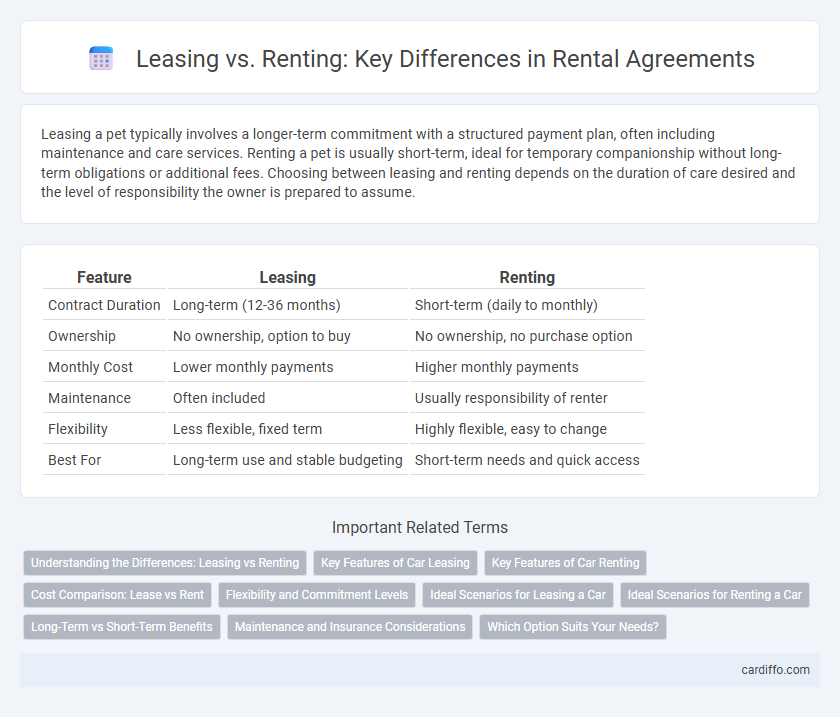

Leasing a pet typically involves a longer-term commitment with a structured payment plan, often including maintenance and care services. Renting a pet is usually short-term, ideal for temporary companionship without long-term obligations or additional fees. Choosing between leasing and renting depends on the duration of care desired and the level of responsibility the owner is prepared to assume.

Table of Comparison

| Feature | Leasing | Renting |

|---|---|---|

| Contract Duration | Long-term (12-36 months) | Short-term (daily to monthly) |

| Ownership | No ownership, option to buy | No ownership, no purchase option |

| Monthly Cost | Lower monthly payments | Higher monthly payments |

| Maintenance | Often included | Usually responsibility of renter |

| Flexibility | Less flexible, fixed term | Highly flexible, easy to change |

| Best For | Long-term use and stable budgeting | Short-term needs and quick access |

Understanding the Differences: Leasing vs Renting

Leasing involves committing to a fixed-term contract, typically ranging from six months to several years, with predetermined monthly payments and limited flexibility for early termination. Renting offers more short-term arrangements, often on a month-to-month basis, allowing tenants to exit or renew leases with minimal obligations. Understanding these distinctions helps individuals and businesses choose options best suited for financial planning and usage duration.

Key Features of Car Leasing

Car leasing offers lower monthly payments compared to traditional car rentals due to longer contract terms averaging 24 to 36 months. Leasing contracts often include maintenance packages, mileage limits typically ranging from 10,000 to 15,000 miles per year, and options to purchase the vehicle at lease-end. Unlike short-term rental agreements, leasing provides flexibility in vehicle choice with the benefit of driving newer models while avoiding depreciation costs.

Key Features of Car Renting

Car renting offers flexible short-term use with no long-term commitment, making it ideal for occasional drivers or travelers. Key features include pay-per-use pricing, comprehensive insurance coverage, and maintenance services handled by the rental company. This convenience contrasts with leasing, which often requires longer contracts, monthly payments, and responsibility for vehicle upkeep.

Cost Comparison: Lease vs Rent

Leasing typically involves lower monthly payments compared to renting but requires a longer commitment period and may include fees for early termination or maintenance. Renting offers more flexibility with shorter terms but often comes with higher monthly costs and potential rent increases. Evaluating total expenses over the desired occupancy duration helps determine whether leasing or renting is more cost-effective.

Flexibility and Commitment Levels

Leasing offers longer-term agreements typically ranging from six months to several years, providing lower monthly payments but requiring a stronger commitment and less flexibility. Renting usually involves shorter-term contracts, such as month-to-month arrangements, enabling greater flexibility for tenants who may need to move frequently or adjust their living situation quickly. Flexibility is higher with renting, while leasing commitments often come with penalties for early termination.

Ideal Scenarios for Leasing a Car

Leasing a car is ideal for individuals who prefer lower monthly payments and drive a predictable number of miles annually, typically under 15,000 miles. This option suits those who enjoy driving newer vehicle models every few years and want to avoid long-term maintenance costs. Businesses benefit from leasing by preserving cash flow and obtaining tax advantages while maintaining an updated fleet.

Ideal Scenarios for Renting a Car

Renting a car is ideal for short-term travel, such as vacations or business trips, where flexibility and convenience are paramount. It suits individuals who need a vehicle temporarily without long-term commitments or maintenance responsibilities. This option also benefits those testing different car models before making a purchase decision.

Long-Term vs Short-Term Benefits

Leasing offers long-term advantages such as stable monthly payments and potential tax benefits, making it ideal for businesses or individuals seeking predictable costs over extended periods. Renting provides short-term flexibility without long-term commitment, suitable for temporary needs or uncertain situations where asset ownership is undesirable. Understanding these distinctions helps optimize financial planning and asset management in rental agreements.

Maintenance and Insurance Considerations

Leasing often includes maintenance services and insurance coverage within the contract, reducing direct responsibilities for the lessee and ensuring consistent upkeep. Renting typically places maintenance and insurance obligations on the tenant, requiring separate arrangements and potential additional costs. Understanding these distinctions helps tenants manage financial risks and property care effectively.

Which Option Suits Your Needs?

Leasing offers long-term benefits such as fixed monthly payments and potential tax advantages, ideal for individuals or businesses seeking stability and predictability. Renting provides flexibility with shorter commitments and easier termination, suited for those needing temporary accommodations or uncertain plans. Evaluate factors like duration, budget, and usage requirements to determine whether leasing or renting better aligns with your specific needs.

Leasing vs Renting Infographic

cardiffo.com

cardiffo.com