Standard insurance for rental pets covers basic veterinary expenses and liability, providing essential protection at a lower cost. Premium insurance offers comprehensive coverage, including accident, illness, and routine care, giving pet owners greater peace of mind. Choosing between standard and premium plans depends on the level of protection desired and the pet owner's budget.

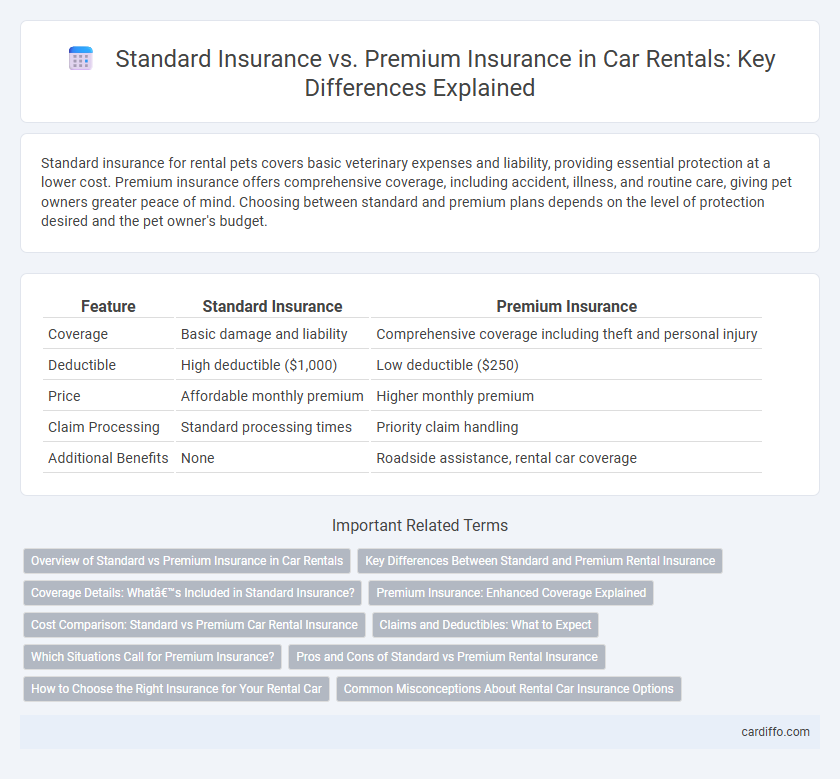

Table of Comparison

| Feature | Standard Insurance | Premium Insurance |

|---|---|---|

| Coverage | Basic damage and liability | Comprehensive coverage including theft and personal injury |

| Deductible | High deductible ($1,000) | Low deductible ($250) |

| Price | Affordable monthly premium | Higher monthly premium |

| Claim Processing | Standard processing times | Priority claim handling |

| Additional Benefits | None | Roadside assistance, rental car coverage |

Overview of Standard vs Premium Insurance in Car Rentals

Standard insurance in car rentals typically covers basic liability, collision damage waiver, and theft protection, providing essential financial protection at a lower cost. Premium insurance packages offer enhanced coverage including comprehensive protection against accidents, personal injury, roadside assistance, and higher liability limits for greater peace of mind. Choosing between standard and premium insurance depends on the renter's risk tolerance, budget, and the value of the rental vehicle.

Key Differences Between Standard and Premium Rental Insurance

Standard rental insurance covers basic risks such as fire, theft, and certain liabilities, offering limited coverage and lower deductibles. Premium rental insurance provides enhanced protection including higher coverage limits, additional perils like water damage or accidental damage, and often includes benefits such as roadside assistance or personal item protection. Policyholders opting for premium insurance receive broader financial security and customized claims support compared to standard plans.

Coverage Details: What’s Included in Standard Insurance?

Standard insurance coverage for rentals typically includes liability protection, collision damage waivers, and theft protection, ensuring basic financial security in case of accidents or loss. It usually covers damages to the rental vehicle up to a certain limit and may include medical coverage for injuries sustained during the rental period. Premium insurance expands on this by offering higher coverage limits, reduced deductibles, and additional protections like roadside assistance, rental reimbursement, and personal effects coverage.

Premium Insurance: Enhanced Coverage Explained

Premium insurance offers enhanced coverage that exceeds standard rental insurance by including protection for accidental damage, theft, and liability, often with higher coverage limits. This type of insurance typically covers a broader range of scenarios, such as roadside assistance, loss of use, and personal injury, providing renters with greater financial security. Choosing premium insurance reduces out-of-pocket expenses in complex claims and ensures more comprehensive peace of mind during the rental period.

Cost Comparison: Standard vs Premium Car Rental Insurance

Standard car rental insurance typically offers basic coverage at a lower cost, including liability protection and limited collision damage waivers. Premium insurance, priced higher, extends coverage with added benefits such as zero deductible, theft protection, and roadside assistance. Choosing between standard and premium insurance depends on balancing budget constraints with the need for comprehensive protection during the rental period.

Claims and Deductibles: What to Expect

Standard insurance for rental properties typically features lower premiums but higher deductibles, leading to increased out-of-pocket expenses when filing claims. Premium insurance offers more comprehensive coverage with lower deductibles, facilitating smoother claims processing and reduced financial burden during damages or losses. Renters should weigh the balance between upfront cost and potential claim expenses when choosing between standard and premium insurance plans.

Which Situations Call for Premium Insurance?

Premium insurance is essential in high-risk rental situations, such as luxury vehicle rentals, long-term leases, or rentals in areas with high theft or accident rates. Renters seeking extensive coverage for collision, liability, and comprehensive protection benefit from opting for premium insurance plans. This level of insurance also suits individuals who require peace of mind against costly damages and potential legal claims during the rental period.

Pros and Cons of Standard vs Premium Rental Insurance

Standard rental insurance offers basic coverage including liability, collision, and theft protection at a lower cost, making it suitable for budget-conscious renters. Premium rental insurance provides comprehensive coverage such as roadside assistance, zero deductible options, and higher liability limits, ensuring enhanced protection but at a higher premium. Choosing between standard and premium rental insurance depends on factors like risk tolerance, vehicle value, and desired coverage scope.

How to Choose the Right Insurance for Your Rental Car

When selecting the right insurance for your rental car, evaluate coverage limits, deductibles, and specific protections such as collision damage waiver or personal accident insurance. Standard insurance typically offers basic liability and damage protection, suitable for short-term or low-risk rentals, while premium insurance provides comprehensive coverage including theft protection and roadside assistance. Assess your personal risk tolerance, rental duration, and any existing personal auto insurance policies to determine whether the broader protection of premium insurance justifies the added cost.

Common Misconceptions About Rental Car Insurance Options

Common misconceptions about rental car insurance options include the belief that standard insurance coverage always provides sufficient protection, which often leads renters to underestimate potential liability and damage costs. Premium insurance, while costing more upfront, typically offers broader coverage such as zero deductible, theft protection, and coverage for personal belongings, reducing out-of-pocket expenses during claims. Renters should carefully review policy details and compare coverage limits, exclusions, and claim procedures to avoid unexpected expenses and ensure appropriate protection.

Standard insurance vs premium insurance Infographic

cardiffo.com

cardiffo.com