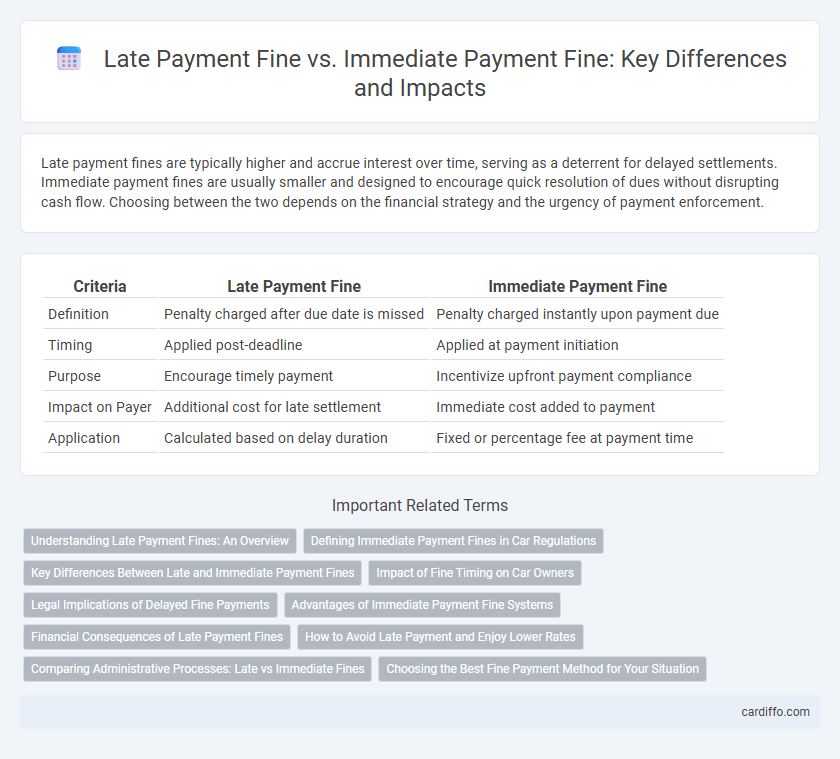

Late payment fines are typically higher and accrue interest over time, serving as a deterrent for delayed settlements. Immediate payment fines are usually smaller and designed to encourage quick resolution of dues without disrupting cash flow. Choosing between the two depends on the financial strategy and the urgency of payment enforcement.

Table of Comparison

| Criteria | Late Payment Fine | Immediate Payment Fine |

|---|---|---|

| Definition | Penalty charged after due date is missed | Penalty charged instantly upon payment due |

| Timing | Applied post-deadline | Applied at payment initiation |

| Purpose | Encourage timely payment | Incentivize upfront payment compliance |

| Impact on Payer | Additional cost for late settlement | Immediate cost added to payment |

| Application | Calculated based on delay duration | Fixed or percentage fee at payment time |

Understanding Late Payment Fines: An Overview

Late payment fines are penalties imposed when payments are not made by the due date, encouraging timely financial responsibility and reducing the risk of cash flow issues for businesses. These fines typically accrue as a percentage of the outstanding amount or a fixed fee, increasing the cost of delayed payments and incentivizing prompt settlement. Understanding the structure and impact of late payment fines helps individuals and organizations manage their financial obligations effectively and avoid additional charges.

Defining Immediate Payment Fines in Car Regulations

Immediate payment fines in car regulations require the offender to settle the penalty at the time of violation detection, promoting swift compliance and reducing administrative backlog. These fines often come with reduced amounts compared to late payment fines, incentivizing prompt resolution and minimizing legal complications. Immediate payment policies streamline enforcement processes and enhance road safety by encouraging timely adherence to traffic laws.

Key Differences Between Late and Immediate Payment Fines

Late payment fines typically incur higher penalties as a consequence of delayed settlement, designed to encourage timely compliance by increasing financial responsibility over time. Immediate payment fines are fixed charges applied promptly upon a payment due, aiming to deter default through an upfront cost without escalating fees. The key difference lies in timing and penalty structure: late fines grow with delay, while immediate fines remain constant regardless of payment speed.

Impact of Fine Timing on Car Owners

Late payment fines often accumulate higher costs, significantly affecting car owners' budgets by increasing the total financial burden over time. Immediate payment fines, while potentially steeper upfront, encourage timely compliance and prevent the escalation of penalties that can lead to more severe legal or administrative consequences. Timing of the fine plays a critical role in driver behavior, with immediate penalties fostering prompt payments and reducing long-term expenses for car owners.

Legal Implications of Delayed Fine Payments

Delayed payment of fines can lead to escalating legal consequences involving penalties such as additional interest charges, enforcement actions, and potential court proceedings. Jurisdictions often impose statutory deadlines for fine settlements, where failure to comply may result in license suspensions, wage garnishments, or asset seizures. Understanding the legal framework surrounding delayed fines is critical to mitigating risks of intensified financial liabilities and enforcement mechanisms.

Advantages of Immediate Payment Fine Systems

Immediate payment fine systems encourage prompt settlement of dues, reducing outstanding receivables and improving cash flow efficiency. They offer clear financial incentives, minimizing administrative costs associated with tracking and collecting late payments. By fostering timely payments, businesses enhance customer relationships and maintain healthier credit profiles.

Financial Consequences of Late Payment Fines

Late payment fines impose additional financial burdens by increasing the total amount owed, often resulting in interest accumulation and reduced credit scores. Unlike immediate payment fines, which are predetermined and fixed, late payment fines can escalate over time, creating severe cash flow problems for individuals and businesses. These escalating penalties incentivize timely payments but can lead to long-term financial strain and increased debt if ignored.

How to Avoid Late Payment and Enjoy Lower Rates

To avoid late payment fines and benefit from immediate payment discounts, prioritize timely bill management by setting up automated payments or calendar reminders. Early payment often results in lower interest rates or fees, reducing overall expenses and maintaining a positive credit history. Consistently paying invoices before the due date enhances financial stability and access to preferential payment terms.

Comparing Administrative Processes: Late vs Immediate Fines

Late payment fines require additional administrative steps, including sending reminders, processing overdue notices, and managing appeals, which increases the workload and delays revenue collection. Immediate payment fines streamline the administrative process by enforcing penalties at the point of transaction, reducing follow-up actions and improving cash flow management. Comparing these approaches highlights that immediate fines are more efficient for administrative operations, while late fines involve complex tracking and higher operational costs.

Choosing the Best Fine Payment Method for Your Situation

Choosing the best fine payment method depends on your financial situation and urgency to settle debts. Late payment fines often incur higher interest rates and additional penalties, increasing overall costs, whereas immediate payment fines generally offer discounted amounts or prevent further charges. Evaluating your cash flow and the consequences of delay ensures you select the most cost-effective and strategic fine payment option.

Late Payment Fine vs Immediate Payment Fine Infographic

cardiffo.com

cardiffo.com