An insurance lapse fine is imposed when a vehicle's insurance coverage expires or is not maintained, resulting in financial penalties for non-compliance with mandatory insurance laws. A registration lapse fine occurs when a vehicle owner fails to renew vehicle registration on time, leading to fines for driving with an expired registration. Both fines serve to enforce legal requirements, but insurance lapse fines specifically address financial protection coverage, whereas registration lapse fines focus on vehicle documentation and compliance.

Table of Comparison

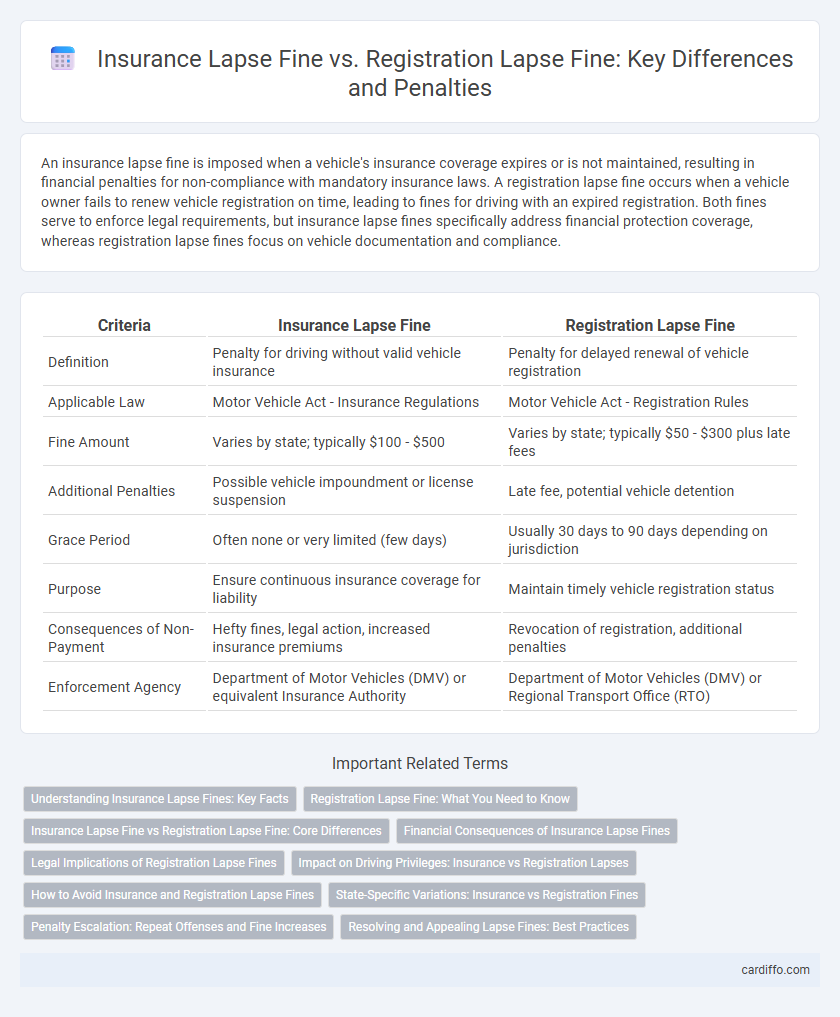

| Criteria | Insurance Lapse Fine | Registration Lapse Fine |

|---|---|---|

| Definition | Penalty for driving without valid vehicle insurance | Penalty for delayed renewal of vehicle registration |

| Applicable Law | Motor Vehicle Act - Insurance Regulations | Motor Vehicle Act - Registration Rules |

| Fine Amount | Varies by state; typically $100 - $500 | Varies by state; typically $50 - $300 plus late fees |

| Additional Penalties | Possible vehicle impoundment or license suspension | Late fee, potential vehicle detention |

| Grace Period | Often none or very limited (few days) | Usually 30 days to 90 days depending on jurisdiction |

| Purpose | Ensure continuous insurance coverage for liability | Maintain timely vehicle registration status |

| Consequences of Non-Payment | Hefty fines, legal action, increased insurance premiums | Revocation of registration, additional penalties |

| Enforcement Agency | Department of Motor Vehicles (DMV) or equivalent Insurance Authority | Department of Motor Vehicles (DMV) or Regional Transport Office (RTO) |

Understanding Insurance Lapse Fines: Key Facts

Insurance lapse fines occur when a policyholder allows their insurance coverage to expire, resulting in penalties imposed by state authorities to encourage continuous coverage and reduce uninsured risks on the road. Registration lapse fines arise from failing to renew vehicle registration on time, often leading to additional fees and possible legal consequences. Understanding these fines helps drivers maintain compliance, avoid costly penalties, and ensure legal operation of their vehicles.

Registration Lapse Fine: What You Need to Know

Registration lapse fines occur when a vehicle owner fails to renew the vehicle registration within the stipulated period, resulting in penalties imposed by the transport authority. These fines vary by region but typically increase based on the duration of the lapse, with some jurisdictions charging daily late fees or a flat penalty after a grace period. Understanding the specific rules regarding registration lapse fines can help vehicle owners avoid costly penalties and ensure compliance with local transportation laws.

Insurance Lapse Fine vs Registration Lapse Fine: Core Differences

Insurance lapse fines are penalties imposed for failure to maintain continuous vehicle insurance coverage, emphasizing protection against financial liability. Registration lapse fines arise when a vehicle's registration expires without timely renewal, focusing on legal authorization to operate the vehicle on public roads. Both fines differ in regulatory purpose, enforcement agencies, and impact on vehicle operation legality.

Financial Consequences of Insurance Lapse Fines

Insurance lapse fines often result in immediate financial penalties that exceed registration lapse fines, with costs varying by state but typically ranging from $100 to $500. Unlike registration lapse fines, insurance lapse fines can lead to increased premium rates and potential policy cancellations due to higher perceived risk by insurers. Policyholders may also face long-term financial burdens from legal fees or vehicle impoundment if driving without valid insurance coverage.

Legal Implications of Registration Lapse Fines

Registration lapse fines carry significant legal implications, including vehicle impoundment and suspension of driving privileges, which can disrupt daily activities and employment. Unlike insurance lapse fines that primarily impose financial penalties, registration lapse fines may trigger court appearances and additional legal costs due to non-compliance with state motor vehicle laws. Persistent registration lapses can escalate to criminal charges, underscoring the importance of timely registration renewal to avoid severe legal consequences.

Impact on Driving Privileges: Insurance vs Registration Lapses

Insurance lapse fines directly affect driving privileges by potentially causing immediate suspension of the driver's license until proof of coverage is provided, which can restrict legal vehicle operation. Registration lapse fines impact driving privileges through penalties that may result in vehicle impoundment or citation but typically do not suspend the driver's license itself. Both types of lapses increase financial burdens and legal risks, but insurance lapses carry a higher risk of license suspension, emphasizing the importance of continuous coverage for driving compliance.

How to Avoid Insurance and Registration Lapse Fines

Maintaining continuous insurance coverage and timely vehicle registration renewals are key steps to avoid insurance and registration lapse fines. Setting up automatic payments or calendar reminders helps ensure deadlines are not missed, preventing costly penalties. Regularly reviewing policy and registration renewal dates enhances compliance and financial protection.

State-Specific Variations: Insurance vs Registration Fines

State-specific variations in insurance lapse fines often involve penalties ranging from $100 to over $500 depending on the duration without coverage, while registration lapse fines vary widely, with some states imposing daily fees or flat fines exceeding $1,000. States like California and Texas enforce stricter insurance lapse fines to encourage continuous coverage, whereas registration lapse fines in states like Florida or New York emphasize timely vehicle registration renewal. Understanding these variances is crucial for vehicle owners to avoid costly penalties and maintain legal compliance across different jurisdictions.

Penalty Escalation: Repeat Offenses and Fine Increases

Insurance lapse fines often escalate significantly with repeat offenses, reflecting the increased risk uninsured drivers pose to public safety and the financial system. Registration lapse fines similarly rise with multiple violations, emphasizing the legal obligation to maintain up-to-date vehicle documentation. Both penalties impose stricter financial deterrents over time to encourage compliance and reduce the frequency of lapses.

Resolving and Appealing Lapse Fines: Best Practices

Resolving insurance lapse fines requires promptly providing proof of continuous coverage to the issuing authority, often resulting in reduced penalties or fee waivers. For registration lapse fines, submitting a late renewal application along with payment and any required documentation helps mitigate additional penalties. Appealing either type of lapse fine involves gathering evidence like payment records or extenuating circumstances and formally requesting reconsideration through the proper administrative channels.

Insurance lapse fine vs Registration lapse fine Infographic

cardiffo.com

cardiffo.com