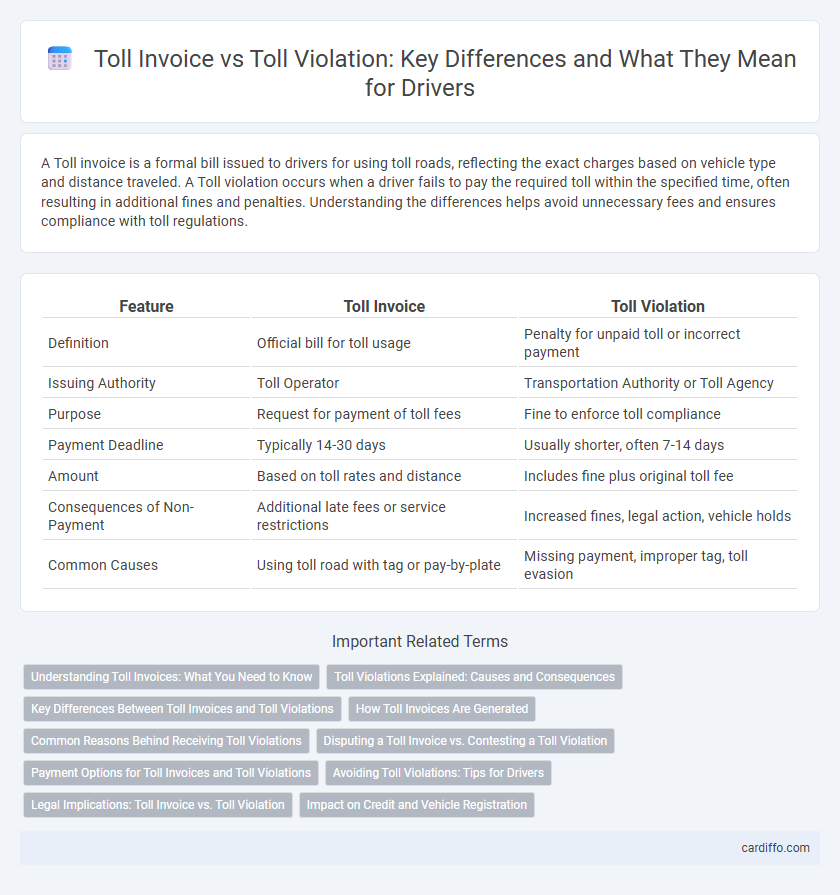

A Toll invoice is a formal bill issued to drivers for using toll roads, reflecting the exact charges based on vehicle type and distance traveled. A Toll violation occurs when a driver fails to pay the required toll within the specified time, often resulting in additional fines and penalties. Understanding the differences helps avoid unnecessary fees and ensures compliance with toll regulations.

Table of Comparison

| Feature | Toll Invoice | Toll Violation |

|---|---|---|

| Definition | Official bill for toll usage | Penalty for unpaid toll or incorrect payment |

| Issuing Authority | Toll Operator | Transportation Authority or Toll Agency |

| Purpose | Request for payment of toll fees | Fine to enforce toll compliance |

| Payment Deadline | Typically 14-30 days | Usually shorter, often 7-14 days |

| Amount | Based on toll rates and distance | Includes fine plus original toll fee |

| Consequences of Non-Payment | Additional late fees or service restrictions | Increased fines, legal action, vehicle holds |

| Common Causes | Using toll road with tag or pay-by-plate | Missing payment, improper tag, toll evasion |

Understanding Toll Invoices: What You Need to Know

Toll invoices provide detailed billing information for toll road usage, including the date, time, and location of each toll crossing, the vehicle details, and the total charges incurred. It is essential to review the invoice carefully to ensure accuracy, as discrepancies can lead to incorrect billing or missed payments. Understanding how to interpret the invoice helps avoid toll violations and associated fines, ensuring compliance with toll regulations.

Toll Violations Explained: Causes and Consequences

Toll violations occur when a vehicle passes through a toll point without proper payment, often due to insufficient account balance, expired transponders, or unregistered license plates. These violations result in fines and penalties that escalate if left unpaid, impacting the vehicle owner's credit score or leading to vehicle registration suspension. Timely resolution of toll violations is essential to avoid legal consequences and additional administrative fees.

Key Differences Between Toll Invoices and Toll Violations

Toll invoices are official bills issued for toll road usage, detailing the exact charges and payment due dates, while toll violations occur when a vehicle passes through a toll point without proper payment, resulting in fines or penalties. Toll invoices allow straightforward payments based on recorded usage, whereas toll violations often trigger administrative fees and legal consequences. The key difference lies in toll invoices being preemptive charges verified by electronic or manual toll collection, whereas violations represent unpaid tolls subject to enforcement actions.

How Toll Invoices Are Generated

Toll invoices are generated when a vehicle passes through a toll facility without an active electronic toll tag or fails to pay at the point of entry, triggering cameras to capture the license plate for billing. The system automatically links the vehicle registration to the account holder, creating an invoice that details the date, time, location, and applicable toll charges. This automated process helps maintain accurate toll revenue collection while providing accountability for unpaid tolls.

Common Reasons Behind Receiving Toll Violations

Toll violations commonly result from expired or insufficient prepaid toll balance, incorrect or missing vehicle license plate information, and failure to properly tag or register electronic toll transponders. Other factors include using a toll road without a valid account, vehicle ownership discrepancies, and toll system errors such as camera misreads. Understanding these causes helps drivers avoid unexpected fines and maintain accurate records for toll invoices.

Disputing a Toll Invoice vs. Contesting a Toll Violation

Disputing a Toll Invoice involves addressing billing errors or incorrect charges on the issued bill, often requiring submission of proof such as payment receipts or video evidence to the toll authority. Contesting a Toll Violation pertains to challenging the recorded infraction, like missed toll payments or improper vehicle classification, which may involve legal grounds and appeals through the relevant transportation or judicial system. Timely response and thorough documentation are crucial for both disputing invoices and contesting violations to avoid penalties and ensure resolution.

Payment Options for Toll Invoices and Toll Violations

Toll invoices offer multiple payment options including online portals, mobile apps, and authorized retail locations to ensure timely settlement and avoid penalties. Toll violations typically require prompt payment through designated methods such as official websites, customer service centers, or mail-in payments to prevent additional fines or legal action. Electronic payments via credit/debit cards and automatic bank deductions are widely accepted for both toll invoices and violations to facilitate convenience and compliance.

Avoiding Toll Violations: Tips for Drivers

To avoid toll violations, drivers should ensure accurate vehicle and payment information is registered with the toll authority and review invoices promptly for discrepancies. Utilizing electronic toll collection systems like E-ZPass or FasTrak helps automate payments and reduces missed tolls. Keeping track of toll rates and locations through official apps or websites minimizes the risk of fines and ensures smooth travel.

Legal Implications: Toll Invoice vs. Toll Violation

Toll invoices represent legitimate charges for using tolled roads, enforceable under contract law, whereas toll violations often result in penalties, fines, and potential legal actions for non-payment. Failure to address toll violations can escalate to liens, registration holds, or court summons, impacting credit scores and legal standing. Understanding the distinct legal implications between toll invoices and violations is crucial for compliance and avoiding prolonged legal consequences.

Impact on Credit and Vehicle Registration

Toll invoices must be paid promptly to avoid negative impacts on credit scores and potential holds on vehicle registration renewal. Unpaid toll violations accrue fines and can lead to collections, further damaging credit history and causing DMV restrictions. Timely resolution of toll charges ensures uninterrupted vehicle registration and maintains favorable credit standing.

Toll invoice vs Toll violation Infographic

cardiffo.com

cardiffo.com