Insurance-included rental offers comprehensive coverage that protects both the renter and the pet from unexpected incidents, reducing the risk of costly medical bills or property damage. Standard rental options typically require separate insurance purchases, leaving gaps in protection and increasing out-of-pocket expenses. Choosing insurance-included rentals ensures peace of mind and a smoother experience for pet owners during the rental period.

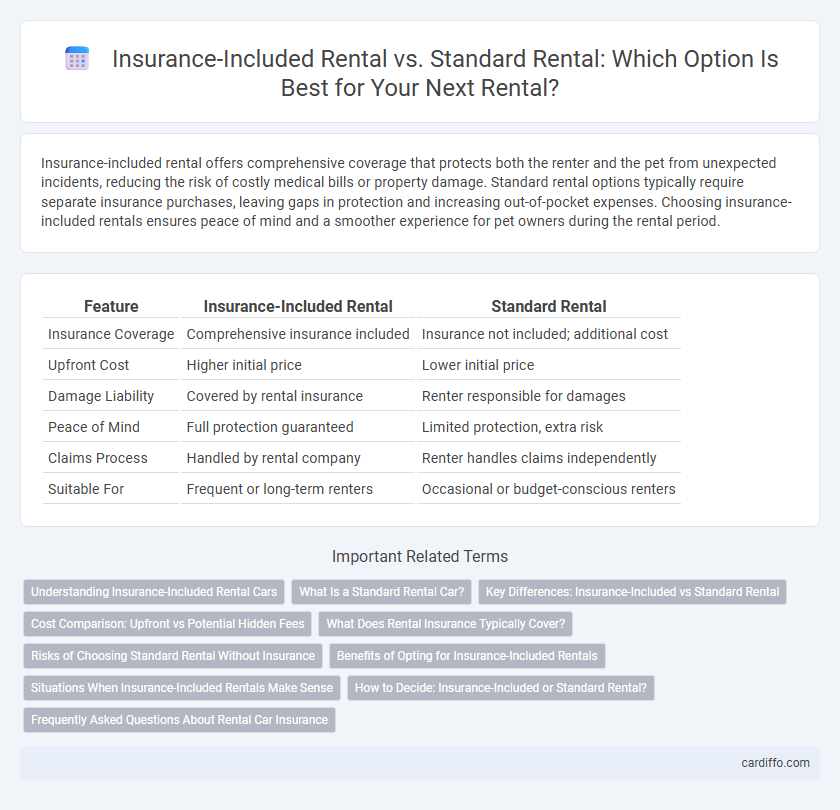

Table of Comparison

| Feature | Insurance-Included Rental | Standard Rental |

|---|---|---|

| Insurance Coverage | Comprehensive insurance included | Insurance not included; additional cost |

| Upfront Cost | Higher initial price | Lower initial price |

| Damage Liability | Covered by rental insurance | Renter responsible for damages |

| Peace of Mind | Full protection guaranteed | Limited protection, extra risk |

| Claims Process | Handled by rental company | Renter handles claims independently |

| Suitable For | Frequent or long-term renters | Occasional or budget-conscious renters |

Understanding Insurance-Included Rental Cars

Insurance-included rental cars provide comprehensive coverage directly through the rental company, eliminating the need for separate insurance purchases and reducing out-of-pocket expenses in case of an accident. Standard rentals often require customers to secure third-party insurance or rely on personal car insurance policies, which may involve deductibles or coverage limits. Choosing insurance-included rentals streamlines the rental process, offering peace of mind with clearly defined liability and damage protection tailored for renters.

What Is a Standard Rental Car?

A standard rental car typically offers basic coverage with minimal insurance included, requiring renters to purchase additional insurance for comprehensive protection. This type of rental often includes liability coverage but excludes collision damage waiver (CDW) and personal accident insurance unless added separately. Renters must carefully assess the coverage limits and consider their own auto insurance or credit card benefits before choosing a standard rental car.

Key Differences: Insurance-Included vs Standard Rental

Insurance-included rental offers comprehensive coverage that protects renters from potential damages or theft without additional fees, while standard rental requires purchasing separate insurance, often increasing the total cost. The insurance-included option simplifies the rental process by eliminating the need for multiple policies and provides immediate financial security in case of accidents. Renters choosing standard rental must carefully evaluate insurance terms to avoid unexpected liabilities during the rental period.

Cost Comparison: Upfront vs Potential Hidden Fees

Insurance-included rentals often have higher upfront costs compared to standard rentals but eliminate the risk of unexpected expenses due to accidents or damages. Standard rentals may offer lower initial prices but can result in significant hidden fees if insurance is purchased separately or if damage occurs without coverage. Comparing total cost of ownership, insurance-included options provide cost predictability and financial protection, reducing the likelihood of out-of-pocket expenses during the rental period.

What Does Rental Insurance Typically Cover?

Rental insurance typically covers damages to the rented property caused by accidents, theft, fire, or natural disasters, providing financial protection for renters. It often includes liability coverage for injuries or damages to third parties incurred during the rental period. Insurance-included rentals automatically incorporate these protections, while standard rentals may require separate insurance purchases for adequate coverage.

Risks of Choosing Standard Rental Without Insurance

Choosing a standard rental without insurance exposes renters to significant financial risks, including liability for damage to the vehicle or third-party property, theft, and medical expenses from accidents. Without insurance coverage, renters may face costly out-of-pocket expenses that can exceed the rental fee, leading to unexpected financial strain. Comprehensive insurance-included rentals mitigate these risks by providing peace of mind and protecting against potential claims and liabilities.

Benefits of Opting for Insurance-Included Rentals

Insurance-included rentals provide comprehensive coverage that minimizes financial risks associated with accidents, theft, or damage, offering peace of mind during the rental period. Renters avoid unexpected out-of-pocket expenses, ensuring predictable total costs and protection against liability claims. This option enhances convenience by bundling insurance with the rental agreement, simplifying the process and reducing administrative burdens.

Situations When Insurance-Included Rentals Make Sense

Insurance-included rentals provide essential coverage in high-risk scenarios such as urban driving with heavy traffic or off-road adventures where vehicle damage is more likely. This option eliminates out-of-pocket expenses for accidents, theft, or damages, offering peace of mind during trips in unfamiliar locations. For travelers prioritizing hassle-free rentals and minimizing financial liability, insurance-included rental agreements are a practical choice.

How to Decide: Insurance-Included or Standard Rental?

Choosing between insurance-included rental and standard rental depends on risk tolerance and budget. Insurance-included rentals offer full coverage, reducing out-of-pocket expenses in case of damage or theft, ideal for those seeking hassle-free protection. Standard rentals may have lower upfront costs but require purchasing separate insurance or risking personal liability, suitable for experienced renters comfortable managing potential risks.

Frequently Asked Questions About Rental Car Insurance

Insurance-included rental offers comprehensive coverage as part of the rental price, eliminating the need for separate insurance purchases and providing peace of mind for drivers. Standard rental agreements typically require renters to have their own auto insurance or to buy additional coverage at the counter, which can result in higher overall costs and potential gaps in protection. Common questions address whether personal auto policies cover rental cars, what types of damage are included, and how liability is handled in insurance-included versus standard rental options.

Insurance-included rental vs Standard rental Infographic

cardiffo.com

cardiffo.com