-party Coverage vs Personal Accident Insurance Infographic

cardiffo.com

cardiffo.com