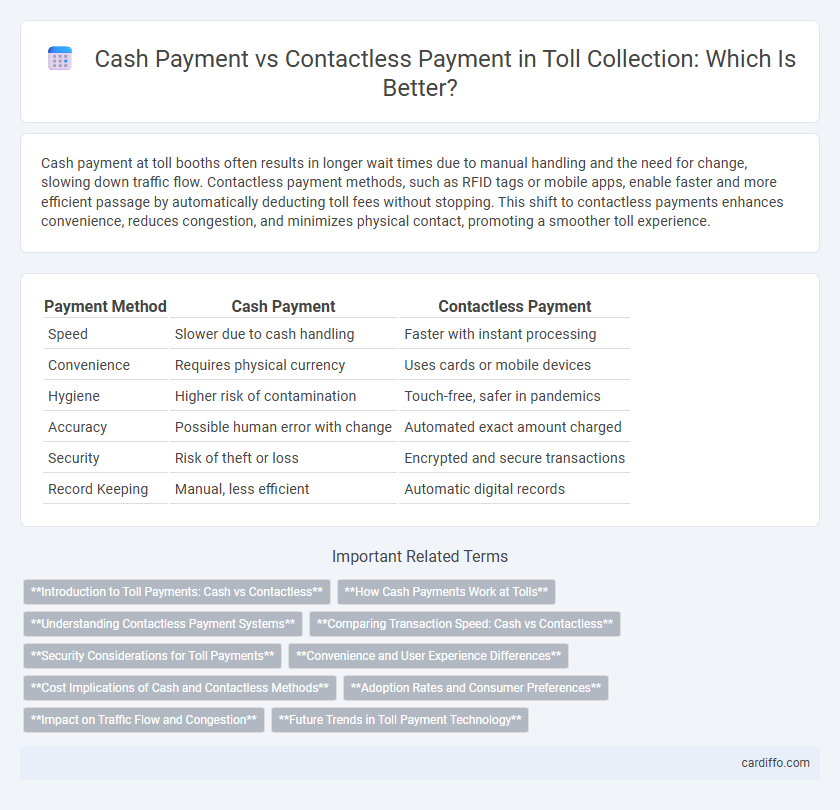

Cash payment at toll booths often results in longer wait times due to manual handling and the need for change, slowing down traffic flow. Contactless payment methods, such as RFID tags or mobile apps, enable faster and more efficient passage by automatically deducting toll fees without stopping. This shift to contactless payments enhances convenience, reduces congestion, and minimizes physical contact, promoting a smoother toll experience.

Table of Comparison

| Payment Method | Cash Payment | Contactless Payment |

|---|---|---|

| Speed | Slower due to cash handling | Faster with instant processing |

| Convenience | Requires physical currency | Uses cards or mobile devices |

| Hygiene | Higher risk of contamination | Touch-free, safer in pandemics |

| Accuracy | Possible human error with change | Automated exact amount charged |

| Security | Risk of theft or loss | Encrypted and secure transactions |

| Record Keeping | Manual, less efficient | Automatic digital records |

Introduction to Toll Payments: Cash vs Contactless

Toll payments have evolved from traditional cash transactions to increasingly preferred contactless methods, enhancing speed and convenience for drivers. Contactless payment options, including RFID tags and mobile apps, reduce queuing times and minimize cash handling errors. Modern toll systems leverage these technologies to streamline traffic flow and improve overall toll plaza efficiency.

How Cash Payments Work at Tolls

Cash payments at tolls require drivers to stop at a toll booth and hand over the exact amount or receive change from the toll operator, ensuring immediate transaction completion. This method relies on physical currency exchange and human interaction, often causing delays during peak traffic hours. Tolls accepting cash typically display clear signage indicating accepted denominations and provide receipts upon request.

Understanding Contactless Payment Systems

Contactless payment systems utilize near-field communication (NFC) technology, allowing vehicles to pay tolls quickly by simply tapping a card or smartphone equipped with a transit app. Unlike cash payment, which requires physical currency and manual collection, contactless payments reduce congestion and improve traffic flow at toll plazas. Enhanced security features, such as tokenization and encryption, protect users' financial data during each transaction.

Comparing Transaction Speed: Cash vs Contactless

Contactless payments through RFID or NFC technology complete toll transactions in under two seconds, significantly faster than cash payments, which average 15-30 seconds due to counting change and handling bills. The reduced transaction time in contactless toll processing enhances traffic flow, decreases congestion at toll booths, and lowers vehicle emissions caused by idling. Studies show contactless payments can process up to 40 vehicles per minute compared to only 10-15 with cash, making contactless the superior option for high-volume toll plazas.

Security Considerations for Toll Payments

Cash payments at toll booths carry risks such as theft and counterfeit currency, posing significant security concerns for both drivers and toll operators. Contactless payment methods use encryption and tokenization to protect sensitive financial information, reducing fraud and unauthorized access. Implementing contactless systems enhances transaction security while minimizing physical interaction, supporting safer and more efficient toll collection.

Convenience and User Experience Differences

Cash payment at tolls requires physical currency and often leads to slower processing times due to counting and handling, causing potential delays and inconvenience. Contactless payment leverages RFID or mobile apps, enabling seamless and rapid transactions that enhance user experience by minimizing wait times and reducing queues. The convenience of contactless methods significantly improves traffic flow and provides a smoother, more efficient tolling process.

Cost Implications of Cash and Contactless Methods

Cash payments at toll booths often incur higher operational costs due to the need for staff, cash handling, and security measures, increasing overall expenses for toll operators. Contactless payment methods reduce transaction time and minimize cash handling errors, leading to lower administrative costs and enhanced efficiency. The shift towards contactless payments also decreases the risk of revenue leakage and maintenance costs associated with cash processing equipment.

Adoption Rates and Consumer Preferences

Contactless payment adoption rates at toll booths have surged due to increased consumer preference for speed and convenience, with studies showing over 70% of drivers now favor touchless transactions. Cash payments have declined, representing less than 20% of toll transactions, driven by concerns over hygiene and extended processing times. Consumer trends indicate a growing demand for seamless, contactless tolling systems integrated with mobile wallets and RFID technology.

Impact on Traffic Flow and Congestion

Cash payment at toll booths significantly slows down traffic flow due to manual transaction processing and cash handling, leading to increased congestion during peak hours. Contactless payment systems expedite vehicle passage by enabling seamless, automated toll collection, reducing wait times and minimizing traffic bottlenecks. Implementing widespread contactless payment solutions can improve overall traffic management and decrease vehicle emissions caused by idling in congested toll lanes.

Future Trends in Toll Payment Technology

Future trends in toll payment technology emphasize widespread adoption of contactless payments, leveraging NFC and RFID for seamless vehicle identification and automatic billing. Integration with mobile wallets and in-vehicle systems enhances user convenience while reducing congestion and manual cash handling costs. Emerging technologies like blockchain and AI-driven analytics aim to increase transaction security and optimize toll pricing dynamically based on traffic patterns.

Cash payment vs contactless payment Infographic

cardiffo.com

cardiffo.com