Wear-and-tear coverage protects against the gradual deterioration of your pet's belongings due to regular use, while mechanical breakdown insurance specifically covers sudden malfunctions or failures of mechanical components in pet-related equipment. Wear-and-tear coverage addresses issues arising from everyday use, such as frayed leashes or worn-out collars, whereas mechanical breakdown insurance applies to unexpected damages like motor failure in automated pet feeders. Choosing the right protection depends on whether you want to guard against inevitable aging or unforeseen mechanical problems.

Table of Comparison

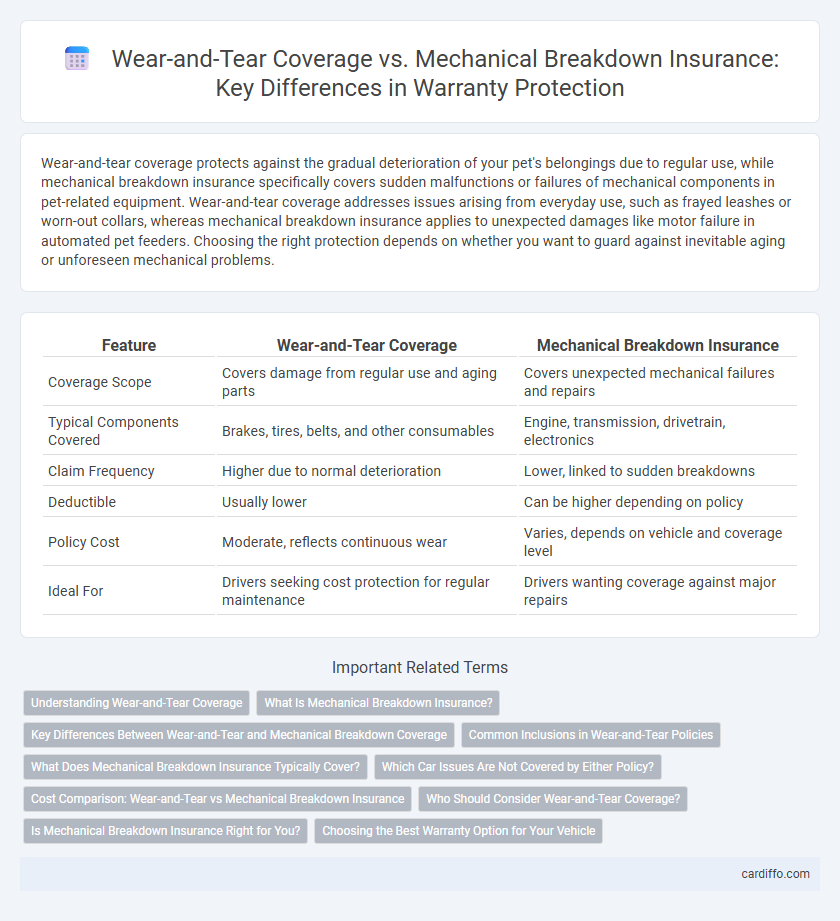

| Feature | Wear-and-Tear Coverage | Mechanical Breakdown Insurance |

|---|---|---|

| Coverage Scope | Covers damage from regular use and aging parts | Covers unexpected mechanical failures and repairs |

| Typical Components Covered | Brakes, tires, belts, and other consumables | Engine, transmission, drivetrain, electronics |

| Claim Frequency | Higher due to normal deterioration | Lower, linked to sudden breakdowns |

| Deductible | Usually lower | Can be higher depending on policy |

| Policy Cost | Moderate, reflects continuous wear | Varies, depends on vehicle and coverage level |

| Ideal For | Drivers seeking cost protection for regular maintenance | Drivers wanting coverage against major repairs |

Understanding Wear-and-Tear Coverage

Wear-and-Tear Coverage specifically addresses the gradual deterioration of vehicle components due to normal use, covering parts like brake pads, tires, and suspension systems. It differs from Mechanical Breakdown Insurance, which protects against unexpected failures of major mechanical parts such as the engine or transmission. Understanding Wear-and-Tear Coverage helps vehicle owners anticipate routine maintenance costs and avoid out-of-pocket expenses for common wear items.

What Is Mechanical Breakdown Insurance?

Mechanical Breakdown Insurance (MBI) covers repair costs for vehicle components that fail due to mechanical or electrical breakdowns beyond normal wear-and-tear. Unlike Wear-and-Tear Coverage, which addresses routine deterioration, MBI protects against unexpected failures such as engine malfunctions, transmission issues, and electrical system breakdowns. This insurance typically includes parts and labor expenses, providing comprehensive financial protection for major repairs not covered by standard warranties.

Key Differences Between Wear-and-Tear and Mechanical Breakdown Coverage

Wear-and-tear coverage protects against gradual deterioration of vehicle components due to regular use, while mechanical breakdown insurance covers sudden malfunctions of major mechanical systems not caused by wear. Wear-and-tear policies typically include items like brake pads and tires, whereas mechanical breakdown insurance focuses on engine, transmission, and electrical system failures. Understanding these distinctions helps consumers choose coverage that best fits their vehicle maintenance and risk preferences.

Common Inclusions in Wear-and-Tear Policies

Wear-and-tear coverage commonly includes components such as brake pads, tires, belts, and hoses that naturally deteriorate over time due to regular use. This type of policy typically covers routine maintenance failures and gradual component degradation without sudden mechanical failure. Mechanical breakdown insurance usually excludes these wear-related parts, focusing instead on unexpected malfunctions of the engine, transmission, or electrical systems.

What Does Mechanical Breakdown Insurance Typically Cover?

Mechanical Breakdown Insurance (MBI) typically covers repairs or replacements for internal components of a vehicle that fail due to mechanical or electrical breakdowns, excluding wear-and-tear items. Commonly covered parts include the engine, transmission, drivetrain, electrical systems, and air conditioning. MBI usually does not cover routine maintenance, cosmetic damages, or items subject to regular wear, such as brake pads or tires.

Which Car Issues Are Not Covered by Either Policy?

Wear-and-tear coverage and mechanical breakdown insurance typically exclude pre-existing conditions, damage from accidents, and routine maintenance like oil changes or brake pads replacement. Both policies do not cover issues stemming from neglect, such as failure to maintain the vehicle according to manufacturer guidelines. Cosmetic damage, theft, and tire wear are also generally excluded from coverage under either plan.

Cost Comparison: Wear-and-Tear vs Mechanical Breakdown Insurance

Wear-and-tear coverage typically incurs higher premiums due to the broader range of components covered, often including routine maintenance parts prone to gradual deterioration. Mechanical breakdown insurance usually offers lower-cost premiums by focusing on major mechanical failures excluding wear-related issues, resulting in more affordable protection for sudden, unexpected repairs. Comparing costs, wear-and-tear plans tend to be more expensive upfront but may reduce out-of-pocket expenses over time, whereas mechanical breakdown insurance provides cost-effective coverage primarily for significant component failures.

Who Should Consider Wear-and-Tear Coverage?

Wear-and-tear coverage is ideal for vehicle owners with higher mileage or older cars experiencing gradual degradation of key components like brakes, tires, and suspension. Drivers who want predictable repair costs without the unexpected burden of mechanical failure can benefit from this type of protection. Those who prioritize coverage for routine wear-related parts rather than sudden breakdowns should consider wear-and-tear plans over mechanical breakdown insurance.

Is Mechanical Breakdown Insurance Right for You?

Mechanical Breakdown Insurance (MBI) covers unexpected repairs due to mechanical failures not included in standard warranties or wear-and-tear coverage, making it ideal for those with older vehicles or high-mileage cars. Unlike wear-and-tear policies that address gradual deterioration, MBI protects against sudden component breakdowns such as engine, transmission, and electrical system failures. Evaluating your vehicle's age, maintenance history, and risk tolerance helps determine if MBI offers valuable financial protection beyond basic warranty and wear coverage.

Choosing the Best Warranty Option for Your Vehicle

Wear-and-tear coverage protects against deterioration from regular use, while mechanical breakdown insurance covers unexpected component failures beyond standard warranty periods. Selecting the optimal vehicle warranty depends on factors like your car's age, mileage, and typical driving conditions to balance cost and protection. Analyzing repair frequency, coverage limits, and claim procedures ensures you choose a warranty that minimizes out-of-pocket expenses and maximizes vehicle reliability.

Wear-and-Tear Coverage vs Mechanical Breakdown Insurance Infographic

cardiffo.com

cardiffo.com